Article content

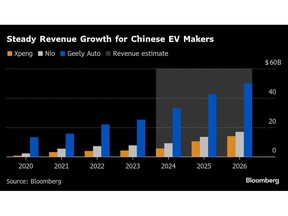

(Bloomberg) — Xiaomi Corp., Geely Automobile Holdings Ltd., NIO Inc. and Xpeng Inc. will show how resilient China’s electric-vehicle sector is to a stagnant domestic economy and tariffs in the US and European Union.

Xiaomi Corp., Geely Automobile Holdings Ltd., NIO Inc. and Xpeng Inc. will show how resilient China’s electric-vehicle sector is to a stagnant domestic economy and tariffs in the US and European Union.

(Bloomberg) — Xiaomi Corp., Geely Automobile Holdings Ltd., NIO Inc. and Xpeng Inc. will show how resilient China’s electric-vehicle sector is to a stagnant domestic economy and tariffs in the US and European Union.

Article content

Article content

All four firms delivered more vehicles in 2024. China auto exports had a buoyant start to 2025, with 46% growth in EV exports so far, Macquarie said. Retail car sales in China rose 26% in February from a year earlier, with a 85% jump in sales of new energy vehicles, according to estimation by the China Passenger Car Association.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

The country’s auto executives offered a range of ambitious policy proposals to cement China’s position as a global powerhouse in transportation at the annual National People’s Congress in Beijing. Measures included artificial intelligence-controlled vehicles and flying cars, with aggressive overseas expansion ambitions.

Investors will also scrutinize Tencent Holdings Ltd.’s AI progress and how it fared against rivals like Alibaba Group Holding Ltd. The tech giant may not see significant incremental AI earnings this year and it faces a more challenging 2025 given the risk of further US sanctions, Bloomberg Intelligence said.

Highlights to look out for:

Monday: No major earnings of note.

Tuesday: Xiaomi’s (1810 HK) fourth-quarter revenue likely surged 43%, the fastest since 2021. Smartphone sales could see stronger growth this year as it pushes into the premium market traditionally dominated by Apple Inc., while benefiting from China’s smartphone subsidies, BI said. Its electric vehicle business will also continue to lift earnings, as it saw popular demand with the SU7 Ultra model.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

Wednesday: Tencent’s (700 HK) fourth-quarter revenue probably grew 8.7% as it saw continued strength in its video games and advertising segments. Still, rising economic headwinds and tensions with the US may hurt the longer-term outlook, while profits from AI are unlikely in the near-term, BI said.

Thursday: CK Hutchison’s (1 HK) $19 billion sale of the bulk of its ports could help it boost shareholder returns and repay debt, with more opportunities for acquisitions, BI said. Full-year net income fell 4% compared with a 36% decline a year earlier, estimates show. Shares slid on Friday after China’s top office on Hong Kong issues reposted an attack on its sales of a controlling stake in Panama ports.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Friday: NIO’s (NIO US) quarterly losses may have remained steady as the sales mix included a greater share of the cheaper Onvo brand. Sales volumes rose 45%, according to monthly disclosures, but a price war in its home market may limit revenue growth. Markets will also watch for commentary on the impact of EU tariffs, as well as plans to deal with President Donald Trump’s levies. The company’s aim to double vehicle deliveries in 2025 looks ambitious and it may be a challenge to shrink losses, BI said.

Article content

Share this article in your social network