Article content

(Bloomberg) — Chinese steel prices are languishing, despite signs of resilience in the wider economy and the approach of peak demand season in the building industry.

Chinese steel prices are languishing, despite signs of resilience in the wider economy and the approach of peak demand season in the building industry.

(Bloomberg) — Chinese steel prices are languishing, despite signs of resilience in the wider economy and the approach of peak demand season in the building industry.

Article content

Article content

The disconnect between better economic data, and the gloomy reality linked to the property market, suggests another tough year ahead for the nation’s steelmakers — and additional impetus for the government to force cuts on an industry bloated by its reliance on real estate spending that isn’t coming back.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

The end of the Lunar New Year holiday and warmer spring weather usually drives increased building activity in China’s highly seasonal economy. But Shanghai futures for reinforcement bar, used in construction, hit a six-month low last week and were more than 10% below year-ago levels.

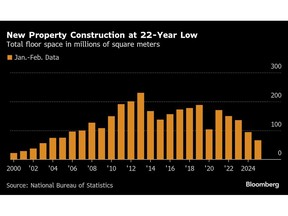

The trigger was yet another collapse in a key Chinese housing metric, this time a 30% plunge in new builds over January and February, according to Lawrence Zhang, an analyst at Wood Mackenzie Ltd. That’s the most steel-intensive part of the market and it was the worst start to a year in over two decades.

Look beyond the yearslong property crisis, though, and the economy’s prospects look brighter, including data that normally speak to steel demand. Fixed-asset investment accelerated over the two months, lifted by more state spending. The construction purchasing managers’ index rebounded into expansion in February.

More broadly, the government has signaled its intention to meet its ambitious 5% growth target by dialing up the budget deficit for the year to a record. More spending is promised at the local government level via bonds that are typically used for infrastructure, and that debt is being issued at a faster pace than usual.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

But the top-line data is largely being discounted as the market looks for the devil in the detail in the latest property figures.

“This granularity provides a more detailed and accurate picture of the market dynamics, overshadowing the broader positive indicators,” Zhang said by email.

Stabilizing the real estate sector remains a top policy goal, and fewer housing starts will eventually help balance supply and demand. But that’s no salve for steel markets that rely on construction.

Although steel demand is increasingly keyed to infrastructure, rather than the private property developments, that’s becoming less metal-intensive as the economy matures. And Beijing is in any case prioritizing consumption over investment, and higher tech growth drivers over the old economy, with its spending plans.

In fact, the government’s only initiative for the steel market at this month’s legislative meetings was a pledge to cut production, which is probably all you need to know about the prognosis for the industry’s long-term health.

On the Wire

Chinese solar panel makers are set to experience a surge in 2Q orders as downstream consumers race to finish installations to secure favorable, fixed power tariffs before the June deadline, according to Bloomberg Intelligence.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

President Donald Trump on Monday issued an order allowing a 25% tariff to be imposed on any nation purchasing oil and gas from Venezuela, putting further pressure on China, which is a major purchaser of Venezuelan crude.

US lawmakers, labor unions and steel manufacturers were at odds with shipping companies and farm exporters Monday over a Trump administration proposal to put million-dollar levies on China-linked ships docking in the US.

This Week’s Diary

(All times Beijing unless noted.)

Tuesday, March 25:

Wednesday, March 26:

Thursday, March 27:

Friday, March 28:

Saturday, March 29

Sunday, March 30

Article content

Share this article in your social network