Two rival governments have been fighting for days over the central bank’s leadership, threatening a UN-brokered peace deal.

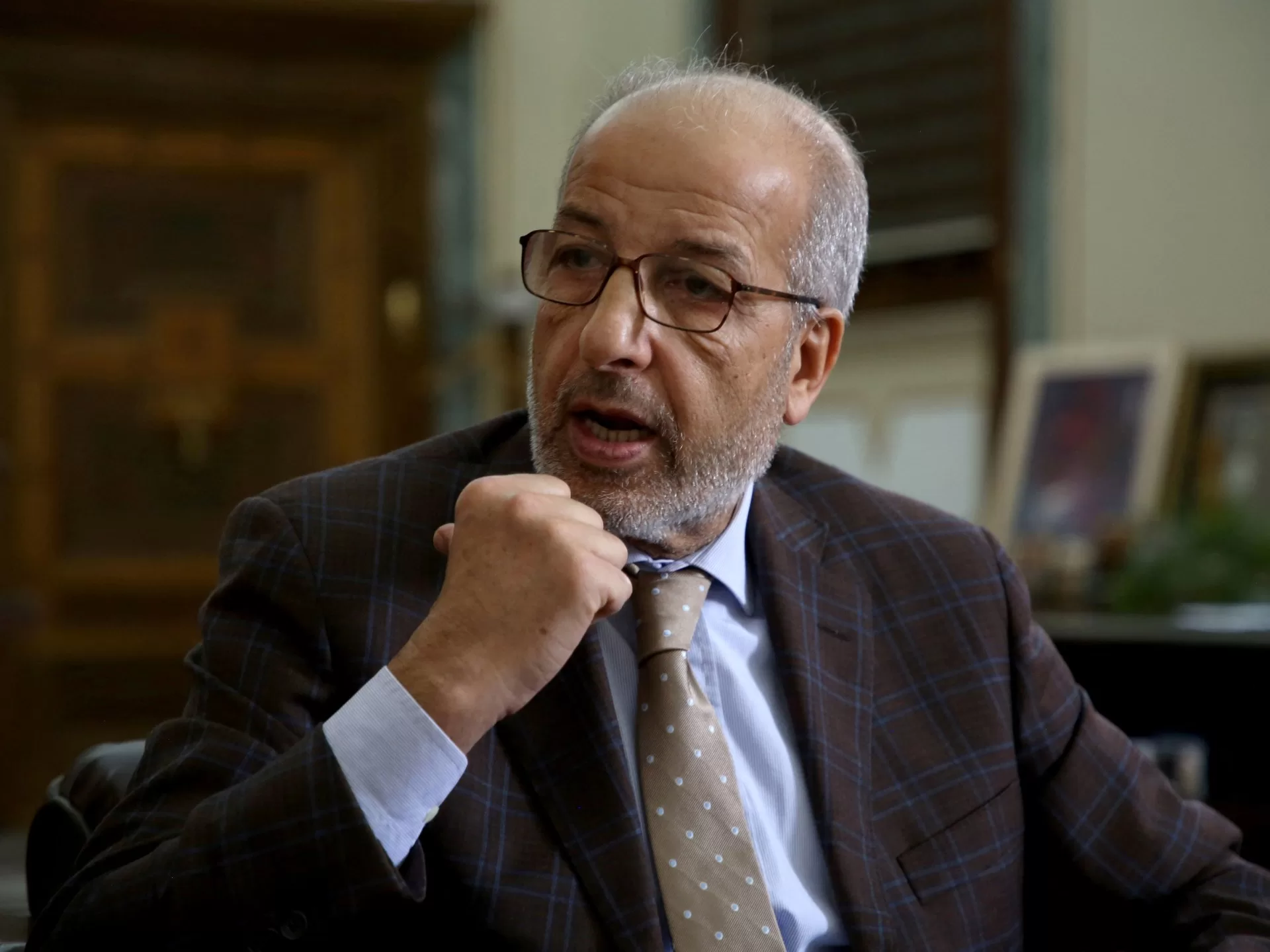

Libya’s internationally-unrecognised eastern-based government is shutting down oilfields in response to “attacks on the leadership and employees of the Central Bank of Libya”, its prime minister, Osama Hammad, says.

The “force majeure” applies to all fields, terminals and oil facilities, the eastern authorities said on Monday in a statement on Facebook.

While the eastern government in Benghazi lacks international legitimacy, most of Libya’s oilfields are under the control of eastern military leader Khalifa Haftar.

The Benghazi government did not specify for how long the oilfields could be closed.

Abdul Hamid Dbeibah, the prime minister of the internationally-recognised Government of National Unity, based in the capital Tripoli in western Libya, said that oilfields should not be allowed to be shut down “under flimsy pretexts”.

The National Oil Corp (NOC) did not confirm whether production had been shutdown, but a subsidiary, the Waha Oil Company, said that it planned to gradually reduce output, while another subsidiary, Sirte Oil Company, said it would cut output.

Two engineers at Messla and Abu Attifel told Reuters on Monday on condition of anonymity that production continued and there had been no orders to halt output.

The announced oilfield shutdown comes as part of an ongoing dispute between the eastern government and the UN-recognised government based in Tripoli, which for days have been fighting over the central bank’s leadership, threatening a UN-brokered peace deal.

This latest spat between the two administrations came after attempts to replace the Central Bank of Libya (CBL) head Sadiq al-Kabir with armed factions mobilising on each side.

Critics have accused al-Kabir of mishandling oil revenues.

The Tripoli government’s Presidential Council appointed Mohamed Alshukri as governor of the central bank last week, Al Jazeera’s Libya correspondent Malik Traina said, a move rejected by the CBL.

Alshukri eventually announced he would not take the position, rejecting “any bloodshed between Libyans on his behalf”, Traina said.

However, the dispute continued on Monday after a Tripoli government delegation attempted to takeover the CBL bank governor’s office.

Hammad denounced the attempt to replace the head of the CBL and said he would “take all legal measures” against the storming of the bank and the “kidnapping of a number of its employees”, local media quoted him as saying.

The eastern-based government did not specify for how long the oilfields could be closed.

A drop in Libyan oil exports may push Brent crude prices to the mid-$80s a barrel, according to an analyst at Citigroup, Bloomberg reported.

Brent crude prices broke through the $80 mark on Monday, having been as low as $75 a barrel last week.

The central bank has long maintained its independence from the rival governments and is the only internationally recognised depository for Libyan oil revenues, a vital source of income for a country torn by years of fighting.

Libya is still driven by conflict and civil war more than a decade after the 2011 NATO-backed overthrow of longtime ruler Muammar Gaddafi.