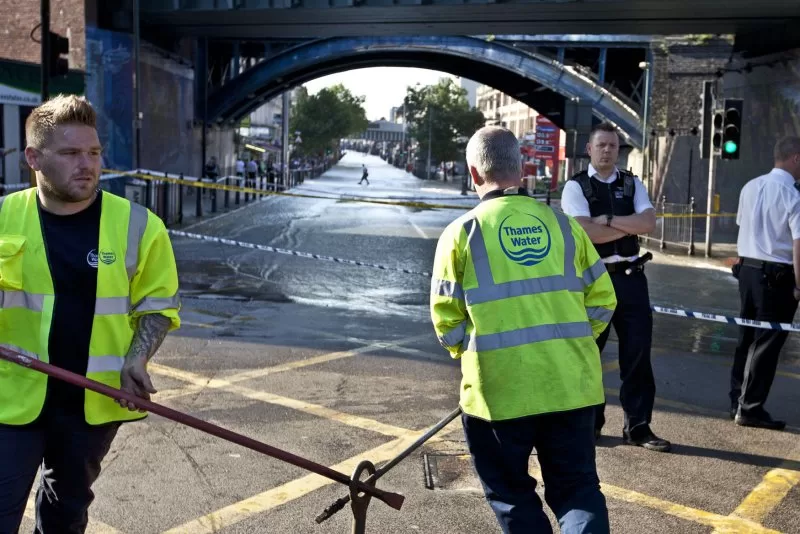

Thames Water, Britain’s largest water utility, announced Friday it had secured a $3.9 billion lifeline, access to cash reserves and extensions on its liabilities to keep it afloat for the next 12 months as it battles to restructure a $20.8 billion mountain of debt. File photo by Terry Schmitt/UPI |

License PhotoOct. 25 (UPI) — Britain’s embattled Thames Water, the country’s largest water utility, announced Friday it had secured a $3.9 billion line of credit, access to cash reserves and extensions on its debt to keep it afloat through October 2025 after regulators capped bill rises.

The company, which serves 16 million homes and businesses in London and the southeast, said in a news release that it had launched a “consent process” on a transaction support agreement with its creditors and shareholders that if approved would provide a significant boost to Thames Water’s “liquidity runway.”

It said completion of the Liquidity Extension Transaction and the related Security Trust and Intercreditor Deed proposals would improve the solvency position of the business sufficiently “to enable us to continue with the planned investment and maintenance of our infrastructure in order to continue to meet customers’ needs, and our environmental responsibilities.”

The deal buys Thames more time to restructure a $20.8 billion debt mountain that it admitted would climb to $23.3 billion by the end of the financial year in March.

But Thames said it would also allow it to progress its equity raise process, a recapitalization transaction and complete a final determination process to figure out if a five-year Ofwat package of price controls, service requirements and incentives is workable — and if not, to appeal to the antitrust regulator.

Launching an appeal with the Competition and Markets Authority would further extend the transaction, keeping Thames liquid for another seven months through May 2026.

The BBC reported that the deal centered on existing creditors agreeing to take a haircut.

Last month, Thames warned it could run out of money by December after Ofwat, the water industry regulator, placed it in special measures and denied it permission in July to hike customers’ bills — initially by 43% by 2030 and then 53% — that the company said it needed to avoid going bust

Thames and 15 other water utilities in England and Wales wanted to cover the $135.7 billion cost of modernization plans to maintain quality drinking water, build 10 new reservoirs and cut water pollution by raising annual bills by $187 over the next five years.

But Ofwat capped the rise at $122 amid public anger over poor performance including the loss of billions of gallons of water through leaks, raw sewage spills into rivers and lakes and polluted swimming beaches.

Thames was allowed a 23% raise meaning the average bill will rise to $695 a year.

The cap is linked to a September 2023 ruling in which Ofwat said 11 of the water companies must pay their customers back a combined $139 million in 2024 through lower bills as a penalty for “underperformance” on pollution, leaks and customer service.

As the largest water utility by far, Thames had to pick up 90% of the tab or $122.7 million after their performance was assessed against annual targets for 2022 to 2023 and found “seriously wanting.” It was among seven water companies judged as “lagging, with the other four deemed only “average” and none were categorized as ‘leading.'”

However, CEO Chris Weston hailed Friday’s announcement as proof of the progress Thames, which has a $20.8 billion debt mountain, was making toward getting back onto a more stable financial footing, stressing that the company had also upped Ofwat-verified service performance levels

“We are working closely with and have the support of our creditors, enabling Thames to continue to implement our turnaround plan so that we can deliver better results for our customers and the environment whilst seeking to attract new capital into the business,” said CEO Chris Weston.

“In the meantime, our teams on the ground continue to supply our services to our 16 million customers every day.”

Thames Water Chairman Sir Adrian Montague said the finance injection was an important step in the process of bolstering the company’s long-term financial resilience.

“There will be further stages and we will continue to work collaboratively with our many stakeholders as we look to attract new equity into the business and seek a final determination that enables the delivery of our ambitious business plan for the next five years,” said Sir Adrian.