The emotion-filled family sequel grossed $100 million from theaters in the U.S. and Canada during its second weekend, representing a mere 35% decline from its gangbusters domestic opening. With $724 million in global ticket sales so far and impressive word-of-mouth, a $1-billion total seems all but assured. Those kinds of numbers go a long way toward burnishing the Pixar brand, which was in need of a confidence boost.

Coming up next for family audiences: more sequels! Universal and Illumination’s “Despicable Me 4” is expected to do huge numbers when it launches during the week of July 4. Disney is betting on “Moana 2” and “Mufasa: The Lion King” (spun off from the “live-action” “Lion King” remake that was entirely computer-generated) to continue its animated momentum.

But the biggest question facing the feature animation business is one that neither “Inside Out 2” nor the Minions — or even Sony’s successful “The Garfield Movie” — can address: What is going on with originals?

While Hollywood thrives on sequels, a robust industry depends on the creation of new franchises. This is especially true for Disney, which relies on new movies to fuel its parks business, toy sales and other facets of its corporate entertainment apparatus. Those new hit properties have been hard to come by lately.

Before “Inside Out 2,” Disney Animation released “Wish,” which failed to impress critics or audiences. Pixar’s “Elemental,” while it eventually found its footing in theaters, posted modest numbers compared with the studio’s prior efforts. DreamWorks Animation’s “Ruby Gillman, Teenage Kraken” and Disney’s “Strange World” full-on bombed. Disney’s “Encanto,” released in the pandemic-afflicted year of 2021, disappointed in theaters, though it became a viral musical phenomenon when it reached streaming.

“There has been trouble getting new stuff established,” said Tom Sito, an animation professor at USC’s School of Cinematic Arts. “It’s very hard, when you have a brand-new character, to get the audience in 90 minutes. It’s the reason why Disney did so well with fairy tales, because when you hear the word ‘Aladdin’ or ‘The Little Mermaid, you know what you’re getting. When you hear the word ‘Wish’ or ‘Onward,’ you don’t.”

There are multiple theories for why original animated properties have been struggling to generate box office sales.

Disney often is blamed for training audiences to watch its movies at home by sending its pandemic-era Pixar movies “Soul,” “Luca” and “Turning Red” straight to Disney+. Other studios shortened their theatrical windows after using COVID-19 as an opportunity to experiment with different release strategies, meaning moviegoers had more flexibility to wait to see new films online if they wanted.

Economic factors also are at play. Animation is expensive for studios, with Pixar and Disney typically spending $175 million to $200 million to produce a feature film (rivals, including Illumination, Sony and Paramount, spend less). That puts a limit on the companies’ appetite for risk.

And for families, taking kids to the movies can be expensive, and getting everyone in the car on time is a hassle. With those costs and headaches in mind, parents want to be reasonably sure the experience is worth the trouble, and movies with already familiar characters are generally considered a safer bet.

There’s also just so much competition for children’s attention, between social media, YouTube and streaming. Studios have to work harder for new stuff to break through.

It’s more difficult to market these movies now than during the Disney renaissance era, when the Burbank entertainment giant could use every arm of the company, including ABC and the Disney Channel, to make the pitch to kids and parents. Disney still does that, but with linear TV on the decline, it’s a less powerful strategy than it once was.

For those reasons and others, families aren’t always trekking to the theater on opening weekend for an original motion picture, as “Elemental” showed. That movie opened with Pixar’s worst domestic debut since the first “Toy Story” in 1995 but had remarkable staying power, eventually grossing nearly $500 million, suggesting the problem wasn’t the quality of the movie itself. As Ireland-based kids media consultant Emily Horgan has noted, the film also was a hit on streaming.

Universal and Illumination had a weak start with “Migration” over Christmas weekend yet held on to reach almost $300 million (still low, but not as bad as it could have been).

Despite the challenges, studios are still trying to make originals. DreamWorks Animation in September will release “The Wild Robot,” a sci-fi adventure based on a book of the same name, featuring the voice of Lupita Nyong’o. Disney and Pixar will test the originality waters again next year with “Elio,” about a young boy who accidentally becomes Earth’s intergalactic ambassador. But sequels will be there to fill the coffers. In 2026, Disney will release “Toy Story 5” and “Frozen III.”

Pixar executives, in interviews with Bloomberg, have outlined a strategy of releasing three movies every two years, toggling back and forth between originals, sequels and spinoffs.

One hopes that Pixar will continue to be selective when it comes to mining its past hits. “Inside Out 2” worked because it had an inspired premise — what new emotions would come into the mix once Riley hit puberty? It was a simple idea, well executed. And the timing was ideal, with memories of the groundbreaking original still firmly implanted in the emotionally wrecked minds of the folks who saw it in 2015, many of whom now have offspring of their own.

But sequels and spinoffs have their own risks, as Pixar’s “Toy Story” offshoot “Lightyear” demonstrated when it cratered in 2022. Young people, even kids, can smell an ill-conceived franchise extension a mile away.

