Getty Images

Getty ImagesA rise in energy prices pushed UK inflation to its highest rate for six months, official figures show.

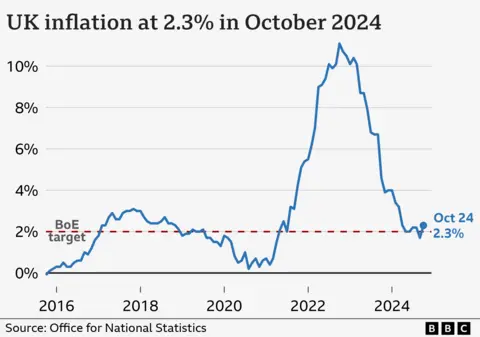

The inflation rate, which measures price changes over time, hit 2.3% in the year to October, a bigger-than-expected increase from 1.7% in September.

Annual gas and electricity bills for a typical household went up by about £149 last month, but prices are rising much more slowly than in recent years.

The latest inflation figure comes after the government revealed that an additional 50,000 pensioners will be living in relative poverty next year as a result of cuts to the winter fuel allowance.

Higher inflation pushes up the cost of living for households, and can lead to interest rates remaining at a higher level, making the cost of loans, credit cards and mortgages, more expensive.

Inflation has fallen from its peak in October 2022, but when the rate falls, it does not mean that prices are coming down, but that they are rising less quickly.

There are concerns inflation could be fuelled further by big tax and spending plans announced in the government’s Budget, as well as potential trade taxes imposed by the US, with Donald Trump pledging a 20% tariff on all imports.

Some charities have already voiced concerns about how less well-off households will cope during the colder months.

In September, the government announced the £300 winter fuel payment is to be means-tested for all but the poorest pensioners.

Other support for energy bills which was handed out in recent years has since been scaled back.

However, with temperatures dropping to freezing levels this week, the focus on the cost of heating homes is likely to become the focus of many households.

Although there has been a jump in electricity and gas costs, energy prices are still lower than last winter and the winter before. People using an typical amount of gas and electricity are currently paying £1,717 under the energy price cap, which is set by the regulator Ofgem.

The cap determines the price paid for each unit of energy used in 27 million homes across Britain. Different rules apply in Northern Ireland.

Derek Likorish, chief executive of energy supplier Utilita, said he had seen a 60% increase in customers asking the company for help with bills.

“Now it’s really cold, that figure is going to be even higher,” he told the BBC, adding that people were “running on empty” after being hit with rising costs through the pandemic and energy crisis.

“I have never been so concerned as I am about this winter with no additional help from the government,” Mr Likorish added.

Grant Fitzner, chief economist for the Office for National Statistics (ONS), said while higher energy costs drove inflation higher last month, the increase was offset by falls in live music and theatre ticket prices, as well as the raw material costs for businesses falling.

Inflation in the services sector, which measures price rises for things such as haircuts, airfares and hotels, ticked up to 5%, the ONS said.

Food price inflation remained unchanged from September, but alcohol and tobacco prices rose sharply.

‘Constant battle’

James Stott, general manager of Garten Bar in Manchester’s Corn Exchange, said inflation was “yet another challenge in an industry that seems to constantly battle challenges”.

“We will strive to not let that affect our guest prices, but eventually it will have to be passed on,” he said.

Darren Jones, chief secretary to the Treasury, said the government knew “families across Britain are still struggling with the cost of living”, but told the BBC it was “good news” that inflation was “stable”.

Interest rates were cut to 4.75% two weeks ago, but experts suggest they will not be cut again until next year. The last time inflation was at 2.3% – above the Bank of England’s target – was in April.

Shadow chancellor Mel Stride said claimed Labour’s Budget would “push up inflation and mortgage rates”.

Russ Mould, investment director at AJ Bell, said policymakers could argue inflation at 2.3% is still “relatively low”, but he added households were still feeling the impact of price rises over the last few years.

Compared to October 2020, the goods monitored to calculate the UK’s inflation rate were up by 24%, he said.

Fiona Cincotta, a financial market analyst, pointed out that the “hotter” than expected inflation rate comes after the Bank of England has “already warned that rates may be cut at a slower pace”.

Andrew Bailey, the Bank’s governor, said earlier this month that interest rates were likely to “continue to fall gradually from here”, but cautioned they could not be cut “too quickly or by too much”.

How to keep energy use – and bills – down

- If your hot water is too hot to wash your hands in, then your setting is too high so turn the boiler down

- Manage your draughts, such as putting a black bag with scrunched up paper up an unused chimney, or limit other draughts around the home

- Limit time in the shower to four minutes. The charity WaterAid has compiled a playlist of four-minute songs to keep you to time