Josh D’Amaro was named Disney’s CEO. Now the real work begins

It has been a roller coaster week for theme parks boss Josh D’Amaro, who was named the next chief executive of Walt Disney Co. last week.

Once he officially takes the helm of the Mouse House in mid-March, he must tackle several key areas to chart the future of the 102-year-old media and entertainment giant.

For one, he’ll need to bolster Disney’s pipeline of content. As the saying goes, “content is king.”

The Burbank company already has a strong stable of franchises and stories that power its entertainment and streaming businesses, theme parks, merchandise and cruise ships, but Disney will need to keep building on that.

Strong sequels like last year’s “Zootopia 2” and live-action adaptations such as “Lilo & Stitch” — both of which grossed more than $1 billion in worldwide box office revenue — show that good stories can keep paying dividends in new ways, Moffett Nathanson senior research analyst Robert Fishman wrote in a note to clients last week.

On the bright side: This year’s film lineup has several historically strong franchise contenders, including Disney and Pixar’s “Toy Story 5,” Lucasfilm’s “Star Wars: The Mandalorian and Grogu” and Marvel Studios’ “Avengers: Doomsday.” (Marvel, however, has struggled in recent years to pump out consistent hits at the box office.)

But Disney also needs to develop new stories — which has been more of a struggle.

Disney and Pixar’s “Elio” misfired at the box office last year, as original animated movies have had a harder time bringing in the massive audiences they once did because of the drop-off in theater attendance since the pandemic.

That puts more pressure on Disney and Pixar’s upcoming “Hoppers,” an original animated film out in March. The film has gotten strong early traction in online trailer views, Fishman wrote.

The content investment also extends to scripted series, which Fishman noted are a “critical component of success and cannot become an afterthought to theatrical.” He singled out Disney-owned FX as a “prestige outlet” that can contribute to both television and streaming lineups. The network has had a number of successes, including 2024’s “Shogun,” which was one of my favorites.

D’Amaro likely will get help on the content side from soon-to-be president and chief creative officer Dana Walden, a longtime television executive who is respected in Hollywood and well-versed in the entertainment knowledge he lacks.

D’Amaro’s area of expertise is Disney’s experiences sector, which includes the theme parks, cruise line, merchandise and Aulani resort and spa in Hawaii and brings in the lion’s share of operating income for the company. In the fiscal first quarter of this year, the experiences business hauled in a record $10 billion in revenue.

The challenge there will be maintaining Disney’s market dominance in the theme park space while continuing to invest to drive growth and managing attendance in the face of ongoing competition from arch rival Universal Studios.

On the investment front, Disney is all in. The experiences business is in the midst of a 10-year, $60-billion expansion project that would add new themed lands to parks around the world, including at Anaheim’s Disneyland Resort. The company also is building a park in Abu Dhabi and added new cruise ships.

In the near term, however, are concerns about “international visitation headwinds” at Disney’s U.S. parks. The company signaled in its most recent earnings call that those foreign visitor trends could contribute to “modest” operating income growth for the experiences division in the fiscal second quarter, along with pre-launch costs for a new cruise ship and an upcoming “Frozen” land in Disneyland Paris.

To keep attendance rates up, the company shifted its marketing and promotional focus to a more domestic audience, said Hugh Johnston, senior executive vice president and chief financial officer, on the earnings call. But stock analysts — and D’Amaro — undoubtedly will be keeping an eye on international attendance rates and what that will mean for the theme parks going forward.

The part of the company with the potential to drive the most growth, analysts say, is its streaming business.

After recording billions of dollars in losses, Disney’s streaming services, which included Disney+, Hulu and ESPN+, finally reached profitability in 2024. The company’s next goal is to reach 10% operating margins in its entertainment streaming business comprised of Disney+ and Hulu — a milestone that would give investors confidence in its vision.

To get there, continued investment in local language content will be a key priority to increase international subscriptions, as well as bolstering the tech that powers the platforms and provides recommendations.

In short, D’Amaro faces a choice.

“Some investors are thinking, ‘Will he choose to be the same? Or can he start a new era?’” asked Laurent Yoon, senior analyst at Bernstein.

At least one former Disney CEO has weighed in.

“My advice to Josh is continue Bob Iger’s strategy that creativity will handle profits, always protect the brand, and keep close the words of Walt Disney: ‘We love to entertain kings and queens, but the vital thing to remember is this — every guest receives the VIP treatment,’” Michael Eisner posted on social media last week.