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Stuff we wrote

Hollywood’s exodus: Why film and TV workers are leaving Los Angeles. With Hollywood production activity and employment down while the cost of living rises, some film and TV workers are leaving Los Angeles — and California.

Fox News and others sign on to carry CNN’s presidential debate. Major broadcast networks and cable news outlets have agreed to simulcast the event featuring CNN anchors Jake Tapper and Dana Bash.

Disney canceled a Florida relocation. Employees who were told to move are suing. A lawsuit seeks damages for Disney employees who moved from California to Florida after the company told them they were being transferred — and then backtracked.

California lawmakers are trying to regulate AI before it’s too late. Here’s how. California lawmakers are trying to get ahead of AI in the workplace but are already playing catch-up.

ICYMI:

Prosecutors allege Alec Baldwin acted recklessly on ‘Rust’ set

Netflix to open retail centers in Texas and Pennsylvania

Donna Langley on AI: ‘We’ve got to get the ethics of it right’

Number of the week

$2

Cut costs and raise prices. That’s the plan for Paramount Global as it charges into a new era after a deal fell apart that would have put Skydance Media founder David Ellison in charge of the studio.

Paramount on Monday announced plans to boost the monthly price of its streaming service, Paramount+. The ad-supported Paramount+ Essential tier will see its fee hiked $2 to $7.99, while the ad-free Paramount+ With Showtime will increase by $1 to $12.99. The new pricing scheme will take effect in August for new subscribers.

This comes as streamers across the board raise fees in order to hit profitability targets. Paramount also is looking to slash expenses as it forges ahead as a standalone media company, with its new three-executive “office of the CEO” recently identifying $500 million in reductions.

