When Paramount+ launched in 2021, there were plenty of reasons to believe the service with the self-proclaimed “mountain of entertainment” would end up relegated to the bunny slopes.

The company was late to the direct-to-consumer game and had suffered from chronic underinvestment. Its legacy media brands, including MTV and Comedy Central, had lost their edge.

But although parent company Paramount Global — home of CBS, Nickelodeon and “Top Gun” — may be in a state of limbo as the media firm prepares for sweeping changes under new ownership, recent achievements in streaming have become a bright spot. In the fourth quarter of last year, Paramount+ gained 5.6 million subscribers globally, reaching 77.5 million.

The service ranked No. 2 in terms of viewing time for original shows during the quarter thanks to hits including “Landman” and “Tulsa King,” coming in behind only Netflix despite having far less new content than its chief rivals, according to Nielsen figures. Watch time for original series increased 20% from the same time last year, per internal data. Churn rates fell.

Paramount’s current management team — led by co-Chief Executives George Cheeks, Brian Robbins and Chris McCarthy — last month reiterated expectations for Paramount+ to achieve full-year U.S. profitability in 2025.

“When we launched only a few years ago, a lot of people probably counted us out,” said McCarthy, who’s also head of Showtime/MTV Entertainment Studios and Paramount Media Networks. “We often heard, ‘Too little, too late.’ … I think we took a lot of people by surprise.”

Chris McCarthy in 2021.

(Jesse Dittmar / For The Times)

The company is far from out of the woods. The positive streaming numbers come at a time when linear television networks are deteriorating, especially in basic cable.

Paramount went through a roller coaster of turmoil over the years, with multiple rounds of layoffs and restructurings as it tried to adapt. Overall fourth-quarter revenue missed Wall Street’s projections as cable continued to erode. But adjusted operating income, excluding certain items, increased in 2024 after several years of declines.

“Paramount+ is a viable product. The question, though, always has to be, ‘How much worse is linear TV going to get?’” said Doug Creutz, a media analyst at TD Cowen. “Just because streaming is profitable, if it isn’t significantly profitable and if linear continues to get worse, then your overall profits are going to go down.”

Challenges in the media industry and management missteps ultimately led to the decision by controlling shareholder Shari Redstone to sell to Skydance Media founder and tech scion David Ellison.

The $8-billion merger of Paramount and Skydance is expected to close in the first half of this year, though the deal has been complicated by President Trump’s lawsuit against CBS over edits to a “60 Minutes” interview with Kamala Harris. Paramount is also contending with a Federal Communications Commission probe concerning the same issue.

It will be up to the new owners to figure out how to boost Paramount+’s prospects, perhaps through more investment and partnerships. Many analysts still say Paramount+ lacks the size and scope to compete with the other streaming offerings. It accounted for just 1.3% of all TV viewing in February, putting it far behind Netflix, Disney and Amazon’s Prime Video.

“One of the biggest questions as we think about how the company will deal with streaming going forward is how much investment is going to be put behind the streaming pivot, and where those dollars are going to go,” said Robert Fishman, a media analyst at MoffettNathanson.

For now, Paramount bosses have to focus on what they can control, and that is making popular shows.

On that front, the company has produced a series of legit winners, particularly those created by “Yellowstone” maestro Taylor Sheridan. Three of his projects — “Tulsa King,” “Landman” and “Lioness” — were in the top 10 most-watched originals last quarter, according to Nielsen data.

“Tulsa King,” starring Sylvester Stallone, has been renewed for a third season, the company said this week. Sheridan, in an emailed statement, credited McCarthy with betting on his expansive vision after the success of “Yellowstone,” which aired on basic cable and streams on rival Peacock.

“His thinking was as ambitious as the worlds I wanted to create, asking me to make him long-form movies with the only goal being excellence in every aspect,” Sheridan said. “If we had told people then what we were planning to build, no one would have believed us.”

In addition to the Sheridan oeuvre, Paramount+ benefited from new Showtime series: The prequel “Dexter: Original Sin” and George Clooney-produced “The Agency.” In a statement, David Campanelli, president of global investment at media agency Horizon Media, credited Paramount for its high “batting average.” In addition to originals, CBS programming, live sports and “SpongeBob SquarePants” drove engagement last year.

The recent wins resulted from an unconventional decision — born of necessity — to pursue a less-is-more strategy. Instead of investing in a high-volume slate, the company banked on a handful of projects with high production values and big-screen star power. That approach got its first test cases with “1883” and “Tulsa King,” which saw substantial viewership overlap, despite coming from different genres.

“We certainly weren’t going to win the volume game,” McCarthy said. “Our bet was placed on not being the one that has the most volume, but being one of the ones with the most hits. … If we can engage, surprise and delight somebody every time they come for a big new hit, that’s when they’re going to stay with us.”

Another big upcoming streaming bet is “MobLand,” a drama from Guy Ritchie, starring Tom Hardy as a fixer for a crime family run by Pierce Brosnan and Helen Mirren’s characters.

Not all of McCarthy’s early plans to develop franchises for Paramount+ bore fruit. After Showtime came under McCarthy’s domain, he embarked on a strategy of spin-offs from the brand’s best-known series, including “Billions” and “Dexter,” hoping to repeat the success of Sheridan’s “Yellowstone” offshoots.

The “Dexter” plan became a reality with “Original Sin” and the upcoming “Dexter: Resurrection.” But planned “Billions” projects (“Millions” and “Trillions” were among the ideas proposed for the “Billions” television universe) were set aside. Instead, Paramount turned its attention to developing another series, based on the nonfiction book “Moneyland,” set in the world of international shell companies and tax havens.

