If you’ve been reading this newsletter, you know that Hollywood is already in a tough spot. President Trump’s tariffs, the resulting stock market volatility and a possibly looming recession won’t make life any easier for the entertainment industry.

In the days after Trump’s so-called Liberation Day speech, the markets have given investors whiplash, with each new update sending stocks gyrating for another unpredictable cycle.

The administration’s subsequent backtracking hasn’t quelled the turmoil. Last week, Trump put a 90-day pause on the latest levies, but the 10% across-the-board tariffs remain in place and with import taxes now at 145% for Chinese goods. Now Trump says smartphones, computers and other electronics are excluded from the tariffs on China.

Confused? You’re not alone, and as the cliche goes, markets hate uncertainty.

Stocks are generally down, including those of the major media and entertainment firms, which are all vulnerable to a potential economic downturn, even if they aren’t all as exposed to trade disputes on their own. Concerns about pocketbook issues could make people think twice about taking vacations and going out. They might even encourage people to further cull their streaming services.

Walt Disney Co. shares are down 14% from a month ago. Warner Bros. Discovery, which is loaded up with debt and thus sensitive to shakiness in the capital markets, is off by 21%. Comcast, Paramount, Lionsgate and AMC Networks have all fallen.

Though Hollywood isn’t as dependent on global trade as, say, the microchip industry, there are several ways the current situation could play out.

Advertising spending tends to pull back in a wobbly economy, and this is all happening just weeks before the networks’ and streaming services put on their big upfront presentations to ad buyers. So the timing is not great, and streaming services are increasingly reliant on cheaper ad-based tiers for revenue and subscriber growth.

Theme parks could come under increased pressure. Park attendance, including at Disneyland and Walt Disney World, is typically a good barometer for consumers’ confidence in the economy, which already appears to be falling. Meanwhile, Comcast is preparing to open its long-awaited Epic Universe theme park in Orlando, Fla., in a big bet on its own intellectual property at a time when consumers are feeling pessimistic about the economy.

Although Disney executives have expressed optimism about summer booking for the parks this year, the trade war and the administration’s generally nationalistic worldview has increased anti-U.S. sentiment abroad. That is already putting a damper on America’s tourism industry, according to a report from Bernstein analyst Laurent Yoon and as my colleagues Suhauna Hussain and Andrea Chang reported.

For California’s already struggling film and TV production landscape, the tariffs will result in cost increases, for example, by raising the price of Canadian lumber used to build sets.

And don’t forget the possible loss of the Chinese box office, which has already become a problem for Hollywood and may soon get worse. The China Film Administration on Thursday said it would cut back on the number of U.S. films allowed into the world’s second-largest film market.

China used to be a gold mine for U.S. studios, which could count on certain blockbuster films making huge amounts of money from the nation’s booming middle class. But that changed in recent years as China’s own film industry became increasingly adept at creating films with impressive production values and often patriotic themes.

The Chinese government, of course, put its thumb on the scale in favor of homegrown productions.

Hollywood’s box office from China last year was down at least 75% from its 2017 peak, according to TD Cowen analyst Doug Creutz. Hollywood now accounts for a small percentage of overall annual ticket sales in China.

Even so, it would be a mistake to downplay the issue. With the costs of U.S. movies increasing, every little bit of lost revenue matters. Effects-driven spectacles such as “Jurassic World Rebirth” and “Avatar: Fire and Ash” can still do big business in the Middle Kingdom if they’re allowed in. What would the “Fast & Furious” series be without Chinese audiences?

Don’t forget Hollywood already lost Russia as a film market, after Vladimir Putin’s invasion of Ukraine. One less major territory these days can make the difference between breaking even and not, according to film industry insiders.

Most high-level dealmaking is also probably on hold for now. With Trump, everything is a negotiating tactic, and policies announced one day might be completely different the next. In that murky kind of environment, it will be difficult for executives to make long-term multibillion-dollar commitments.

That, for the time being, is the big-picture issue.

Whether you think Trump is recklessly dismantling an eight-decade global trade system for wrongheaded ideological reasons, or you believe he’s causing short-term pain to rewire the economic order in America’s favor, few would deny these moves are destabilizing.

Newsletter

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Stuff we wrote

President Trump tees off on ‘60 Minutes’ again, threatens CBS broadcast licenses. Trump takes to his Truth Social platform to criticize ‘60 Minutes’ coverage, which remains relentless despite his legal action against the program.

Theaters want you to wait longer to stream movies. Why that probably won’t happen. Top theater lobbyist Michael O’Leary called for a minimum theatrical window for 45 days. But many say it’s too late to turn back time.

