Article content

(Bloomberg) — The result of Germany’s parliamentary election complicates the path to more lenient fiscal policy in the future, limiting the options of next government in trying to lift the economy out of its long bout of stagnation.

The result of Germany’s parliamentary election complicates the path to more lenient fiscal policy in the future, limiting the options of next government in trying to lift the economy out of its long bout of stagnation.

(Bloomberg) — The result of Germany’s parliamentary election complicates the path to more lenient fiscal policy in the future, limiting the options of next government in trying to lift the economy out of its long bout of stagnation.

Article content

Article content

Mainstream parties including Friedrich Merz’s CDU/CSU won less than two thirds of the seats in the lower house, leaving them short of the necessary votes to revise strict limits on public borrowing enshrined in the constitution.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

It’s a major setback for Merz, whose conservative garnered 28.5% — the most votes in Sunday’s poll. The Social Democrats and the Greens dropped to 16.4% and 11.6% respectively, with extremist parties on the left and right winning a combined 29.6%. Translated into seats in parliament that leaves the far-right AfD and Left with a combined 216 lawmakers in the 630 member parliament.

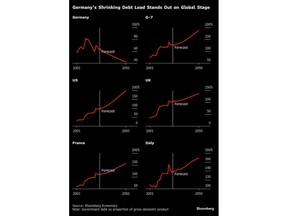

While Merz himself has signaled his priority is to cut spending and lower taxes, economists have said such measures won’t create the kind of fiscal space necessary to modernize Germany’s aging infrastructure and boost defense spending. Center-left parties had vowed to change to Germany’s fiscal framework, which limits budget shortfalls to 0.35% of gross domestic product.

For 2025, a Merz administration could agree to suspend the limit again on the basis of an emergency situation, possibly due to war in Ukraine. A simple majority in parliament would be sufficient for such a step.

Such suspensions were in place during the pandemic and the energy crisis to allow the government to dish out aid to companies and households. Failed discussions over whether how to meet the target again were key to the collapse of Olaf Scholz’s government.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

Critics argue that the rule, which was agreed after the 2008 financial crisis, has contributed to underinvestment in infrastructure like roads and digital technologies. It’s also blamed for playing a role in the weak performance of the German economy since the pandemic, which was a key topic during the election campaign.

Before the vote, UBS Group AG economists described an outcome without fiscal reform as the least beneficial for German growth, saying that the economy would expand by less than 0.8% in 2026 in such a scenario.

Bundesbank President Joachim Nagel said this month that his institution will present a proposal on how to reform the debt brake after the election, arguing there’s “room to maneuver.” The government’s Council of Economic Experts has also put forward ideas on what should be changed.

But without a constitutional majority, Germany’s next administration will have to find other sources of funding. That could include cuts to welfare spending, getting rid of subsidies and injecting equity into state-adjacent companies so that they can borrow more.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

What Bloomberg Economics Says…

“If a reform of the debt brake is not possible, then the new chancellor could ask again parliament to temporarily suspend the rule to allow for higher spending. A key risk to watch in such a scenario would then be any lawsuits before the country’s Federal Constitutional Court. While it is hard to predict how the court would react, it might be more amenable to allow for an emergency suspension, particularly given the rising geopolitical challenges.”

—Antonio Barroso and Martin Ademmer. For full react, click here

However, Berenberg Chief Economist Holger Schmieding warned last week that without debt-brake reform, it would be very difficult to even keep defense spending at the current NATO target of 2% of GDP after a special €100 billion fund expires at the end of 2027 — let alone raise expenditures above that threshold.

Other ways to ramp up military spending may yet come to pass. Work is underway at the EU level to find the necessary wiggle room in the bloc’s fiscal framework. There’s also talk of joint financing, which is becoming a realistic option for a growing list of leaders.

Article content

Share this article in your social network