McCarthy admitted he “may have oversimplified” the idea that the company could “re-create that magic” of the original “Billions.” Writers Brian Koppelman and David Levien “created a beautiful script in a whole new world” for a new show, but “it just wasn’t necessarily where we thought we needed to go,” he said.

“What we decided to do was take the essence of what ‘Billions’ was about and, rather than do another series about a hedge fund or another Wall Street, ask how do we elevate it to the next level?” McCarthy said. That show is expected to come out in 2026.

Whether McCarthy will be a part of the next era under Ellison and his cohorts remains to be seen. A representative for the Skydance group declined to comment.

Asked about his plans post-merger, McCarthy said: “No decision to share today. I continue to be focused on making the biggest hits that can create the most value for the company.”

Newsletter

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Stuff we wrote

Two-minute TV shows have taken over China. Can they take over the world? ‘Micro dramas’ (90-second episodes, cheesy plots, lots of romance) are catching on worldwide. Will they upend the entertainment industry?

‘Joker,’ ‘Matrix’ producer files for bankruptcy protection amid Warner Bros. fight. Village Roadshow attributed its red ink to its protracted battle with Warner Bros. over the release of “The Matrix Resurrections” and a push into independent production.

Comcast signs $3-billion deal to keep Olympics on NBC through 2036. The contract extension will allow NBCUniversal to broadcast the 2034 Olympic Games in Salt Lake City on NBC and streaming service Peacock

‘The Apprentice’ made Trump a reality TV mogul. Amazon is putting it back in the spotlight. The NBC show, which premiered in 2004, helped propel Donald Trump to new heights and set the stage for his political career. Now it’s streaming on Amazon.

With live-action ‘Snow White,’ Disney finds itself again in culture war crosshairs. Disney’s live-action ‘Snow White’ has faced a difficult road to its opening next week, with external controversies dogging it at every step.

ICYMI

Film shoots

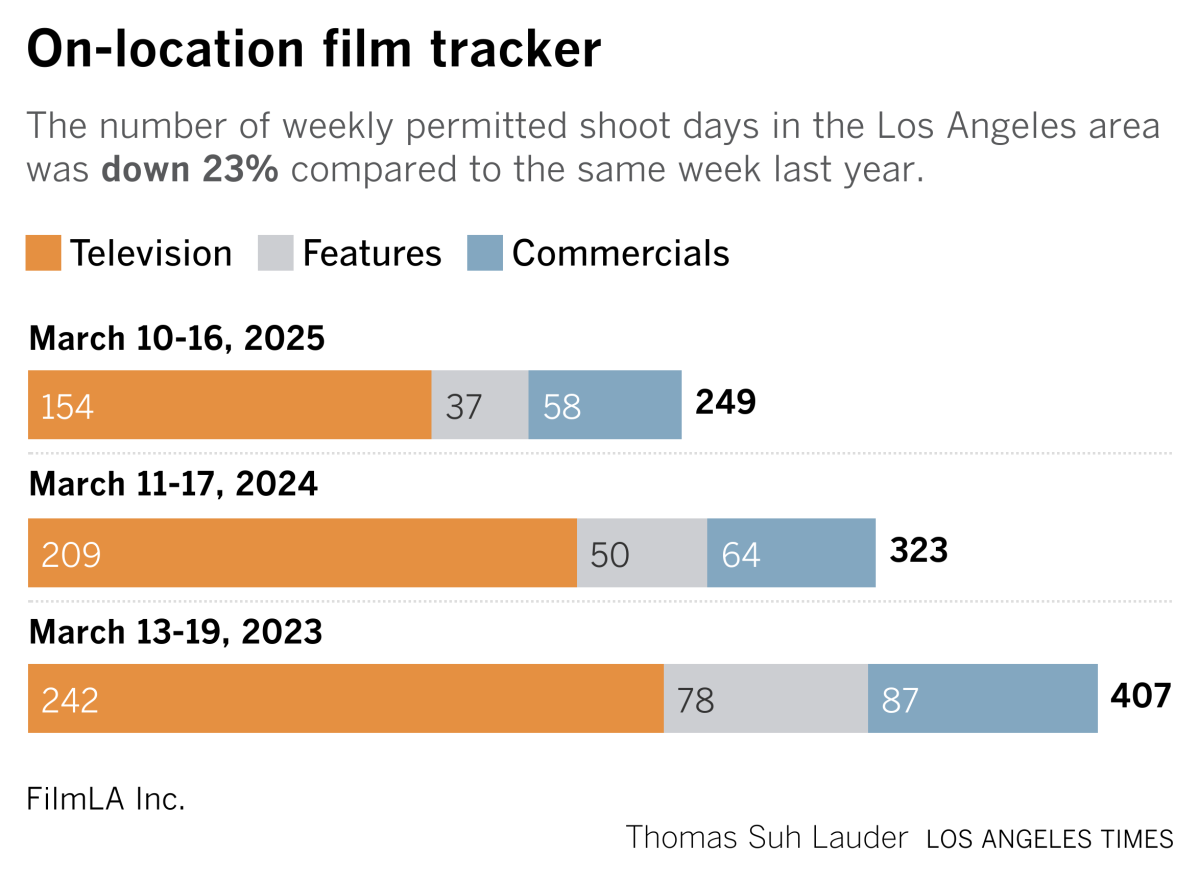

On-location production in the L.A. area last week was down 23% from a year ago, according to FilmLA data.

Finally …

NBC’s “The Office” turns 20 years old on March 24. Here’s Stephen Battaglio’s piece on the show and its lasting influence.