Judge sides with Sony in ‘Wheel of Fortune’ and ‘Jeopardy!’ fight with CBS. Sony claimed CBS licensed the shows to TV stations at below-market rates and failed to maximize advertising revenues.

Newsmax made defamatory statements about Dominion Voting Systems, judge rules. Dominion is seeking $1.6 billion in damages, which will be decided by a jury in a trial that will begin April 28 unless a settlement is reached.

Coalition urges California attorney general to halt OpenAI’s for-profit transition. A petition signed by nonprofits, foundations and labor groups was sent to the state attorney general on Wednesday, urging him to halt OpenAI’s plans to restructure the nonprofit’s commercial arm into a for-profit business.

Numbers of the week

Hollywood’s pullback hasn’t reached the Warner Bros. Discovery executive suite.

Even after a rocky year, Chief Executive David Zaslav’s pay package rose 4% to $52 million for 2024, maintaining his standing as one of the most handsomely paid executives in America, ahead of his Hollywood counterparts, Meg James wrote. Bob Iger, who runs the much larger Disney, was paid $41 million last year.

Angel Studios’ animated movie “The King of Kings” opened with $19 million domestically, making it the latest faith-based success from the independent distributor.

It debuted in second place, behind “A Minecraft Movie,” which has now grossed $281 million in the U.S. and Canada, giving theaters a much-needed boost. Domestic sales are now essentially flat with last year, but still down significantly from prepandemic levels.

