Article content

(Bloomberg) — Stocks in Asia may struggle for direction on Friday, after US shares declined as concerns of a widening trade war overshadowed a US economy growing faster-than-estimated.

Stocks in Asia may struggle for direction on Friday, after US shares declined as concerns of a widening trade war overshadowed a US economy growing faster-than-estimated.

(Bloomberg) — Stocks in Asia may struggle for direction on Friday, after US shares declined as concerns of a widening trade war overshadowed a US economy growing faster-than-estimated.

Article content

Article content

Equity futures for Australia pointed to losses, while those for Japan were little changed and contracts for Hong Kong advanced. In the US, the S&P 500 and Nasdaq 100 both fell, with automakers getting hit. Megacaps were mixed, with Apple Inc. up and Nvidia Corp. down. In late hours, Lululemon Athletica Inc. gave a gloomy outlook. Gold hit a new record. Futures contracts for the S&P 500 fluctuated in early Asian trading.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

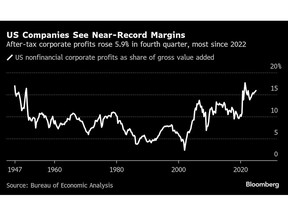

President Donald Trump is set to implement a 25% tariff on auto imports and has pledged harsher punishment on the EU and Canada if they join forces against the US. Trump’s escalating trade actions are likely to deepen tensions with key trading partners even before his promised so-called reciprocal tariffs on April 2. Data showing the economy expanded at a quicker pace in the fourth quarter than previously estimated failed to offset sentiment.

“The fourth quarter GDP data tell us the economy entered the year with momentum and profitability and can thus withstand a degree of policy uncertainty,” Wells Fargo economists Shannon Grein and Tim Quinlan wrote in a note following the release of data. “That said, the concern is increasingly centered on how will businesses act in the face of trade winds leading to tremendous uncertainty this year.”

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

In Asia, a senior Chinese leader on Thursday called for increased global cooperation, in a thinly veiled critique aimed at the US for destabilizing trade and geopolitical relations. Facing external headwinds, policymakers have made boosting domestic demand the top economic priority this year.

“No matter how the external environment changes, China will open wider to the world,” Ding Xuexiang, the ruling Communist Party’s sixth-ranking official, said during his keynote speech at the annual Boao Forum.

(Get the Markets Daily newsletter to learn what’s moving stocks, bonds, currencies and commodities.)

Trade authorities from South Korea and Japan are set to meet with their Chinese counterparts in Seoul this weekend to discuss economic cooperation as they seek ways to respond to increasing trade pressure from the US, according to a media report.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Elsewhere, Australia’s government will hold its national election on May 3, kicking off what’s expected to be a closely-fought campaign centered on cost-of-living pressures and a housing crisis in a sluggish economy.

US Inflation

Just days before the end of a quarter that’s set to be the worst for the S&P 500 since 2023, investors will turn their focus to Friday’s US personal consumption expenditures price index. The Federal Reserve’s preferred measure of underlying inflation is forecast to show signs of stickiness as prices remain at a disquieting level for officials.

Fed Boston President Susan Collins said it looks “inevitable” that tariffs will boost inflation, at least in the near term, adding it’s likely appropriate to keep interest rates steady for longer.

Short-dated US debt outperformed longer ones as bonds flashed concerns about inflation. The yield on 10-year Treasuries rose one basis point on Thursday to 4.36%. The dollar wavered.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

“Investors will want to see in-line or better inflation results and a strong employment number to gain some reassurance,” said Bret Kenwell at eToro.

In commodities, oil edged higher on potential supply disruption from producers including Iran and Venezuela. West Texas Intermediate advanced 0.4% to settle just below $70 a barrel, continuing a three-week rally. Meanwhile, gold climbed to a new high on Thursday, surpassing the previous record hit a week ago.

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Commodities

This story was produced with the assistance of Bloomberg Automation.

Article content

Share this article in your social network