Article content

(Bloomberg) — Bond traders are signaling an increasing risk that the US economy will stall as President Donald Trump’s chaotic tariff rollouts and federal-workforce cuts threaten to further restrain the pace of growth.

Bond traders are signaling an increasing risk that the US economy will stall as President Donald Trump’s chaotic tariff rollouts and federal-workforce cuts threaten to further restrain the pace of growth.

(Bloomberg) — Bond traders are signaling an increasing risk that the US economy will stall as President Donald Trump’s chaotic tariff rollouts and federal-workforce cuts threaten to further restrain the pace of growth.

Article content

Article content

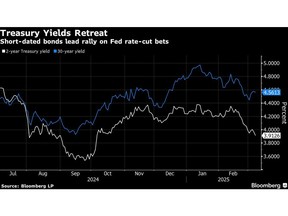

Speculation that Trump would pour stimulus onto the nation’s expansion — and keep upward pressure on Treasury yields — is being rapidly swept aside less than two months into his presidency. Instead, traders have been piling into short-dated Treasuries, pulling the two-year yield down sharply since mid-February, on expectations the Federal Reserve will resume cutting interest rates as soon as May to keep the economy from deteriorating.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

“Just a couple of weeks ago we were getting questions about whether we think the US economy’s re-accelerating —- and now all of a sudden the R word is being brought up repeatedly,” said Gennadiy Goldberg, head of US interest rate strategy at TD Securities, referring to the risk of a recession. “The market’s gone from exuberance about growth to absolute despair.”

The movement marks an abrupt about-face for the Treasuries market, where the dominant driver of the last few years had been the surprising resilience of the US economy even as growth weakened overseas. Investors initially wagered that the outcome of the presidential election would only exaggerate that trend and drove yields sharply higher late last year on anticipation of faster growth and inflation — a pillar of the so-called Trump trade.

Since mid-February, though, Treasury yields have come down as the new administration’s policies cast significant uncertainty over the outlook. The decline has been lead by shorter-dated securities, steepening the yield curve, as typically happens when investors position for the Fed to start easing monetary policy to jumpstart growth.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

A key driver has been Trump’s brewing trade war, which is likely to deliver another inflation shock and roil global supply chains. That fueled a stock-market selloff last week that continued even after he again delayed tariff hikes on Mexico and Canada. The administration’s efforts to withhold federal funding and fire tens of thousands of government workers are also taking a toll.

“Recession risk is definitely higher because of the sequence of Trump’s policies – tariffs first, tax cuts later,” said Tracy Chen, a portfolio manager at Brandywine Global Investment Management.

The shift in market sentiment was underscored this week by the divergence between the bond markets in Europe and the US, which tend to move in unison. Yet when German bond yields surged on the prospect of stepped up defense spending to make up for the US’s pullback in support for Ukraine, Treasuries barely budged.

Of course, bond traders have prepared for the economy to falter repeatedly over the past few years, only to be burned when it continued to power ahead, and the three quarter-point rate cuts now expected this year aren’t enough to suggest the Fed will be in recession-fighting mode. On Friday, Fed Chair Jerome Powell said he is in no rush to resume easing policy, saying “the economy continues to be in a good place” despite “elevated levels of uncertainty.”

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Moreover, inflation may keep upward pressure on yields, with the consumer price index report this week expected to show a yearly increase of 2.9% in February, stubbornly above the Fed’s 2% target.

But signs that the economy are cooling have been steadily piling up, including The Atlanta Fed’s GDPNow gauge, which is signaling the US gross domestic product is set to shrink in the first quarter.

While the Labor Department reported that job growth held up in February, its report Friday also provided evidence that the labor market is softening, with more people permanently out of work, fewer workers on federal government payrolls and a jump in those working part-time for economic reasons.

What Bloomberg Strategists say…

“The details of the [jobs] report were a lot worse than the headlines, and those forward-looking aspects of the report seem to have helped the Treasury rally continue. The data support earlier rate cuts by the Fed, increased recession fears in markets, and, thus, should help to continue the recent bond-bullish, equity-bearish tilt to US financial markets.”

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

—Edward Harrison, Bloomberg MLIV strategist. Real more on MLIV.

The bond market’s direction will depend heavily on how Trump’s policies shape up over the next few months. Treasury Secretary Scott Bessent acknowledged on Friday that the economy may see disruptions due to the administration’s policies but expressed confidence in the long-term outlook.

Trump on Thursday seemed to respond to some of the worries about the government’s aggressive cost-cutting by instructing cabinet secretaries to use a “scalpel” rather than a “hatchet” when it comes to job reductions. As the stock market tumbled, he also delayed tariff increases on Mexico and Canada by a month for a second time, though he has already raised them already on China and has been planning more such moves against others.

“Prior to this tariff war, the market thought tariffs were inflationary and now people think are recessionary,” said Brandywine’s Chen. “So this is a great shift.”

What to Watch

Article content

Share this article in your social network