The last time Donald Trump was president, he delivered a massive tax cut, touting the many benefits of the 2017 law. But a slew of nonpartisan reviews found it mostly benefited the wealthy, expanded the federal deficit enormously and didn’t deliver promised economic benefits to the middle class.

Perhaps recognizing that his previous tax cut lacked populist appeal, the former president has spent the summer reeling off new tax-cut proposals — promising to exempt tips, Social Security benefits and overtime pay from federal taxes.

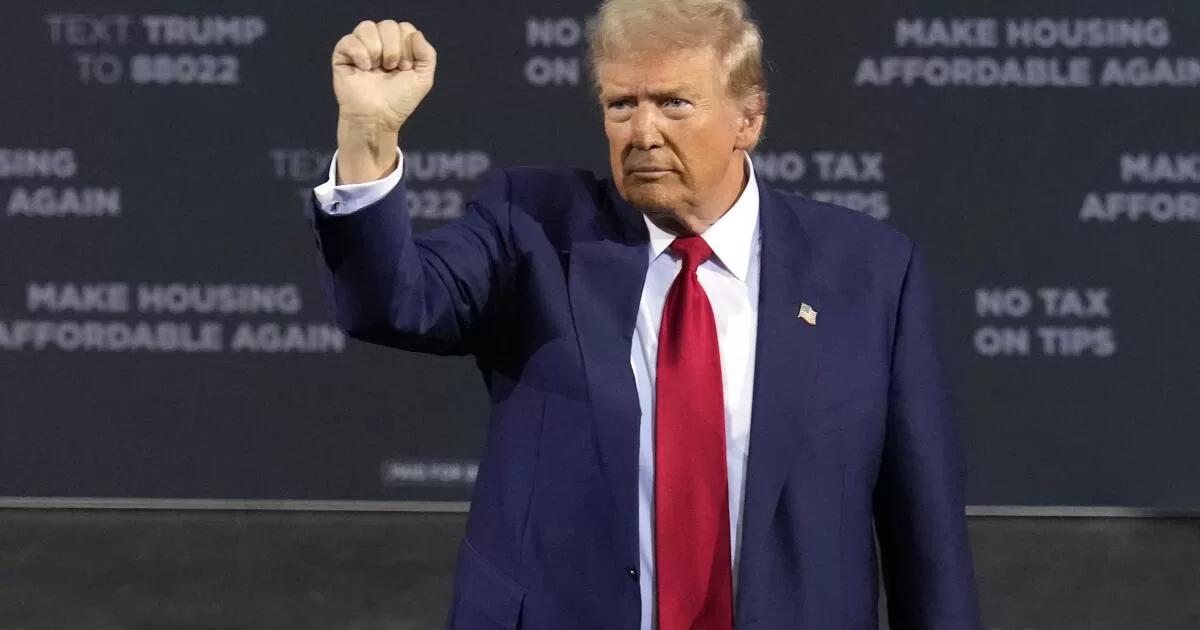

Trump used a rally Thursday in Tucson to roll out the latest proposal, to stop taxing overtime pay.

“People who work overtime are among the hardest-working citizens in our country,” the Republican presidential nominee said. “And for too long, no one in Washington has been looking out for them.”

He said his proposal meant “police officers, nurses, factory workers, construction workers, truck drivers and machine operators” would finally “catch a break.”

Tax and policy analysts from across the ideological spectrum quickly lambasted the Trump proposal, saying it would make an already massive federal budget deficit even larger. It wasn’t immediately clear how much eliminating the three taxes would cost the U.S. Treasury, though one group said the Social Security tax ban alone would deny the government $1.6 trillion over a decade.

Several critics said the proposals amounted to pandering to working-class voters whose support could tip the balance in several states. Offering breaks to those who earn tips and overtime felt like a “sham,” they added, coming from a man whose Labor Department failed to protect worker tips and enacted policies that made millions of employees ineligible for overtime pay.

“Trump has a long anti-overtime record,” Heidi Shierholz, senior economist at EPI Action, a labor-oriented advocacy group, said in a statement. “While president, he stripped overtime protections from millions by refusing to defend the Obama-era overtime rule in court and instead publishing his own, much weaker rule.”

By shifting the income eligibility level at which the Labor Department requires workers be paid overtime, Trump helped push an estimated 3.2 million workers out of the category designated to get the extra pay, usually at time-and-a-half, Shierholz’s analysis showed.

An additional 5.2 million workers were subject to losing overtime payments from businesses that could misclassify them as managers or executives, a frequent maneuver employed by businesses, Shierholz said. And rules proposed by Project 2025 — written for a new Trump administration by Trump allies and former aides, but which the former president insists he will not follow — “would strip overtime protections from at least 8 million [additional] workers,” Shierholz said.

