Could Investing $10,000 in Figma Make You a Millionaire?

Story stocks are fun, but at the end of the day every business eventually needs to be able to produce sustainable profit growth.

There’s certainly no shortage of hype surrounding relatively new stock Figma (FIG -4.22%) these days. And understandably so. This seemingly simple company is growing like crazy, recently reporting a year-over-year quarterly top line of improvement of 41%, with more of the same on the horizon.

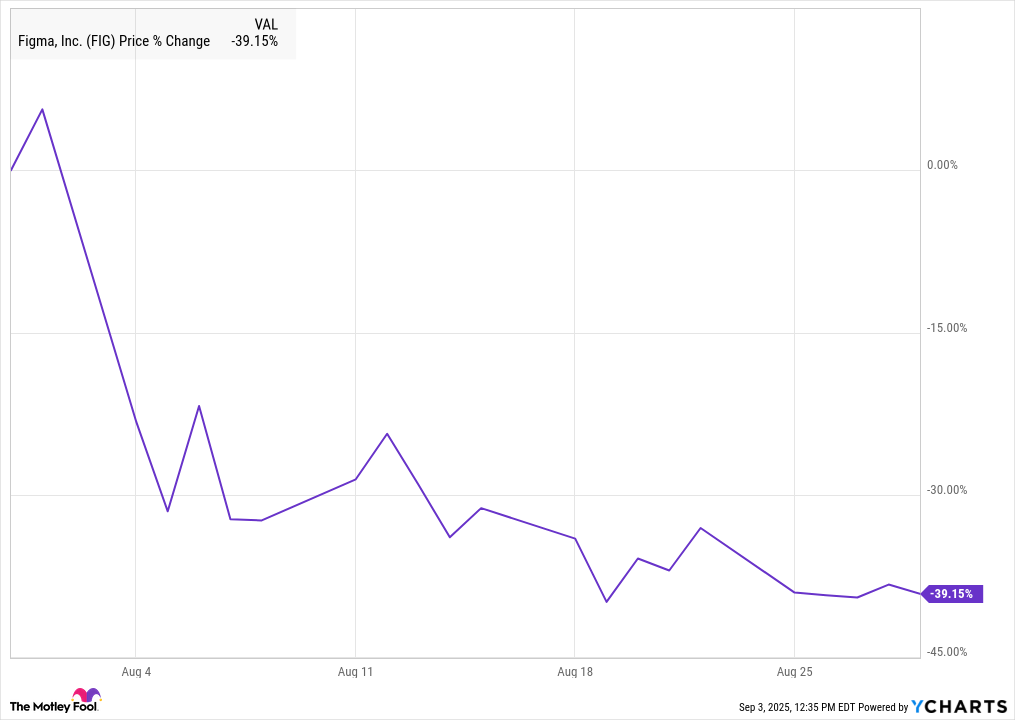

Unfortunately, hype alone doesn’t guarantee bullishness. This stock’s down by more than half of its early August post-IPO surge high, in fact, with much of that setback in response to what seemed like healthy Q2 numbers posted this past week.

Still, many investors insist this weakness is an opportunity rather than an omen, and are using the pullback to step into a position they expect to ultimately soar. Are they right? Could a $10,000 investment in this young ticker turn into a million dollars or more in the foreseeable future?

First things first.

What is Figma anyway?

What’s Figma? The correct answer to the question seems too simple to be true. Yet, it is. Figma is an online collaboration platform that allows multiple members of the same team to co-create and edit visual user interfaces for mobile apps and websites. That’s it. That’s all it does.

OK, this description arguably understates the power of the technological tool. Figma’s cloud-based software helps users build the look of an interactive app or web page from the ground up, change it as often as needed, and facilitate communication between a team’s members as any updates are made. And, though it’s meant for non-coders and non-engineers, a feature called Dev Mode (“dev” being short for “developer”) can easily turn a layout into the computer code needed to make it work in the real world. Figma also offers digital whiteboards and slideshow presentation templates.

By and large, though, the company’s core competency is simply helping organizations easily build what their customers see when using that organization’s app or website.

