Best Trade Finance Bank In Asia-Pacific: DBS Bank

Global Finance is proud to announce the winners of the Best Trade Finance Banks for 2026.

This year’s recipients—Standard Bank, DBS, Banreservas, Raiffeisen Bank International, BBVA, Bank ABC, BNY Mellon, and UniCredit—distinguished themselves by leveraging innovative digital platforms, expanding global and regional connectivity, and developing specialized solutions to navigate increasingly complex trade environments. From supporting key economic corridors in Asia-Pacific to pioneering sustainable finance across Africa and the CEE, these institutions are setting the standard for efficiency, compliance, and client service in the global trade ecosystem.

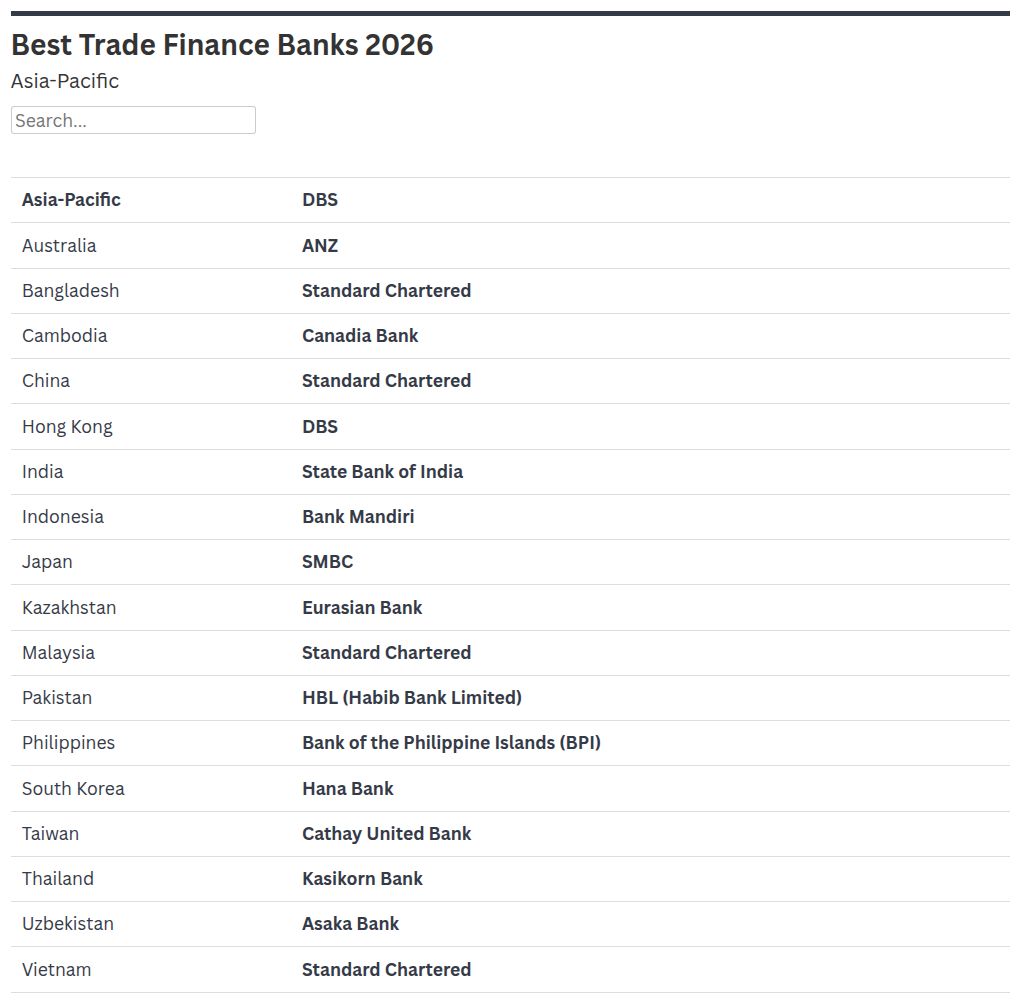

Best Trade Finance Bank in Asia-Pacific

DBS Bank

DBS has been recognized as the Best Trade Finance Bank in Asia Pacific for the fourth year in a row. This sustained success is attributed to the bank’s strategic support for clients as they manage the shift in production and sourcing throughout the APAC region.

DBS supports clients in shifting production and sourcing across APAC. Connecting regional buyers and suppliers through DBS’ trade corridor network, easing entry into new markets and enabling cross-border supplier financing to drive diversification and expand market reach.

In China, DBS is helping firms “outbound” to Southeast Asia while maintaining their RMB settlement. In ASEAN the focus is on “landing” services in Vietnam and Indonesia; supporting the EV/Electronics cluster.

In India, DBS supports the “Make in India” initiative and linking Indian SMEs to ASEAN buyers. DBS defines its “nearshoring hubs” as more than just geographic locations; they are integrated financial corridors designed to handle the “China +1” shift.

These hubs allow multinational corporations to replicate their established production capacity in new regions like Vietnam, India, and Indonesia while maintaining centralized control via Singapore or Hong Kong.

While production moves elsewhere, the regional treasury hubs often remain in these two cities.