But D’Amaro’s own words provide an idea of what he’s thinking. At a global town hall meeting with Disney employees last week, D’Amaro spoke about the company’s legacy — and its path forward.

“We are 100 years old, but we’re 100 years young as well, willing to embrace new technology, new creators and new markets,” he said. “That willingness to change and take risks is what keeps the brand going, and it’s something I intend to continue to push on.”

Stuff We Wrote

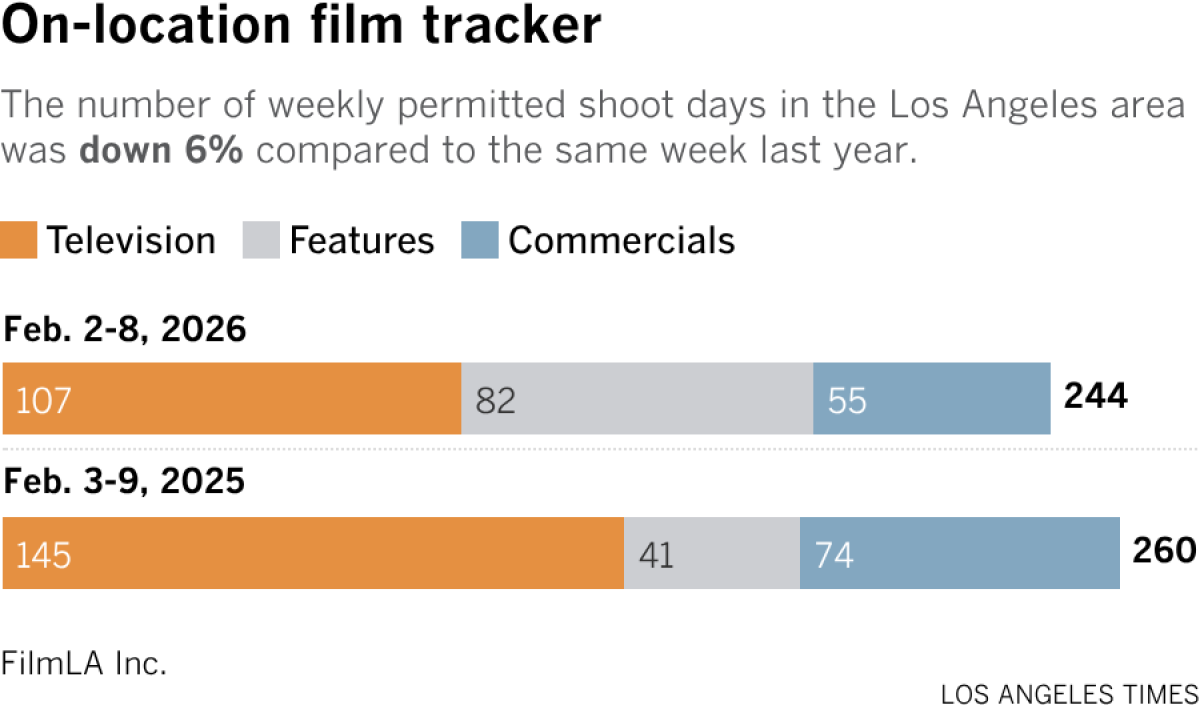

Film shoots

Number of the week

Post-apocalyptic horror film “Iron Lung” has grossed $34.3 million in worldwide box office revenue, a remarkable number given the film’s reported $3 million production budget and self-distribution route.

Written, directed and executive produced by YouTuber Mark Fischbach, who goes by the online alias of Markiplier and also stars in the film, “Iron Lung” follows the story of a convict who sails a blood ocean in a submarine. The movie had a $17.8-million opening during the weekend of Jan. 30, placing it right behind Disney’s 20th Century Studios’ “Send Help,” which grossed about $19.1 million in its debut. “Iron Lung” picked up an additional $6 million this past weekend.

Its success reignited the debate about self-distribution and the theatrical draw of content creators.

What I’m watching

Since the Olympics started last week, I’ve been all in on figure skating, a sport I’ve watched since I was a kid who marveled at the artistry and athleticism of stars like Kristi Yamaguchi, Scott Hamilton, Brian Boitano and Michelle Kwan.

So I was supremely interested in this piece by my colleague Thuc Nhi Nguyen about the strength of the U.S. Olympic figure skating team this year, and the camaraderie between U.S. women Amber Glenn, Alysa Liu and Isabeau Levito.