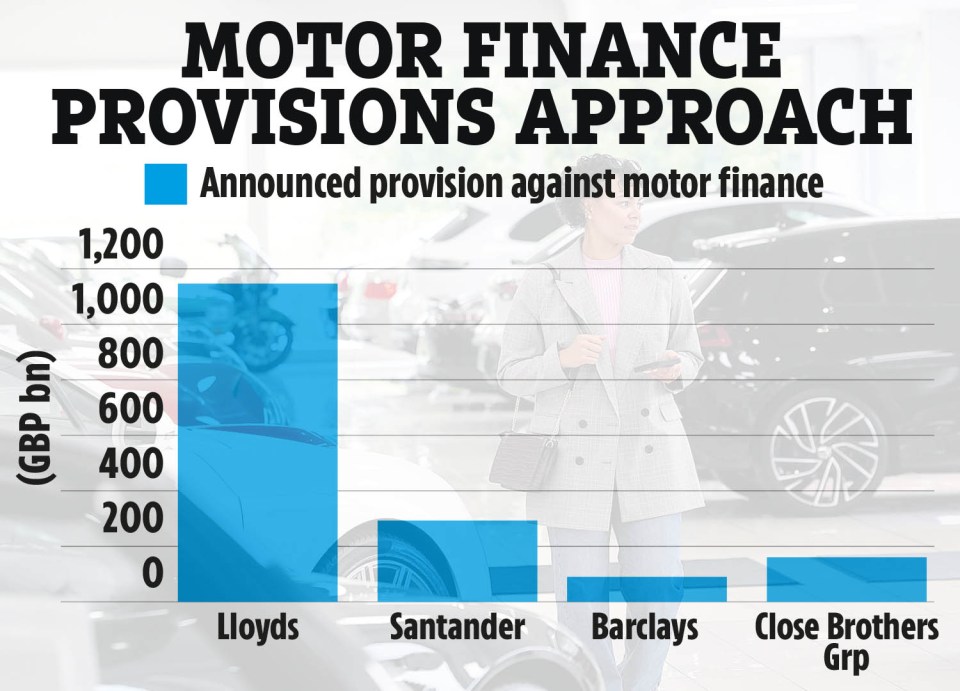

LLOYDS BANKING GROUP has had to shift gears and put aside £1.2billion to cover potential claims from drivers for its part in the motor finance scandal.

The sum is £700million more than it expected to be on the hook for a year ago.

Lloyds is heavily exposed to the mis-selling scandal through its Black Horse brand.

Millions of Brits could be due compensation after a court last October found car dealerships had broken the law by receiving commission on finance deals without customers being aware.

That landmark ruling quashed the long-held view that consumer duty protections could not be applied to the past.

The motor finance scandal has been called PPI 2.0 – following the misselling of payment protection insurance which led to banks paying out £50billion in redress.

Yesterday, credit rating agency Fitch said that the costs associated with the motor finance scandal would exceed £2billion this year, largely due to legal costs.

The situation is being closely watched by the Government, and the Treasury was this week blocked from intervening in the Supreme Court appeal process.

Financial giants have warned the Chancellor that there is a risk of spooking global investors if they believe the UK can change its regulations on a whim.

Lloyds Boss Charlie Nunn yesterday said investors had raised concerns because the ruling “seems to be at odds with 30 years of regulation, and that creates a problem in the minds of investors.

Not just for this sector, not just for the financial services sector, but actually a broader investability question in the UK.”

A director at another firm said there was the risk of being penalised later for following the law “to the letter”.

But another big institution told The Sun that the firms that were now being chased had commission policies in place that “might have been legal, but didn’t pass the smell test.

“They should have known it was wrong.”

Lloyds’ compensation provision has knocked its annual pre-tax profits by a fifth to £6billion.

But its shares rose by five per cent yesterday after it sweetened investors with a 2.1p-a-share dividend and a £1.7billion buyback.

Hirer firing

RECRUITER Hays is slashing staff and shutting offices in the face of a weakening jobs market.

It has closed 15 UK and Irish offices and slashed consultants by more than 1,100, including about 300 in the UK and Ireland in the past year.

The London-based company blamed “considerable headwinds from economic conditions”, as its profits more than halved to £26million. In Britain its fees have dropped by 17 per cent.

Diamonds no longer Anglo’s best friend?

DIAMOND’S are no longer Anglo American’s best friend after the miner wrote down the value of its De Beers business by $2.9billion (£2.2 billion).

The diamond industry is currently in a crisis caused partly by the rapid rise of cheaper lab-grown diamonds.

Natural diamonds have fallen in price by about a quarter in the past two years.

The miner is already trying to find a way to offload De Beers, either in a sale or a stock market listing.

Boss Duncan Wanblad is trying to overhaul Anglo American after a hostile £39billion takeover attempt by miner BHP last year.

At the time Anglo American said it could boost shareholder value by focusing on its more profitable core and iron ore mines instead.

This week it sold off its Brazilian nickel business and is in the process of separating its South African platinum arm.

Gas deflated

BRITISH GAS says its focus is on growing its customer base, after Octopus Energy leapfrogged it to become the UK’s biggest supplier.

Profits in the British Gas household division slumped to £297million in 2024 from £751million in 2023.

British Gas said its customer numbers were two per cent lower with 7.4million households.

And the company backs government regulator Ofgem’s proposals to scrap standing charges.

Layoffs shocker for Quiz

SHOPWORKERS at Quiz have complained they were given just an hour’s notice before being told they were losing their jobs and locks were changed on shuttered stores.

The struggling fast-fashion firm, which employed 722 people across 65 shops, filed for insolvency this week before striking a deal to transfer 531 workers and 42 stores to a business connected to the firm’s family owners.

As a result 23 outlets shut from Brighton to Bristol and 191 staff were made redundant.

One worker told The Sun they were informed on a 4.30pm conference call that they faced a job loss before contractors arrived at 5.30pm to change the locks.

Administrators at Teneo advised on the deal to the controlling Ramzan family.

Quiz had already been through one insolvency in 2019 and delisted from the stock market in December.

GOLD has surged to a record high amid fears of a global trade war sparked by US President Donald Trump’s tariffs.

Prices rose by 0.4 per cent to $2,944 yesterday.

Some analysts are betting the precious metal could hit $3,000.

Biofuels for shop

SAINSBURY’S is turning its food waste into fuel for 30 of its lorries.

The supermarket will use biofuel made from its leftovers to power trucks from its distribution centre in Bristol.

The grocer is working with waste processor Reneco and says the switch from diesel could save over 3,000 tonnes of carbon monoxide each year.

And Tesco is working with RenEco on a project to turn food waste into animal feed.