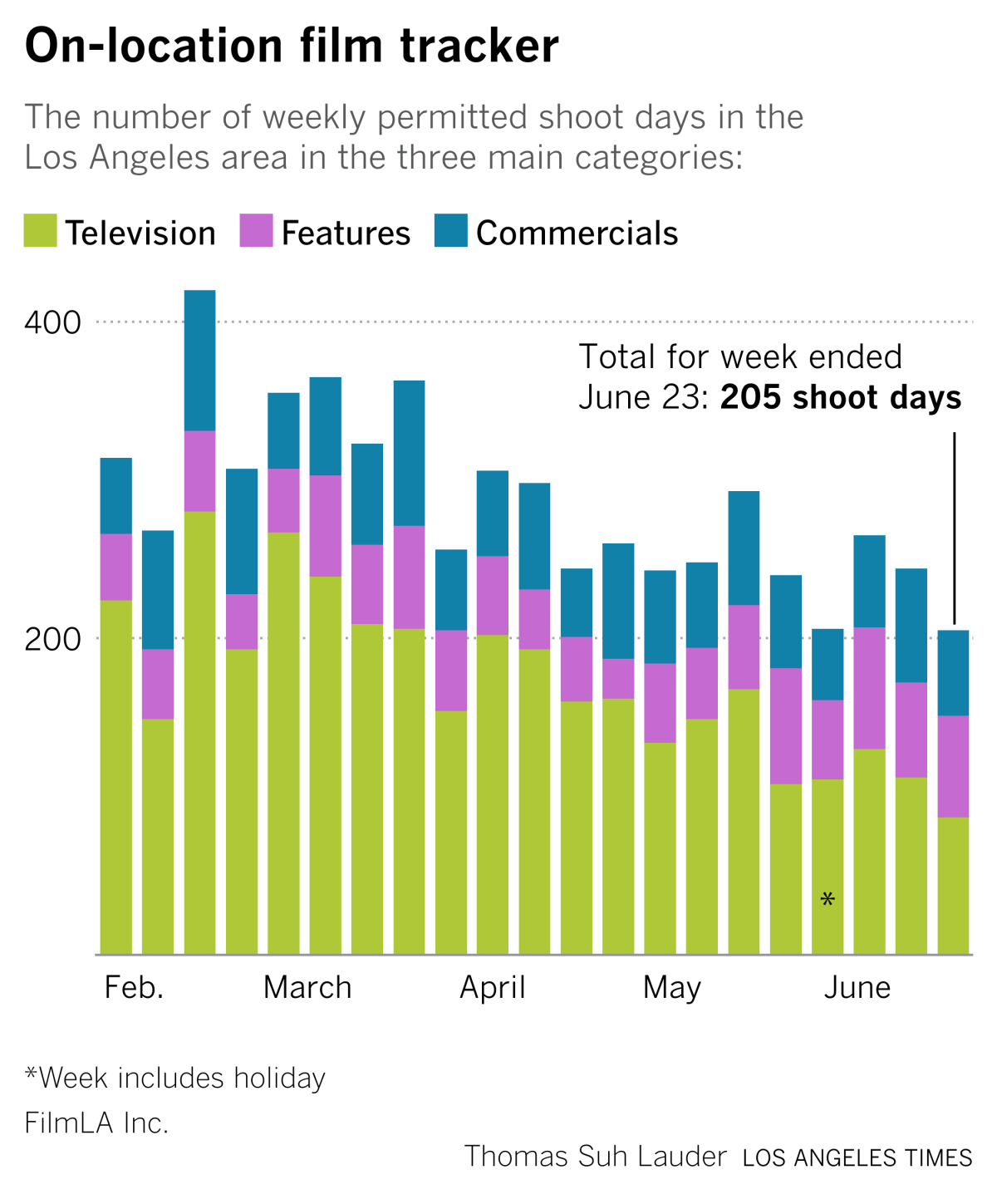

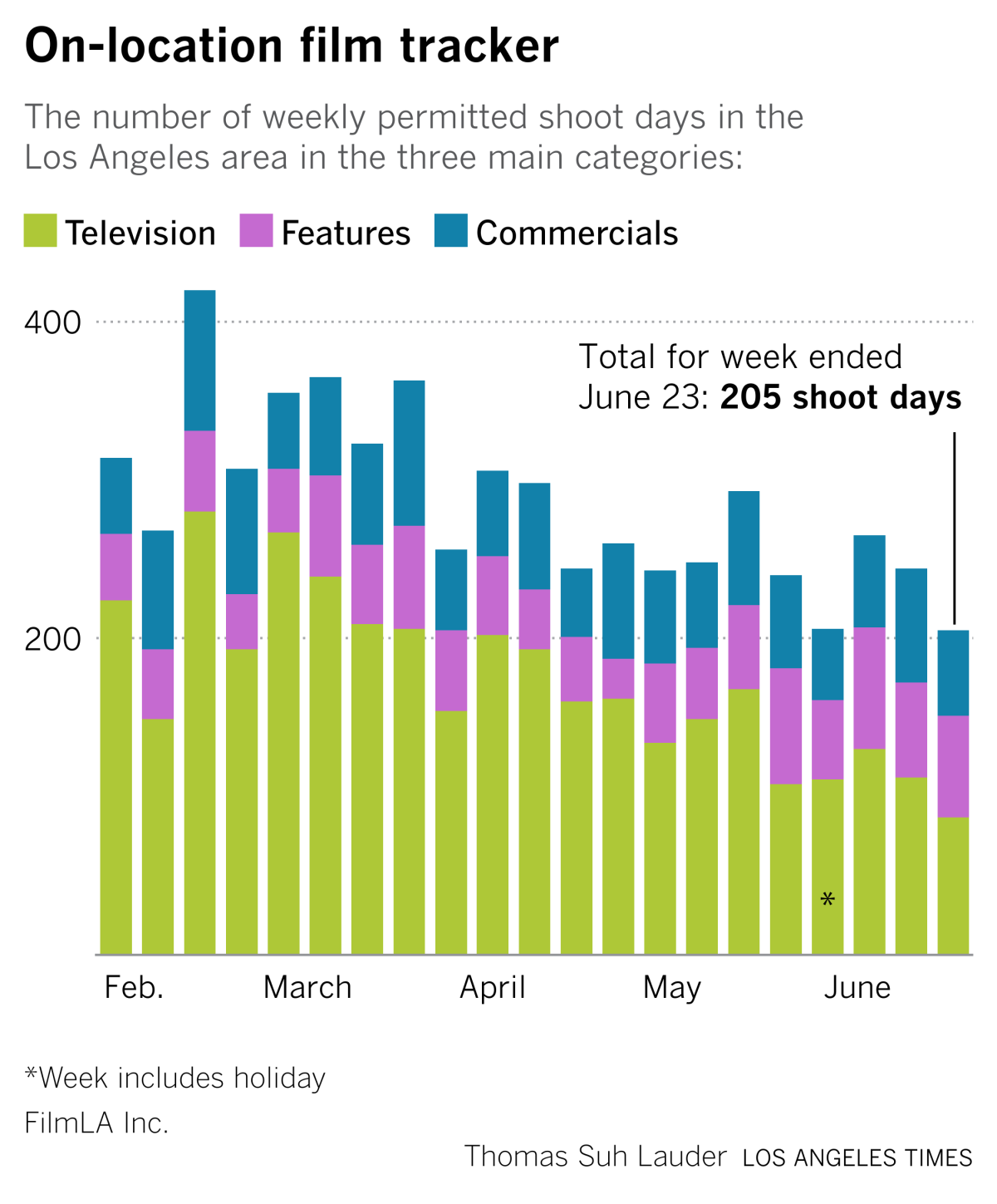

Film shoots

The production recovery that wasn’t.

Best of the web

— What ‘Game of Thrones’ did to the media business. (the Verge)

— Marketing campaigns for online dating apps have gotten super weird. (Wall Street Journal)

— How Netflix’s internal culture has changed. (New York Times)

— Dial Acorn for (cozy) murder. Behind the success of the British streamer. (Vulture)