Article content

(Bloomberg) — Companies sold a record volume of leveraged loans last month, taking advantage of the cash chasing credit. A glance at recovery rates for defaults, however, highlights a growing risk in this debt.

For newly issued first-lien debt in the US and Canada in the first quarter, investors could expect to get back less than 35% of their investment when loans sour, compared with 72% from 2018 through 2022, according to a presentation this month by S&P Global Ratings.

Article content

Borrowers that run into trouble are doing a good job of pitting creditors against one another, pushing some debt holders further back in line to be repaid, in order to get rescue funding from others. Lending agreements have grown increasingly lenient for years, making these emergency financings easier to put together. Such liability management transactions have reduced recovery rates when companies default.

“Aggressive liability management transactions involving loans trading at discounts are a constant threat,” said Scott Macklin, head of US leveraged finance at Obra Capital. “If lenders are wrong once, they probably are going to find themselves punished at least twice with respect to recoveries.”

That’s while the riskiest credits are increasingly coming under more stress and the loan default rate has ticked up to roughly 2.9% on a par-weighted basis, from around 2% a year ago, according to data from JPMorgan Chase & Co. Money managers say they remain discerning so far despite the frenzy when loans are offered for sale.

“The market is ravenous for paper but it is still making these determinations around credit risk,” said David Saitowitz, head of US liquid credit at Intermediate Capital Group Inc., a money manager. “It’s a bifurcated market that is quick to differentiate anything out of the ordinary.”

Article content

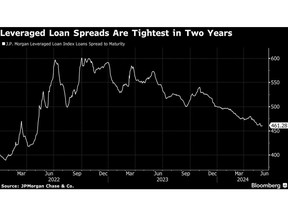

Demand from collateralized loan obligation managers and other loan buyers have sent spreads to their tightest level since May 2022, while a lack of new issuance has also sent secondary-market prices to a two-year high. Investors have been rewarded so far, with the debt providing a total return of about 4% so far this year through Thursday, compared with 1.42% for US high-yield bonds.

Still, there was $87 billion of leveraged loans worldwide actively trading at distressed levels. That makes up almost 15% of the total distressed debt universe as of May 31, according to Bloomberg News’ distressed debt tracker.

Higher borrowing costs and “slower growth have gradually bled through to balance sheet metrics” at companies that are over-leveraged, Morgan Stanley strategists including Vishwas Patkar wrote in a May 22 note. “At the lower end of the rating spectrum, surging interest expense has eaten away a meaningful share of companies’ cash flows.”

The Morgan Stanley strategists recommend investors avoid chasing deeply distressed opportunities, given the yields available elsewhere from performing credit. Others think there’ll be selective chances to profit.

Article content

“One can reasonably conclude that this cycle is likely to show record low recovery rates for defaulted senior loans,” Bruce Richards, co-founder of Marathon Asset Management LP, wrote on LinkedIn this week. “Recovery rates will be very interesting to observe given these lower price points at time of default, representing a large potential opportunity for distressed investors.”

Week in Review

- The highest interest rates in years are taking a toll from the US to Australia, creating cracks in economies despite low unemployment and booming stock markets.

- Major bond investors are back in the market for some of the riskiest bank securities, with a view that they will rally if the Federal Reserve starts cutting interest rates later this year.

- A surge in issuance of a type of bond that can convert into stock on maturity is helping revive a hedge fund strategy that was crushed during the financial crisis.

- Ninepoint Partners LP is temporarily suspending cash distributions in three of its private credit funds, making it the latest lender to put a squeeze on investors to cope with a liquidity crunch.

- Banking giants that once had the most ground to lose to the burgeoning world of private credit keep finding more ways — and much more money — to pump into the sector.

- Subway sold $3.35 billion of asset-backed bonds to help fund its buyout by Roark Capital Group, in what is the largest securitization of its kind on record.

- In private credit, Pluralsight moved intellectual property into a new subsidiary and used those assets to obtain financing from Vista Equity Partners, according to people with knowledge of the matter. It’s a move more common in the world of broadly syndicated leveraged loans.

- Goldman Sachs Group Inc. has put together $21 billion for private credit wagers, its biggest war chest yet for Wall Street’s buzziest asset class.

- A controversial lending structure that lets companies pay interest with more debt is getting a new spin from private credit.

- A Chinese market watchdog asked some financial firms this week to review any bond underwriting that may have gone against government plans to defuse local debt risks.

- A lender to Thames Water Ltd has shelved a planned sale of £500 million of the troubled utilities’ loans.

- For bankers in Hong Kong, where big mergers and acquisitions and initial public offerings have largely stalled, convertible bond issues are very much in vogue.

- Private credit funds are trying to scoop up more of Japan’s ¥4.5 quadrillion ($28.7 trillion) of financial assets to lend globally.

- SoftBank Group Corp. and Sumitomo Mitsui Financial Group Inc. have joined Japanese peers rushing for bond sales before interest rates go up, suggesting investor appetite for riskier assets remains strong in the nation.

Article content

On the Move

- Three portfolio managers who helped create Aegon Asset Management’s sustainable fixed income strategy in the US — James Rich, Brian Wayne, and Alena Solonina — left the firm last month to start a private credit fund focused on innovative climate technology.

- Canadian Imperial Bank of Commerce is bulking up its coverage in leveraged finance, hiring veteran banker Brad Aston from Barclays Plc for its capital-markets business.

- TD Securities recruited former Barclays Plc veteran Daniel Kerstein to lead its structuring solutions and shareholder advisory practice.

- DC Advisory hired Michael Moore and Jono Peters from Union Square Advisors as co-heads of US private-capital markets.

- Crescent Capital Partners Management Pty., an Australian private equity firm, is expanding into private credit and has hired Russell Sinclair from PricewaterhouseCoopers LLP to run the new business.

—With assistance from Maria Clara Cobo.

Share this article in your social network