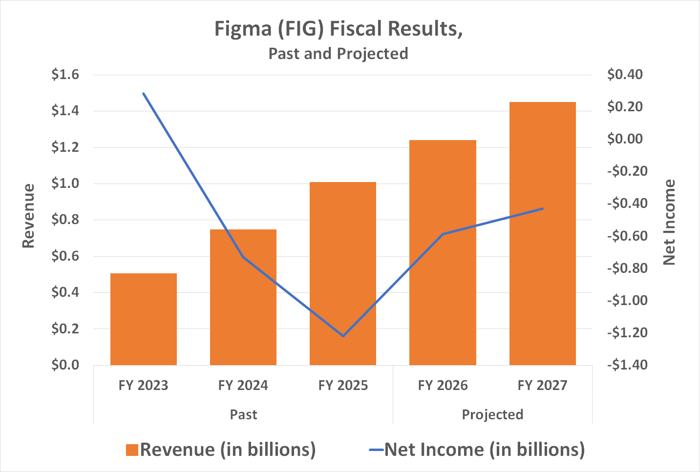

The thing is, there’s a clear and growing demand for such a solution. Figma’s recently reported Q2 top line grew 41% year over year to nearly $250 million. The company’s guidance calls for comparable growth through the rest of the year, too, with the bulk of its mostly recurring revenue coming from existing customers simply adding more features or users to their subscription. Figma’s also reliably profitable (albeit only marginally, for now) despite its small size and fairly young age.

And yet, Figma’s stock tumbled again in response to Wednesday’s second-quarter results. While it was only a wild guess as to how much the company should have reported in profits for the three-month stretch, what was essentially a breakeven clearly wasn’t good enough for most investors.

Or maybe that wasn’t the reason for the setback at all.

Nothing’s ever unusual in the wake of an IPO

It’s a frustrating truth — but it takes a while for newly minted stocks to shake off all of their post-public-offering volatility. It’s also worth detailing that even the stocks that do end up soaring in the long run often suffer major — and sometimes prolonged — sell-offs first.

Case in point: Meta, when it was still called Facebook. It was all the rage before and shortly after its May 2012 IPO. Three months later, however, it had nearly been halved from the price of its first trade as a publicly traded issue. It wouldn’t reclaim that price again until more than a year later.

Rival social networking outfit Snap (parent to Snapchat) ran its shareholders through a similar wringer that still hasn’t run its complete course yet. Although this stock was red-hot following its late-2020 public offering all the way through October of 2021, shares then began what would turn into a sell-off of more than 80% in less than a year, leaving the stock well below its first trade’s price. It’s still roughly at that depressed price today, in fact.

It’s not all bad news, though. Artificial intelligence data center support provider Coreweave got a bit of a wobbly start following its March public offering, but finally found its footing in April and is still much higher than it was then, despite a more recent lull.

But what’s this got to do with Figma? It’s a reminder that the market doesn’t really know how to price — or even what to do with — newly created stocks. Investors innately understand that stocks are usually volatile after their initial public offering. Investors also know, however, that in many cases things end up paying off anyway, even if that ticker’s fundamental argument doesn’t hold much water yet.

In other words, there’s really no way of telling when, where, or even if Figma shares will recover. It’s got more to do with feelings and investors’ perceptions, which are fickle and impossible to predict. It could be months, if not years, before this ticker actually reflects the underlying company’s prospects.

Data source: SimplyWallSt.com. Chart by author.

Or the company may run into a headwind before the stock even gets a chance to do so.

One gaping vulnerability too big to ignore

But the question remains: Could investing $10,000 in Figma today make you a millionaire at any reasonable point in your lifetime? After all, clearly, there’s a growing demand for the interface design collaboration software it provides.

Never say never. But, probably not — just not for the reason you might think, like the stock’s outrageous valuation of nearly 30 times its sales. Not just earnings, but sales, versus the software’s industrywide average price to sales ratio of about 10.

Putting the sheer difficulty of trading stocks with recent IPOs aside for a moment, Figma’s got a much bigger problem. That is, there’s no real moat to speak of here. That just means there’s little to nothing to prevent a bigger and deeper-pocketed rival from seeing the success that Figma is enjoying with its platform and replicating the idea for itself. There’s certainly nothing legally preventing it from happening, anyway. While processes, machinery designs, or new creations can all be patented, a mere premise or a business idea isn’t protected in this way.

Image source: Getty Images.

And don’t think for a minute that would-be competitors aren’t already at least thinking about it, either, particularly now that Figma has proven this business is profitable, as well as highly marketable. Marketing and graphics software outfit Adobe already made an acquisition offer to Figma, in fact. While it ultimately ran into too many regulatory hurdles to be feasible, the fact that Adobe was willing to pay such a premium for Figma all the way back in 2023 underscores its confidence in the marketability of Figma’s technology.

If not Adobe, perhaps Microsoft might find a way of adding this sort of interface-design platform to its lineup of cloud-based productivity and team-collaboration tools. Odds are good that at least most of Figma’s paying customers are already familiar with and using one or two Microsoft-made products anyway.

You get the idea. It wouldn’t take much to launch a viable alternative to Figma. If another player wasn’t interested before, they’re certainly more likely to be interested now in the wake of well-publicized growth for its simple business.

Bottom line? Buy it if you must. Just know what it is you’re buying. You’re not investing in a growth business with proven staying power — at least not yet. You’re betting that the market is going to change its mind about this stock in the very foreseeable future. And that’s a pretty risky proposition.