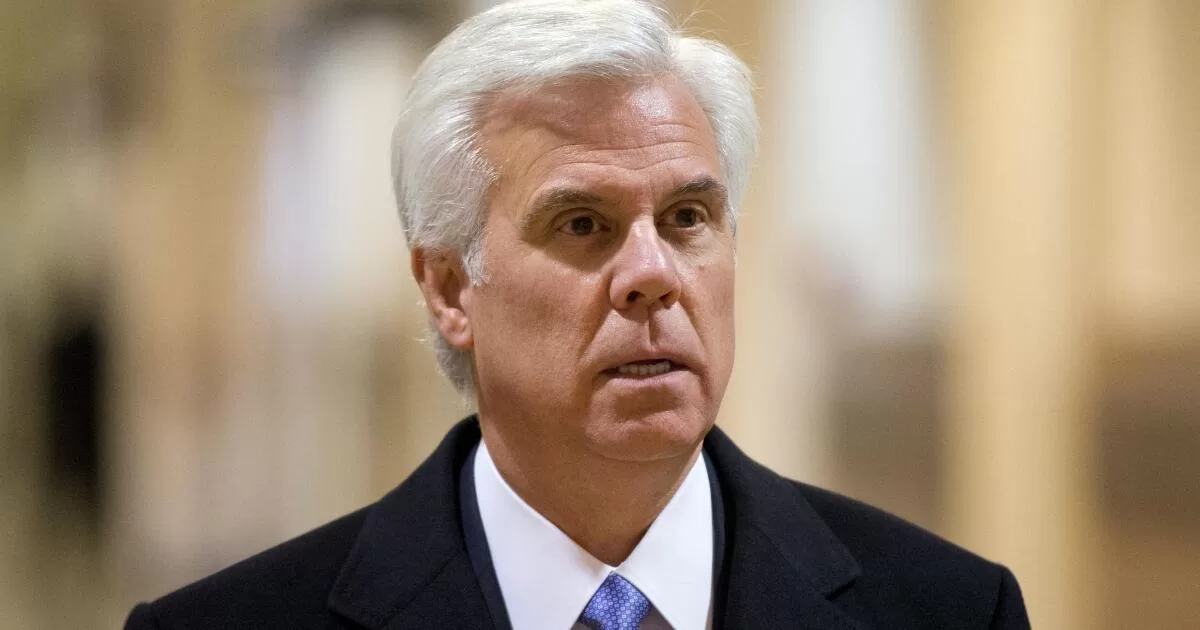

Norcross, a former Democratic National Committee member and one-time head of the Camden County Democratic Party, has been an influential figure in state politics. The indictment alleges that Norcross and others got property rights along the Camden waterfront and collected millions of dollars in state-backed tax credits.

At a news conferenced in Trenton, New Jersey Atty. Gen. Matt Platkin accused Norcross of leading a criminal enterprise in obtaining millions in tax credits and property rights along the Delaware River waterfront in Camden.

Platkin said Norcross told a developer that he had to relinquish his property rights or Norcross would retaliate and make it impossible for the developer to do business in Camden if he refused.

Members of the alleged conspiracy also got a government development agency to help them get leverage in private negotiations, Platkin said.

Norcross sat in the front row during the news conference, steadily watching the attorney general as he detailed the criminal counts against him. Asked what he made of Norcross’ presence in the room Monday, Platkin said he had no comment.

Michael Critchley, Norcross’ attorney, stood to try to ask the attorney general a question, but Platkin left before Critchley could do so. The Associated Press left a message seeking comment from Critchley.

The indictment alleges that Norcoss and his associates “used their political influence to tailor New Jersey economic development legislation to their preferences. After the legislation was enacted in September 2013, members and associates of the Norcross Enterprise conspired to, and did, extort and coerce others to obtain — for certain individuals and business entities — properties and property rights on the Camden, New Jersey waterfront and associated tax incentive credits.”