Article content

(Bloomberg) — Corporate debt’s halcyon days are showing signs of fading, with trade wars damping what had been a relentless demand for credit.

Corporate debt’s halcyon days are showing signs of fading, with trade wars damping what had been a relentless demand for credit.

(Bloomberg) — Corporate debt’s halcyon days are showing signs of fading, with trade wars damping what had been a relentless demand for credit.

Article content

Article content

“Cracks that appeared in the credit market last week culminated into a fracture this week,” Bank of America Corp. strategist Neha Khoda wrote in a note, adding that markets are now pricing in a recession.

Tariffs are expected to dent the growth of the world economy and fears are growing that the policies will lead to stagflation in the US. Junk spreads there widened by the most in six months this past week, but remain near historic lows, meaning they could move out significantly more if a recession hits. Some hedge funds have already stumbled as volatility rises and investors are piling into haven assets like gold.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

“Underneath the surface, the angst levels have just gone up tremendously,” Victor Khosla, founder of opportunistic credit investor Strategic Value Partners, said in an interview with Bloomberg TV on Wednesday.

Here are five charts that highlight shifting sentiment in debt markets:

Junk Risk Premiums

With high-yield spreads in the US on the rise, Goldman Sachs Group Inc. strategists have already sharply raised their forecasts for the risk premiums as tariff risks increase and the White House flags that it is willing to tolerate short-term pain in an attempt to address the trade deficit. They now expect high-yield spreads to reach 440 basis points in the third quarter compared with 295 basis points previously. Levels as of March 13 were 335 basis points.

“Recently, we moved from a market that used to buy rumors and sell facts into a market that buys facts,” said Gauthier Reymondier, head of Bain Capital Credit Europe.

CDS Shift

Algebris Investments portfolio manager Gabriele Foa warned in February that high-yield credit default swaps, which protect against defaults, were trading at levels that had only been seen three times in the last 10 years and each time it was followed by a sharp widening in the six to nine months afterward. Fast forward to now and the Markit CDX North American High Yield Index, which falls when credit risk rises, has dropped to the lowest since August.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

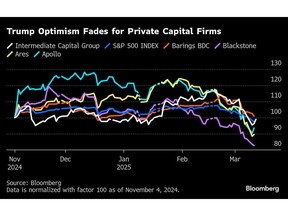

Private Markets Hit

The whipsawing of US economic policy is making it harder for private capital firms to sell off their holdings and many have added more expensive debt to their portfolio companies in response, much of it from private credit lenders.

At a conference in London this past week, a number of attendees spoke on the sidelines of concerns about interest-coverage ratios at private equity-owned companies, the risk that their firms are holding too much leverage and the need for direct lenders to diversify away from a possible overexposure to corporate credit.

“Too much money has flown into the private credit asset class,” said Claire Madden, a managing partner at Connection Capital, which invests in private funds. “We still haven’t had a cycle in a long time. There could still be a lot of problems down the road.”

Leveraged Loans Drop

A falloff in mergers and acquisitions was a plus for issuers in the leveraged loan market over the past year or so as yield-hungry investors snapped up any deals that came to the market, many of which were repricings. Money managers are now becoming more selective, pushing back on aggressive pricing and credits with lower ratings with five deals pulled from syndication in recent weeks.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Credit Outflows

The declines come even as inflows have generally been supporting credit prices in recent months, contributing to the tightness of spreads. But US leveraged loans saw their first outflows this year in the week through March 12, according to LSEG Lipper, while investors pulled money from high yield bonds at the highest rate in about two months. Of course, that might prove a blip if investors rotate into credit amid the equity market correction.

Still, debt markets are “going passive,” said Ted Goldthorpe, head of credit at BC Partners. “That’s not good” because when those funds become too big the market “becomes very flow oriented versus fundamental oriented.”

Click here to listen to the Credit Edge podcast with Goldthorpe of BC Partners

Week In Review

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

On the Move

—With assistance from Sonali Basak, Kat Hidalgo and Rheaa Rao.

Article content

Share this article in your social network