Last year, Walt Disney Co.’s annual shareholder meeting was fraught with tension as a billionaire activist investor sought to shake up the boardroom and change the course of the company.

This year, by comparison, will be less charged.

The Burbank media and entertainment company is coming off a strong year for its studio business, with hit films “Inside Out 2,” “Deadpool & Wolverine” and “Moana 2” each grossing more than $1 billion globally. Disney movies grossed an overall worldwide box office of more than $5 billion in 2024.

Disney also reached profitability for the first time in its streaming businesses, which include Disney+, Hulu and ESPN+.

But the company faces questions about softer results in its theme parks division, which has become Disney’s main economic driver. Disney has also recently tried to stay out of political culture wars, particularly as the Trump administration has targeted diversity, equity and inclusion efforts within corporations.

Ahead of the company’s shareholder meeting Thursday morning, The Times spoke with analysts and investors about what they want the company to address.

The CEO succession plan

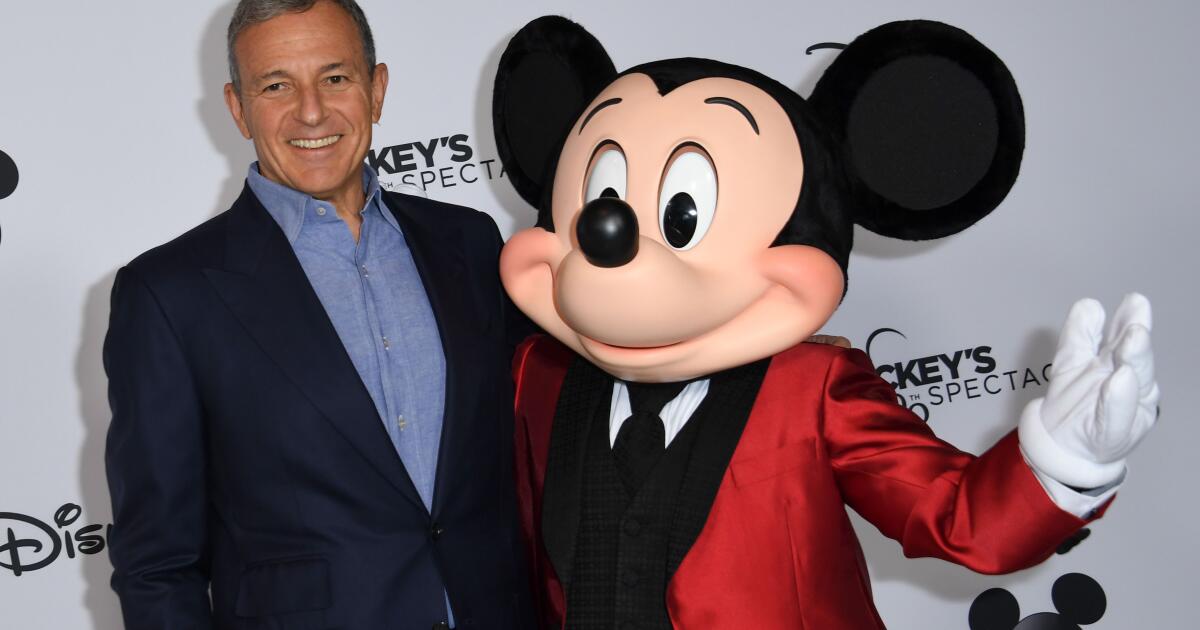

Though Disney has signaled it won’t name a successor to Chief Executive Bob Iger until early 2026, investors and analysts are eager for more details about how the search is progressing.

Disney Entertainment Co-Chair Dana Walden, fellow Entertainment Co-Chair Alan Bergman, parks, products and experiences Chair Josh D’Amaro and ESPN boss James Pitaro are all seen as potential internal successors.

Disney’s newly appointed chairman of the board, former Morgan Stanley executive chairman James P. Gorman, leads the CEO succession planning committee. The company said in its proxy statement that management succession planning “remains a top priority for the board.”

Finding the right successor for Iger, 74, is key to the company’s future stability. The firm fumbled in its last attempt to find a replacement for Iger; now-former CEO Bob Chapek lasted less than three years.

Brian Mulberry, client portfolio manager at Zacks Investment Management, began reducing the firm’s Disney shares after Iger’s departure. Though the firm’s portfolio does not currently include shares of Disney, Mulberry is keeping a close eye on the stock price and wants to get clarity on some of the company’s financial issues before coming to a new position.

“With Bob Iger on his way out, ‘Who’s going to right the ship’ is what we’re particularly looking for in the meeting,” he said.

The prolonged ambiguity about the succession plan is making investors antsy, said Laurent Yoon, senior analyst at Bernstein.

“Bob Iger already came back more than two years ago,” he said. “That uncertainty is not any clearer than before.”

Parks and recession fears

Disney’s experiences division, which includes its theme parks, cruise line and merchandise, ended 2024 with more muted growth due to inflation, expansion costs for the cruise line and softer results at its international parks.

The company will also face greater competition in Florida this summer when rival Comcast Corp. opens its Epic Universe theme park in Orlando — something analysts have frequently queried Disney executives about during earnings calls.

Disney said during its fourth-quarter earnings call in November that it expected to see 6% to 8% growth in operating income this year from its experiences division. But amid growing economic pessimism and fears of a recession, analysts and investors will be looking to see how the company addresses these potential threats to consumer spending.

“This summer is a very important season for Disney because [the parks business is] expected to recover, and if there’s a recession, then that’s a problem,” said Yoon, who maintains a “Buy” rating for the company’s stock. “There will be questions around what Disney would do in case there seems to be some macro headwinds.”

Even before concerns about an economic downturn took hold, there were growing questions about the affordability of a Disney vacation. Ticket prices at the parks have increased over the years.

Gavin Doyle, who has owned a small number of Disney shares since 2009, will be keeping an ear out for any mentions of discount offers, special promotions or even new details about expansions at the parks.

“There’s just a lot of levers they can pull … ways to bring people back in a time when demand may be softening,” said Doyle, founder of MickeyVisit.com, a parks affordability guide.

Handicapping ESPN’s flagship streamer

Live sports is a key attraction for consumers, and Disney has frequently mentioned its plans to launch its standalone ESPN flagship streaming product this summer.

But analysts and investors would like more information about pricing, the look of the product, how its experience will be different from the ESPN channel on linear television and how it will work with other services.

With Disney’s continued transition from linear television to streaming, the company will need to make sure “that transition is smooth,” said Yoon of Bernstein.

The company has already launched an ESPN tile on the Disney+ homepage to try to reduce churn and encourage new subscribers.

Culture wars

One proposal on the company’s proxy statement is an item from the National Center for Public Policy Research, a conservative think tank that is calling on Disney to reconsider its participation in the Human Rights Campaign’s corporate equality index.

The corporate equality index is an annual report that rates employers on their workplace inclusivity for LGBTQ+ workers.

The National Center for Public Policy Research, which often makes proposals at Disney’s shareholder meeting, said Disney’s participation in the index indicated that the company was involved in “partisan behavior” and that it should rethink that decision due to “fiduciary duty to its shareholders.”

Disney recommended its shareholders vote no on the proposal.

The proposal hints at the type of culture wars that Disney has recently started to shrink from. The company recently acknowledged that it removed a trans athlete storyline from a Pixar animated series, saying “many parents would prefer to discuss certain subjects with their children on their own terms and timeline.”

Disney has also softened some of its internal DEI policies, as have other Hollywood studios and businesses in other industries.