Film shoots

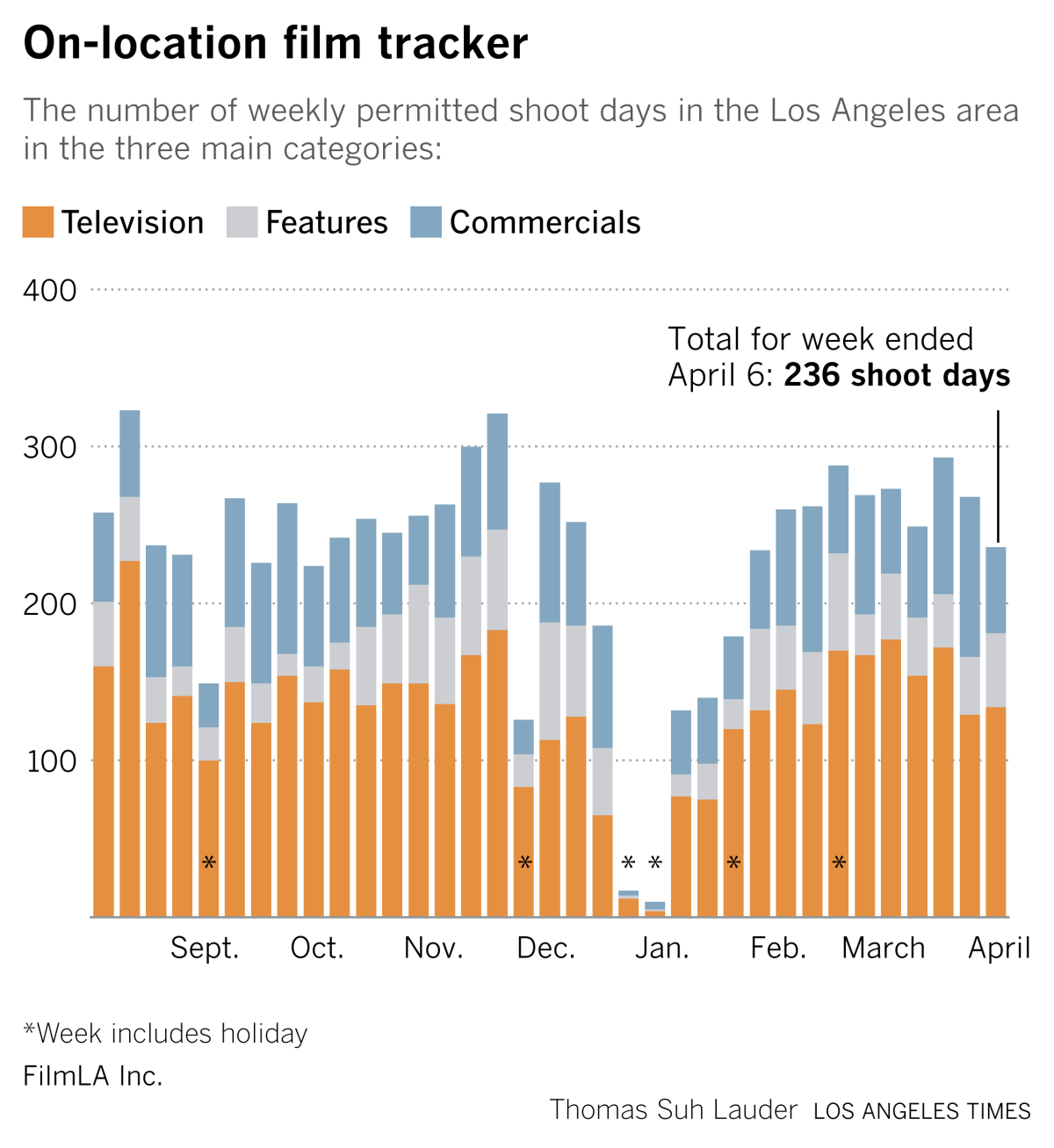

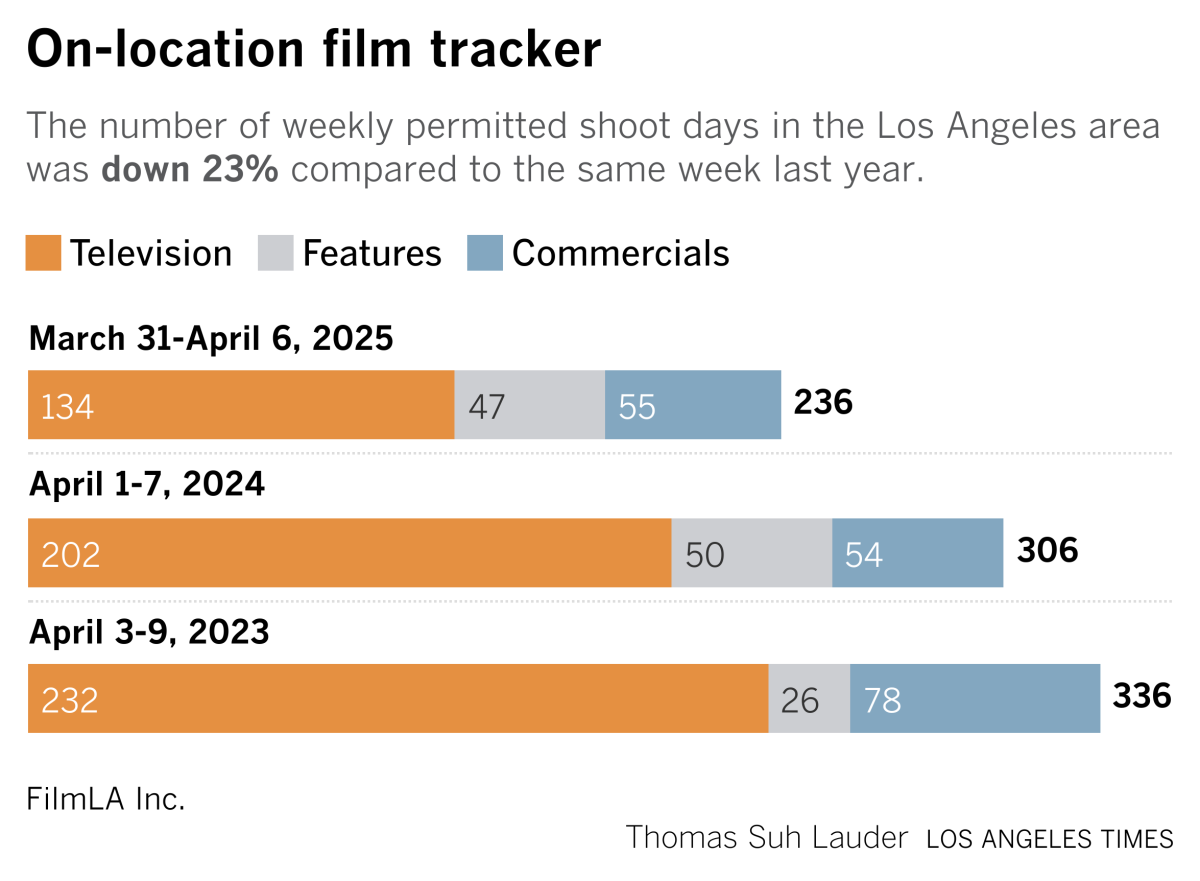

Production of television shows, feature films and commercials all declined in the Los Angeles area during the first three months of the year, Samantha Masunaga reports.

On-location production declined 22.4% compared with the same period a year earlier, according to a report released Monday by the nonprofit organization FilmLA, which tracks shoot days in the Greater Los Angeles region.

This should come as no surprise to anyone following our weekly charts. The latest are below:

Finally …

Listen: Post-hardcore band Turnstile has new music.