SIPPING a cocktail in a lively bar on her hols in Turkey, Lisa Dudley locks eyes with the handsome barman who makes a beeline for her.

He sits down next to her and holds up the drinks menu — not to take her order, but to hide their faces as they kiss.

After being single for ten years, Lisa had found the spark she’d been searching for, and it was like they’d known each other for ever.

But this clinch in Icmeler, Marmaris, was not the start of a fairytale. It was the beginning of a nightmare that would destroy her trust in men, trigger terrifying anxiety and leave her buried under a mountain of debt.

Lisa is a victim of holiday romance fraud, a crime that has risen by nearly 60 per cent since 2020.

In the past year, more than £70million has been taken from victims, with data from Lloyds Bank revealing those aged 65 to 74 lose the most money.

‘Just my type’

Lisa’s story shines a light on the dangers of holiday romances. Her ordeal began when she travelled to Turkey in June last year to celebrate her cousin’s 60th birthday.

On a night out, soon after they had arrived in the country, a young barman came to take their orders . . . and Lisa drank him in.

The personal assistant, who had failed to find love on dating apps such as Bumble and Hinge, says: “He was gorgeous and just my type, so I was excited when he started chatting me up.

“We even shared a secret kiss.”

The barman introduced himself as Sam, aged 34, and at the end of the night he and Lisa swapped numbers.

The following day, she went back to see Sam and the pair headed to Sam’s flat, which he rented by the night.

Lisa says: “The sex was great, making emotional connection even stronger. It does sound crazy but it felt like love at first sight.”

A few days later, Sam messaged saying he could not afford his rent.

He asked Lisa for £3,000 so he could get a place big enough for the two of them, so she could stay whenever she visited.

She says: “I trusted him to pay me back, so I transferred £3,000 of my savings. I was slightly nervous. I’d read about romance scams before but it wasn’t like there was a big age gap between us or that he was out of my league. I was convinced what we had was real.”

Two days later, Lisa’s ten-day trip came to an end.

She says: “Sam kissed me goodbye and told me he loved me. I was surprised he’d said it so soon, but on the plane home, I couldn’t stop crying. This was no holiday fling. I’d fallen for him.”

Back in the UK, Lisa and Sam stayed in touch via WhatsApp.

She says: “We spoke every day and after a few days of being back I told him I loved him too.”

Even when Mum said, ‘He’s conning you’,

I refused to believe it.Lisa Dudley

In July, three weeks after her first visit, Lisa went back to Turkey with her cousin and was reunited with Sam.

She says: “I went to see him at the bar and he kissed me on both cheeks. But over the coming days he was standoffish and preoccupied on his phone.

“I was disappointed and really confused. I wondered what I had done and what had changed.”

While Lisa stayed in an apartment with her cousin, Sam showed her the flat he was supposedly set to buy.

“I was shocked at how awful it was,” she says. “But I trusted him and during the trip we did sleep together again.”

Five days later, Sam had a request. Lisa says: “He told me he’d always wanted his own bar and had found one we could run together, as a partnership.

“I’d worked in a bar in Tenerife and loved it, so owning one with Sam would be a dream come true.

“He said it would cost £15,000 and asked if I had the money. I didn’t, but said I could try to get a loan. He offered to show me the bar but we never got round to it, something I now regret.”

Back in the UK, Lisa struggled to secure the money. She says: “I managed to get a Nationwide loan, but the branch advisers quizzed me over where the money was going.

“I panicked and lied because I didn’t want them to refuse to make the payment.

“Sam had been pressuring me to get it done ASAP. I told them it was for me and a friend to buy a house in Turkey.

“But they refused to transfer the money to the account Sam had given me. Looking back, I wish I’d just told them the truth.”

It felt like love at first sight. I was convinced what we had was real.

Lisa Dudley

Eventually Lisa secured a £5,000 Tesco loan to cover the money she had already given Sam, and a Santander loan for £15,000 for the bar.

She then opened a Monzo account to transfer the money.

She says: “The account details were in the name of the man who owned the bar, but this only made it more real. If the money was going straight to Sam, I’d have been more wary.”

Meanwhile, Lisa and Sam spoke every day. “He was still telling me he loved me, but was messaging less, blaming it on not having wifi,” says Lisa, who had planned another trip to Turkey in October.

LISA’S TIPS TO SPOT A RED FLAG

Be wary of someone trying to establish a bond very quickly: Sam asked for my number on day one. At the time, it felt flattering but in hindsight it was a red flag. People who rush to get close to you often have an agenda.

Lots of affection, too soon: It started with sweet words and nicknames – “baby”, “love”, “sexy”. Too much affection, too fast, is often a tactic used by those people with ulterior motives.

The money problems story: Once they feel they’ve gained your trust, the stories start. Sam shared his financial struggles, but now I see how he was preying on my empathy.

You are always the one paying: I was so eager to feel loved that I paid for our food, drinks and to stay in a hotel room. I only realised afterwards that Sam never bought me a single drink.

Asking for financial help too soon: The biggest warning sign of all. He asked for money – and I gave it. But a healthy relationship does not start with financial dependency. If they ask for money early on, it is a massive red flag.

A couple of weeks later, Lisa’s parents saw her bank statements.

She says: “My mum told me, ‘We know what you’ve done’. She wasn’t angry, just upset for me.

“She and my dad had also found British women warning others about Sam on social media.

“My stomach momentarily dropped, but my feeling that Sam was being honest was stronger.

“Even when Mum said, ‘He’s conning you’, I refused to believe it.

“As far as I was concerned, Sam loved me and they had it all wrong.”

It was only in September, when her friends and parents showed Lisa further posts online about Sam being a serial con artist, that she began to accept the truth.

