Article content

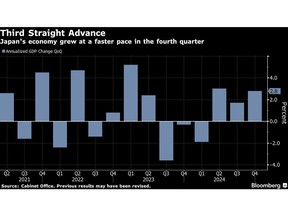

(Bloomberg) — Japan’s economy outperformed forecasts as business spending and net trade helped fuel a third straight quarter of growth that will keep the Bank of Japan on track for further interest rate hikes. The yen strengthened.

Japan’s economy outperformed forecasts as business spending and net trade helped fuel a third straight quarter of growth that will keep the Bank of Japan on track for further interest rate hikes. The yen strengthened.

(Bloomberg) — Japan’s economy outperformed forecasts as business spending and net trade helped fuel a third straight quarter of growth that will keep the Bank of Japan on track for further interest rate hikes. The yen strengthened.

Article content

Article content

Gross domestic product grew at an annualized pace of 2.8% in the three months through December from the prior period, the Cabinet Office reported Monday. That compared with a revised 1.7% clip in the previous period and beat the 1.1% consensus estimate.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

While Monday’s data showed that Japan’s economy continues to grow steadily, there were also pockets of weakness in the report. Net exports grew in part because imports fell, casting a doubt on the health of domestic demand.

Private consumption edged higher in the quarter, exceeding forecasts, but it slowed markedly versus the prior quarter. On an annual basis, the value of private consumption was lower in 2024 than it was a decade earlier.

Even so, the numbers will likely give central bank authorities confidence they can continue to look for opportunities to unwind the BOJ’s ultraeasy policy settings with gradual rate hikes.

“Personal consumption has slowed down a lot and inflation is weighing on consumption because real wages struggle to pick up,” said Yuichi Kodama, economist at Meiji Yasuda Research Institute. “However, overall, the economy is growing, so the BOJ will probably continue to be on track and raise interest rates gradually.”

What Bloomberg Economics Says…

“An increase in investment and resilient consumption suggest the BOJ’s rate hikes haven’t knocked the wind out of the private sector.”

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

— Taro Kimura, senior Japan economist

Click here to read the full report

The GDP figures will be revised in March, about a week before the BOJ next meets to decide policy. Economists expect the BOJ to wait until the summer before raising interest rates again. The yen strengthened to as much as 151.75 per dollar from 152.36 before the release.

Prime Minister Shigeru Ishiba sought to address the impact of inflation with a package of price relief measures as part of an economic stimulus package. More voter friendly measures may come as Ishiba’s minority government is negotiating with smaller opposition parties lobbying for a higher income-tax allowance and free high school tuition to be included in the budget for the year starting in April.

Net exports contributed to growth as imports dropped in the quarter due in part to falling energy prices. Exports picked up moderately, helped by robust spending by inbound tourists, whose outlays are categorized as service exports.

Ishiba will need his economic package to prop up growth in the months ahead given that Japan’s trade outlook is increasingly uncertain as US President Donald Trump threatens to impose tariffs on his trading partners. Tokyo is trying to discern the details of Trump’s reciprocal tariff measures while it also seeks to win an exclusion from the president’s fresh tariffs on steel and aluminum.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

“The outlook for goods exports is a little uncertain, but services, especially inbound demand, will likely continue to grow, albeit at a slower rate to a certain extent,” said Kazuki Fujimoto, economist at the Japan Research Institute. “Overall, I think that exports are moving in a positive direction.”

The strong fourth-quarter result allowed the economy to eke out 0.1% growth for the whole of 2024, defying market expectations of a contraction. Nominal GDP topped ¥600 trillion for the first time in history, marking the achievement of a goal former Prime Minister Shinzo Abe set almost a decade ago.

Even so, the pace of annual growth was the weakest advance since the pandemic.

The weak yen has dimmed Japan’s standing in the global economy by reducing the value of its goods and services in dollar terms. Japan now ranks as the fourth largest economy after the US, China and Germany. Economists expect India to overtake Japanin in the coming years. The yen fell more than 10% versus the dollar last year even as Japanese authorities intervened in the foreign exchange market multiple times to prop it up.

—With assistance from Erica Yokoyama.

(Updates with economists’ comments)

Article content

Share this article in your social network