Article content

(Bloomberg) — Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

- Tough road for IPOs

- U-turn on India

- Bank Nifty farewell

Good morning, this is Ashutosh Joshi, an equities reporter in Mumbai. A pall of gloom continues to hang over India’s stock market, with Nifty futures offering little respite. As the market wraps up a rough week — it’s a public holiday Friday — concerns grow about further declines spurring a potential vicious cycle of selling and falling prices.

Article content

IPO hopefuls brace for rough waters ahead

Food-delivery major Swiggy surprised naysayers with a strong debut on Wednesday even in a bearish market. But other IPO aspirants might not have it so easy now that the market sentiment has soured. Big ticket listings like NTPC Green Energy, LG Electronics and HDB Financial Services are still in the pipeline. If history is any guide, reasonably priced IPOs can still find takers — even in a gloomy market. And the converse is also true: companies can still go public, but need to tone down their expectations, just like investors.

About-face on India

It’s taken just two months for fund managers in Asia to sour on India. Back in September, the majority of them cited India as their favorite bet in the region after Japan. But a survey by BofA Securities earlier this month shows that the majority are now underweight on Indian equities. No prizes for guessing who has wrested India’s runner-up spot: China. Meanwhile, India’s stock market continues to feel the pinch, with foreign outflows since Oct. 1 now crossing the $13 billion mark.

Curtains fall on Bank Nifty weekly contracts

Article content

On Wednesday, traders bid farewell to the contract that fueled India’s retail options frenzy and helped position the country as the world’s largest derivatives market. With most weekly contracts — one of the most liquid trading tools for investors — now extinct, volumes are expected to shift to monthly contracts. Market watchers will be watching closely to see if these regulatory changes succeed in reducing speculative activity or end up pushing retail money flows into even riskier assets.

Analysts actions:

- Britannia Cut to Hold at Batlivala & Karani; PT 5,400 rupees

- Cera Sanitary Raised to Buy at Asian Markets; PT 8,345 rupees

- Eicher Raised to Buy at Asian Markets; PT 5,250 rupees

Three great reads from Bloomberg today:

- India Eclipses China in Driving Asia Oil Demand Growth, EIA Says

- Trump Picks for Top Jobs Stress Loyalty, Culture Wars, TV Skills

- Big Take: Lula Risks Clash With Trump by Embracing Xi and China

And, finally..

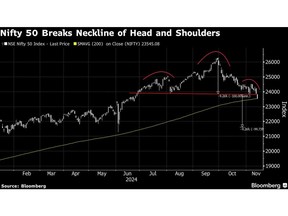

The Nifty entered correction territory after Wednesday’s tumble extended its drop from the September peak to over 10%. This also broke a key ‘head and shoulders’ pattern, hinting at further downside. The one solace for bullish investors is that the index managed to close above the 200-day moving average — a crucial level for technical analysts — after briefly falling below it. With fundamentals looking weak, the attention has shifted mainly to support and resistance levels.

—With assistance from Alex Gabriel Simon, Savio Shetty and Kartik Goyal.

Share this article in your social network