She says: “I even spoke to one woman Sam had been seeing at the same time as me. It hurt so much.”

Trust destroyed

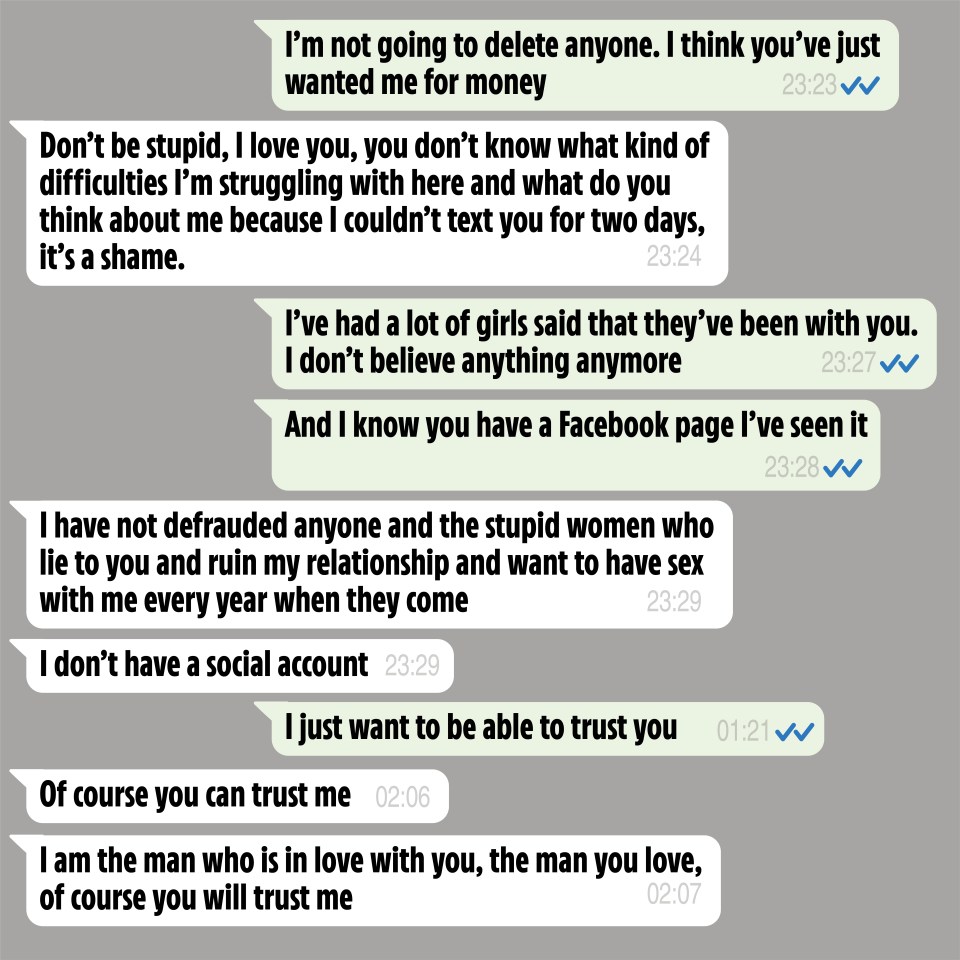

Lisa confronted him about it on WhatsApp, but he branded the women liars, writing that they just “want to have sex with me every year when they come”.

Then suddenly Lisa could not contact him any more . . . he had changed his phone number.

She says: “He had messed with my mind, broken my heart and walked away with £18,000 of my money. I was crying all the time and could barely eat anything.”

Lisa took advice from family and friends and hired a solicitor in October.

She says: “They are dealing with my fraud recovery claim and I will have to wait up to a year to find out if I’ll receive any compensation from Monzo.”

Lisa lives with her parents in Essex, paying them £650 a month.

She says: “I’m so grateful to my parents, who paid off the loans, avoiding the extra £10,000 I’d have had to pay in interest.

“Before meeting Sam, I’d planned to move out and get my own place, but now I can’t afford to.

“I’ve also been diagnosed with anxiety and depression and have been signed off work.”

When Lisa posted on social media to warn others about Sam, she was branded “naive” and a “fool”. She says: “Yes, I may have been stupid, but my feelings were genuine.”

Lisa says Sam has destroyed her trust in men, and adds: “If I meet someone, I’ll always be questioning them. I’m still grieving for my future with Sam and I still love him. Even knowing what I know, I wonder, did he love me?

“When thinking of a holiday romance scam you might picture young men tricking older or wealthier women to get money or a visa, but this was different.

“You just never think it’s going to happen to you.

“But I’m proof this kind of scam can happen to anyone.”

How to protect yourself from scams

BY keeping these tips in mind, you can avoid getting caught up in a scam:

- Firstly, remember that if something seems too good to be true, it normally is.

- Check brands are “verified” on Facebook and Twitter pages – this means the company will have a blue tick on its profile.

- Look for grammatical and spelling errors; fraudsters are notoriously bad at writing proper English. If you receive a message from a “friend” informing you of a freebie, consider whether it’s written in your friend’s normal style.

- If you’re invited to click on a URL, hover over the link to see the address it will take you to – does it look genuine?

- To be on the really safe side, don’t click on unsolicited links in messages, even if they appear to come from a trusted contact.

- Be careful when opening email attachments too. Fraudsters are increasingly attaching files, usually PDFs or spreadsheets, which contain dangerous malware.

- If you receive a suspicious message then report it to the company, block the sender and delete it.

- If you think you’ve fallen for a scam, report it to Action Fraud on 0300 123 2040 or use its online fraud reporting tool.