Article content

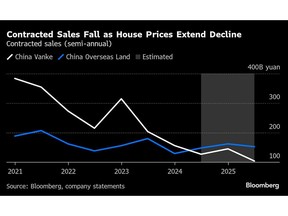

(Bloomberg) — China Vanke Co., Ltd. and China Overseas Land & Investment Ltd. are among the major developers reporting next week amid signs of recovery in the Chinese property sector.

China Vanke Co., Ltd. and China Overseas Land & Investment Ltd. are among the major developers reporting next week amid signs of recovery in the Chinese property sector.

(Bloomberg) — China Vanke Co., Ltd. and China Overseas Land & Investment Ltd. are among the major developers reporting next week amid signs of recovery in the Chinese property sector.

Article content

Article content

A string of recent profit warnings could be a positive future signal, Bloomberg Intelligence said. “Steep write-offs could set these companies up for a better profit outlook in 2025 which could improve earnings profiles, lift equity valuations and aid potential equity financing, which in turn could boost liquidity.”

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

Still, the recovery in housing market remains fragile, as new-home prices experienced a more rapid decline in February, marking the first deterioration in six months. Continued government support will be a key to sustain the recovery, analysts at CGS International estimate. More cities including Shenzhen and Changsha are easing policies to boost the property market.

For last year though, aggregate core earnings for the top five developers — which also include China Resources Land Ltd., Longfor Group Holdings Ltd., and Greentown China Holdings Ltd. — are seen down 93% over the year, according to CGS International.

Over in the energy sector, PetroChina Co. is set to post its highest annual net income in at least two decades as better prices for gas offset lower selling prices for oil. The company is also slated to be a beneficiary should China unveil more economic stimulus measures, BI said.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

In the consumer space, Kweichow Moutai Co.’s slower growth in the fourth quarter may signal a tough 2025, and revenue headwinds could linger throughout the year as consumer sentiment is still subdued, BI said.

Highlights to look out for

Sunday: PetroChina’s (857 HK) annual net income is expected to rise 4.3%, supported by its oil, gas and new energies segment, consensus estimates show. Analysts at Citi said in February that PetroChina was best placed to grapple with China’s tariff on US LNG, coal and crude oil imports given its cheaper imports from Russia.

Monday: China Vanke’s (2202 HK) outlook will be closely watched as Chinese authorities are working on a proposal to help the developer plug a funding gap of about 50 billion yuan ($6.9 billion) this year, people familiar with the matter said in February. The embattled developer warned of record 45 billion yuan loss for 2024, its first annual net loss since listing in 1991.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Tuesday: No major earnings of note.

Wednesday: Kweichow Moutai (600519 CH) likely saw full-year net income surge 15%, according to preliminary earnings. Management of the Chinese baijiu distiller earlier indicated that the company would maintain its five-year target and had implemented measures to stabilize wholesale average selling prices this year, according to a Citi note in February.

Thursday: No major earnings of note.

Friday: Yaskawa’s (6506 JP) operating profit is set for a gradual recovery this year, according to BI, following a likely 4.7% drop in the fourth quarter. Its robot unit may continue to see stable demand thanks to its subsidiary expanding the firm’s hardware application, leading to margin gains.

Article content

Share this article in your social network