Article content

(Bloomberg) — Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

(Bloomberg) — Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

Article content

Article content

Good morning, this is Chiranjivi Chakraborty, an equities reporter in Mumbai. Nifty futures point to a positive start this morning even as Asian stocks are mixed, amid continued uncertainty over US President Donald Trump’s tariff moves. Goldman Sachs’ expectations of a 16% rise in the MSCI China Index may amplify the shift in investor flows, potentially drawing funds from other emerging markets. Locally, traders are eyeing 22,800 as a key support level for the Nifty 50 index after eight consecutive sessions of losses.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

US tariff threat looms over major Indian sectors

The proposed trade talks between India and the US this year could spell trouble for many sectors. According to Emkay Global, India will be the worst-hit among major nations if the US follows through with its threat of reciprocal tariffs. Nearly every large sector could feel the heat, with chemicals, automobiles, textiles and footwear likely to be most affected, according to the firm’s chief economist Madhavi Arora. Defense and renewables energy equipment makers may also see no relief as US President Donald Trump nudges India to increase imports from American suppliers.

A bumpy path ahead for road builders

India’s federal budget offered little cheer to the road construction sector, with the money set aside for the segment remaining flat at 2.7 trillion rupees ($31.1 billion) for the fiscal year starting April 1. As a result, the pace of new road construction is expected to slow to about 26-27 kilometers per day — the slowest in almost seven years, according to rating company ICRA.

Slowing Ad spending sends media shares tumbling

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

A gauge of media and entertainment companies was among the biggest losers on Friday, falling over 3% to close at its lowest level since April 2021. An Elara Securities report, citing data from Pitch Madison, noted that India’s total advertising revenue across channels grew just 9% in 2024 — the slowest expansion since 2017. However, with online advertising gaining momentum, Elara expects companies like Zomato, Afffle and Nykaa to report stronger revenues from their digital platforms. It is also bullish on firms like ENIL, which operate in the out-of-home advertising space, citing “exponential growth” in the segment.

Analysts actions:

Three great reads from Bloomberg today:

And, finally..

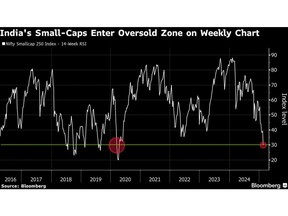

The rout in small-cap stocks has sent an index for such shares into an oversold zone on the weekly charts for the first time since the pandemic. The Nifty Smallcap 250 Index’s relative strength index — a measure of momentum — slipped below 30, signaling selling may be overdone. While the outlook remains uncertain, traders are expecting a short-term rebound, given the steepness of the decline.

To read India Markets Buzz every day, follow Bloomberg India on WhatsApp. Sign up here.

—With assistance from Savio Shetty, Kartik Goyal and Ashutosh Joshi.

Article content

Share this article in your social network