The promise to exempt tips from taxes also rings hollow to some employee groups. That’s because of another action by Trump’s Labor Department, which approved regulations that allowed businesses to “pool” tips, to be shared among employees, but without assuring the money wouldn’t go to management.

The Service Employees International Union said Trump-appointed bureaucrats cost workers an estimated $5.8 billion in tips each year. That “departs from long-standing practice and precedent and threatens the economic security of millions of working people and their families,” the union told the Labor Department.

After an outpouring of 375,000 comments, many of them from outraged restaurant servers and bartenders, Congress approved a bill amending the Fair Labor Standards Act. It made clear that employers could not keep tips earned by their workers.

The Trump campaign did not respond to a request for comment Friday. It has not rolled out detailed summations of the tax-cut proposals, including how the government would make up for the lost revenue or cut programs to make the changes “deficit neutral.”

J. Bradford DeLong, a UC Berkeley economist, said the twin economic crises of the Great Recession and the COVID-19 pandemic made deficit spending warranted. “But that time has come to an end,” DeLong said via email.

“So the first question to ask of any promises about a tax cut is now: Is this going to be financed by cutting spending, and if so, on who, or is this to be financed by raising taxes on somebody else, and if so, on who?” DeLong said. “And if you do not cut spending and do not explicitly raise other taxes, then ultimately inflation will collect the taxes in a very unpleasant and destructive way.”

DeLong said it appeared Trump and his advisors had not thought through such questions, which he called “profoundly unserious” behavior.

Douglas Holtz-Eakin, president of the center-right American Action Forum, said it seemed Trump cooked up his policy proposals on the fly, testing their popular reception at his rallies, without a sober assessment of their effect on the economy and the federal budget.

“He’s looking for the populist appeal,” said Holtz-Eakin, who once headed the Congressional Budget Office and advised President George W. Bush. “These are gimmicks and horrible ideas. Some pointy head like [me] can worry about the impact and the numbers. That’s not his problem.”

Not long after Trump called for an end to taxes on tips, Vice President Kamala Harris also said she would end tips on gratuities. The Democratic presidential nominee said she would simultaneously push for an increase in the federal minimum wage, now at $7.25 and unchanged since 2009.

Harris’ team said it was aware of concerns that high-income individuals might try to mischaracterize their income as tips, to lower their tax liability.

A campaign official who declined to be named to discuss internal policy discussions said: “As president, she would work with Congress to craft a proposal that comes with an income limit and with strict requirements to prevent hedge fund managers and lawyers from structuring their compensation in ways to try to take advantage of the policy.”

Holtz-Eakin said Harris, like Trump, also had made proposals — like a proposed $25,000 in down-payment assistance to first-time homebuyers and a $50,000 tax deduction for small businesses — that potentially could expand the deficit. He accused her and Trump of not taking the U.S. debt crisis seriously.

In the first seven months of this fiscal year, spending on net interest hit $514 billion, surpassing the amount that went to national defense. It was also more than the U.S. spent on Medicare.

“Yesterday, for the first time in U.S. history, interest costs exceeded a trillion dollars in a year,” Holtz-Eakin said, noting that the fiscal year ends on Sept. 30. “And the year’s not over, so hold on.”

The nonpartisan Tax Foundation estimated that Trump’s proposal to end taxes on Social Security benefits would increase the budget deficit by $1.6 trillion over 10 years and accelerate the insolvency of the Social Security and Medicare trust funds.

Trump’s continuation of his 2017 cuts — including on corporate tax rates and capital gains — would be another budget buster. In last week’s debate, Harris protested that the result would be “a tax cut for billionaires and big corporations, which will result in $5 trillion to America’s deficit.”

The Tax Foundation essentially concurred, saying that Trump’s tax cuts (prior to the most recent proposed reductions) would decrease federal tax revenue by $6.1 trillion over 10 years, and somewhat more modestly, when factoring in possible economic growth.

Harris has proposed increasing taxes on capital gains and other sources. Still, the Tax Foundation estimated her tax and spending proposals would increase deficits by $1.5 trillion over the next decade. That shortfall could grow to $2.6 trillion, considering the economic impacts of her policies, the nonprofit said.

Holtz-Eakin called the spiraling debt “appalling,” adding: “It is a paramount threat to the U.S. economy and to national security. Everybody who’s looked at it carefully has come to the same conclusion. But it’s hard work to deal with it, and [the candidates] don’t want to do the work.”