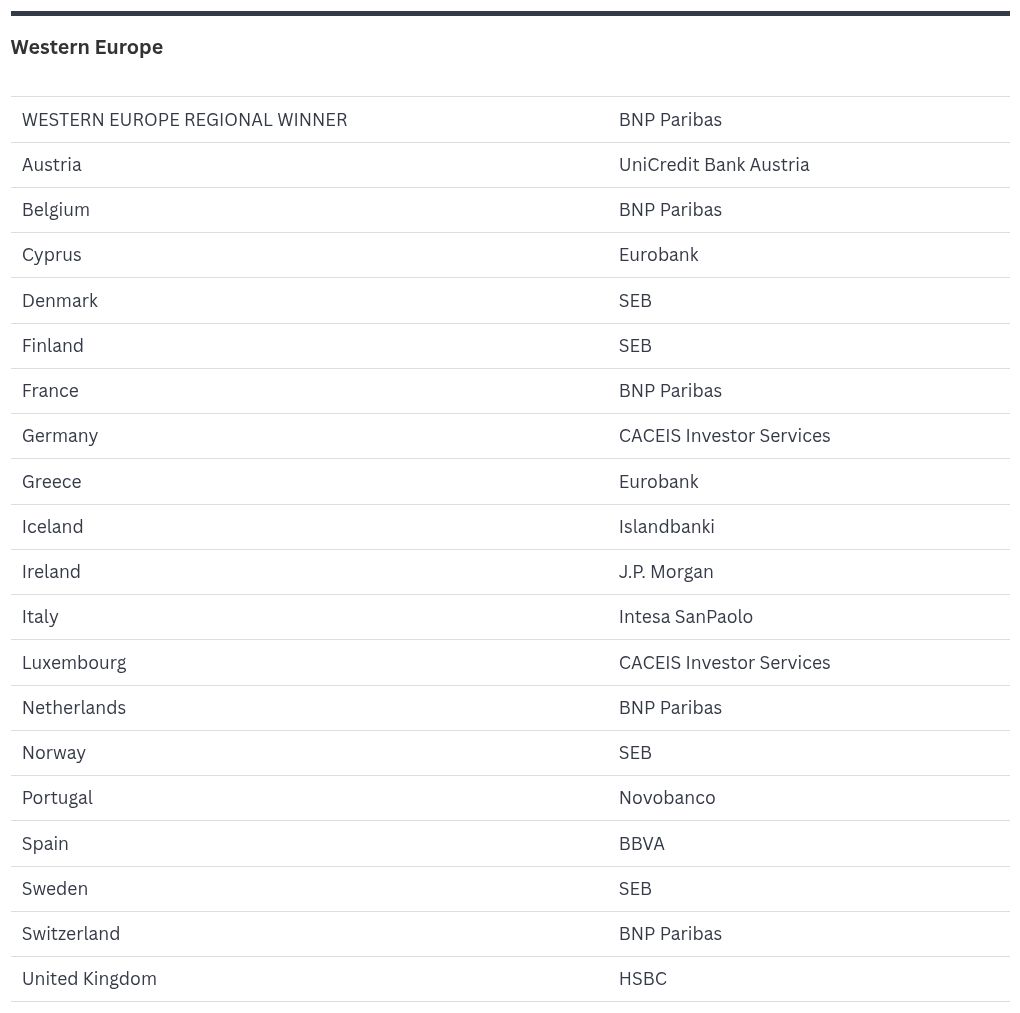

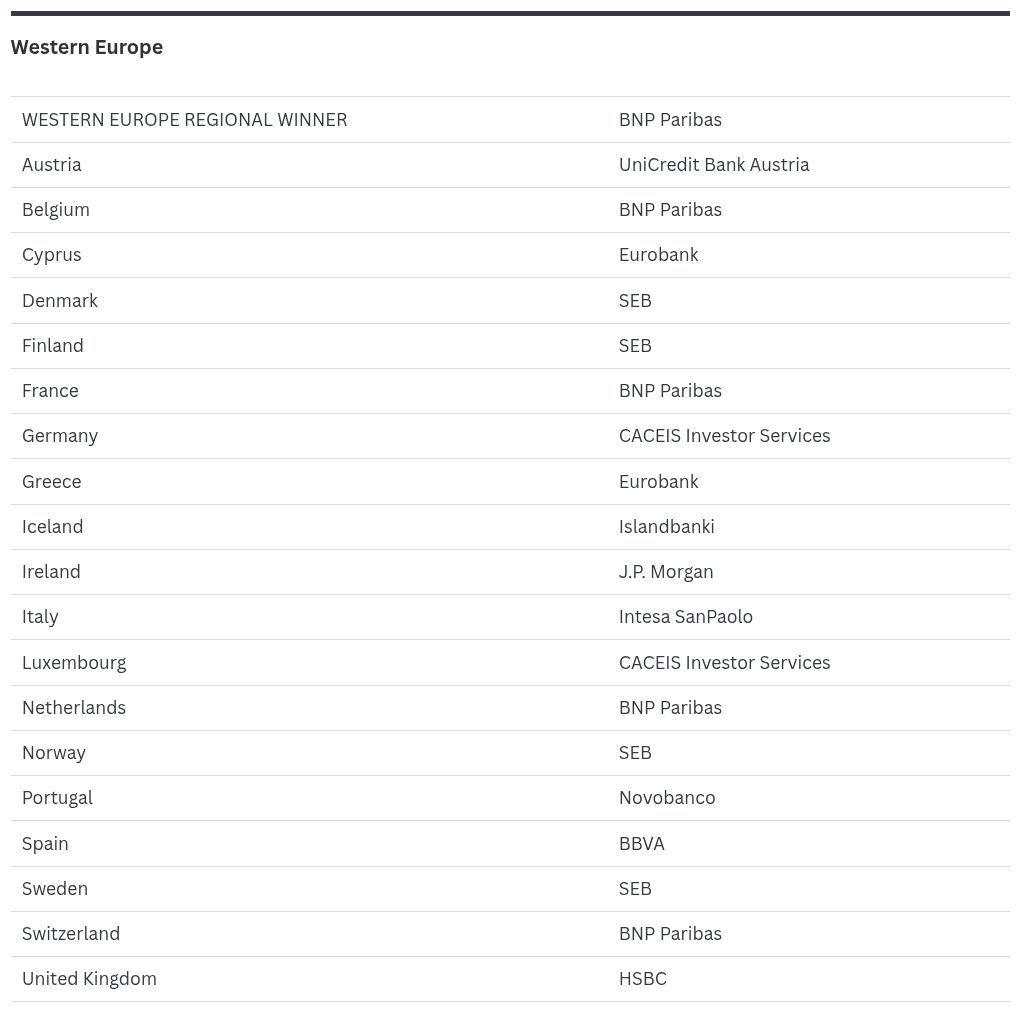

Best Sub-Custodian Banks in Western Europe for 2025

BNP Paribas continues to build on its exceptional securities-services franchise through internal initiatives and partnerships that leverage technology for growth across its platform. With this progress, the bank is recognized as our regional winner for Western Europe. In the region, BNP Paribas is also our country winner in Belgium, France, the Netherlands, and Switzerland.

One of the bank’s service initiatives includes the development of open architecture strategy designed to integrate client-portfolio management systems with the bank’s middle- and back-office services. The offering enables direct and standardized data connectivity between BNP’s global fund-accounting systems and Bloomberg Asset and Investment Manager. This connectivity delivers greater transparency along the transaction lifecycle, with real-time post-trade workflows and faster data availability.

In addition, the bank launched a new post-trade data-management service using offerings from financial data technology provider NeoXam. This provides greater transparency, allowing clients to view securities portfolios across different asset classes and includes performance and risk analytics as well as reporting features.

At the same time, BNP clients benefit from the bank’s NeoLink digital custody platform that delivers a complete, simple, and customizable range of services. BNP recently enhanced the system’s reporting capabilities, allowing users to manage data and reports. The bank has also expanded its centralized booking model, enabling clients to engage with a single legal entity in the Paris office for services across multiple markets, with access to seven European CSDs.

Under this structure, client accounts are segregated based on the market but are linked to a single cash account for efficient settlement. In every country BNP serves, it works with regulators on market developments to both advance the custody infrastructure and advocate for clients in these jurisdictions. With the move to a T+1 settlement cycle in the EU, BNP is committed to a seamless transition for the industry and the bank’s clients by serving as an active member of the EU industry task force on T+1 implementation.

Methodology

In selecting the institutions that reliably provide the best services in these local markets and regions, Global Finance’s editorial board considered market research, input from expert sources, and entry information from the banks themselves. The criteria included such factors as customer relations, quality of service, technology platforms, and post-settlement operations, as well as knowledge of local markets, regulations, and practices.