Article content

(Bloomberg) — Asian shares are set for a mixed start after Wall Street slumped on Friday amid signs US inflation is stickier than expected. Chinese stocks are poised for a strong open after a week-long holiday.

Equity futures in Australia and Hong Kong edged higher while contracts in Japan fell after the S&P 500 dropped 0.5% from a fresh record on Thursday. Treasuries fell, with two-year yields up seven basis points to 4.65% on Friday after the producer price index rose on a sizable jump in costs of services.

Article content

Chinese shares will be in focus in Asia as they resume trading following the week-long Lunar New Year break after the central bank held the interest rate on one-year policy loans at 2.5% while injecting a small amount of cash into the financial system.

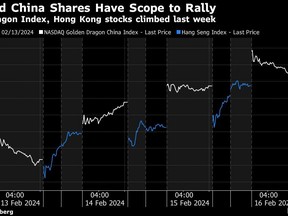

Prior to the PBOC’s announcement, buoyant travel and tourism data suggested consumption has revved up even as the broader economy struggles with deflation and a property crisis. The sentiment has helped the benchmark gauge of stocks in Hong Kong rally 3.8% since it reopened on Wednesday while the Nasdaq Golden Dragon Index jumped 4.3% for the week, underscoring room for onshore shares to play catch-up.

“The early read from Chinese New Year data, from holiday hotel sales to Macau visit numbers, points to bright spots in services-related industries,” said Linda Lam, head of equity advisory for North Asia at Union Bancaire Privee. “A-shares should open on a stronger note, continuing the share price recovery on the back of state support,” she said, referring to Chinese stocks traded on the mainland.

Elsewhere, US and global stocks are yet to respond to the sell-off in Treasuries this month as a string of better-than-expected economic data drove traders to roll back their once-aggressive rate-cut bets so much that their expectations are now approaching the Fed’s own 75 basis-point forecast this year. Swaps are pricing about 90 basis points of rate cuts in 2024 — from more than 150 basis points at the start of February.

Article content

Goldman Sachs expects the rally in the US to continue, with the S&P 500 reaching 5,200 by year-end as the resilient US economy drives company profit growth, strategists led by David Kostin wrote in a note to clients. The new target implies a 3.9% jump from Friday’s close.

UBS Group AG’s wealth management unit also has a positive view on equities once the Federal Reserve starts cutting rates, particularly in small-cap stocks as consumer spending should stay healthy given the strength of the labor market.

“Fed rate cuts are likely still not far off, despite mixed comments from top officials,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management. “While we do not expect the path toward lower inflation and lower rates to be smooth, we maintain the view that a soft landing for the US economy favors quality bonds and equities.”

This week, traders will be keeping an eye on European inflation data as well as earnings from Nvidia Corp. and mining giants BHP Group and Rio Tinto Plc to help gauge the health of the global economy. Meantime, conflict in the Middle East is set to drag on as negotiations aimed at securing an Israel-Hamas cease-fire and the release of hostages haven’t progressed as hoped, Qatar’s foreign minister said.

Article content

Some of the key events this week:

- Japan machinery orders, Monday

- Thailand GDP, Monday

- BHP earnings, Tuesday

- RBA Feb. meeting minutes, Tuesday

- China loan prime rates, Tuesday

- ECB publishes euro-area indicator of negotiated wage rates, Tuesday

- Canada CPI, Tuesday

- Rio Tinto earnings, Wednesday

- Indonesia rate decision, Wednesday

- Eurozone consumer confidence, Wednesday

- Nvidia earnings, Wednesday

- Federal Reserve Jan. meeting minutes, Wednesday

- Eurozone CPI, Thursday

- Mexico GDP, Thursday

- South Korea rate decision, Thursday

- China property prices, Friday

Some of the main moves in markets:

Stocks

- Hang Seng futures rose 0.1% as of 7:23 a.m. Tokyo time

- Nikkei 225 futures fell 0.8%

- S&P/ASX 200 futures rose 0.1%

- CSI 300 futures rose 1.4%

Currencies

- The euro was little changed at $1.0776

- The Japanese yen was little changed at 150.18 per dollar

- The offshore yuan was little changed at 7.2131 per dollar

- The Australian dollar was little changed at $0.6530

Bonds

- The Australian 10-year yield rose 1 basis point to 4.21%

Cryptocurrencies

- Bitcoin was up 0.6% at $52,181.26

- Ether rose 1.1% to $2,878.3

This story was produced with the assistance of Bloomberg Automation.

Share this article in your social network