Article content

(Bloomberg) — UK inflation probably hit its highest level in 10 months in January, continuing a resurgence in price pressures that has made the Bank of England wary over rushing into interest-rate cuts.

UK inflation probably hit its highest level in 10 months in January, continuing a resurgence in price pressures that has made the Bank of England wary over rushing into interest-rate cuts.

(Bloomberg) — UK inflation probably hit its highest level in 10 months in January, continuing a resurgence in price pressures that has made the Bank of England wary over rushing into interest-rate cuts.

Article content

Article content

Data on Wednesday are expected to show consumer prices rising 2.8% compared to a year earlier, driven by a jump in private school fees and a reversal of volatile factors that weakened inflation in December, according to the median projection of economists surveyed by Bloomberg.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

The figures may support worries among BOE rate-setters that Britain’s inflation outlook is darkening at a time when the economy is also stagnating. It expects higher energy bills to lift consumer-price growth to a peak of 3.7% later this year.

While two officials backed a bumper half-point rate cut when the UK central bank eased monetary policy earlier this month, the majority of the committee still sees a need for a guarded approach to lowering borrowing costs.

Most concerning will be an uptick in underlying measures being watched closely by the BOE for signs of domestic pressures.

Services inflation is expected to rebound sharply from 4.4% to 5.2%, driven higher by erratic components such as air fares and an increase in private school fees after the Labour government made them subject to VAT.

What Bloomberg Economics Says:

“With the economy weak we doubt it will stop the BOE from easing further. We expect three more 25 basis-point rate reductions in 2025.”

—Dan Hanson and Ana Andrade. For full analysis, click here

The labor market will also be in focus this week with data on Tuesday expected by forecasters to show wage growth excluding bonuses picked up to 5.9% in the fourth quarter, up from 5.6% previously.

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

While there are signs that Britain’s jobs market is loosening, pay pressures are seen as too strong to keep inflation near the BOE’s 2% target.

Elsewhere, Australia’s first rate cut in the current cycle, another reduction in New Zealand, and purchasing manager indexes from around the world will be among the highlights.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

US and Canada

The US economic data calendar, including several reports on the housing market, lightens up during a holiday-shortened trading week.

On Wednesday, government figures are forecast to show the pace of housing starts slowed in January from a month earlier.

New home construction downshifted in 2024 as builders put more effort into clearing inventory against a backdrop of elevated borrowing costs and high prices in the resale market. On Friday, National Association of Realtors figures are forecast to show a decline in contract closings on previously owned home sales.

This year may prove just as challenging for builders with the Federal Reserve in no rush to further reduce interest rates at a time when inflation has yet to be fully tamed. Minutes of its January meeting, at which policymakers kept borrowing costs unchanged, are due Wednesday.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

At week’s end, investors will monitor final results of the University of Michigan’s survey of consumers. The preliminary February report showed a slump in sentiment and a spike in year-ahead inflation expectations.

Investors will also hear from a number of Fed officials this week, including Vice Chair Philip Jefferson and governors Christopher Waller, Michelle Bowman and Adriana Kugler.

In Canada, inflation data for January is expected to show the headline rate ticked up to 1.9%, with core measures also accelerating slightly, according to the median estimates in a Bloomberg survey of economists.

Momentum in underlying price pressures may boost bets on a pause in the Bank of Canada’s easing cycle, but uncertainty about US President Donald Trump’s tariff threats complicate its next moves. Governor Tiff Macklem will deliver a speech on “trade, structural change and monetary policy,” offering insight into a possible response in the event of a trade war.

Asia

In its first meeting of the year, the Reserve Bank of Australia is expected to finally join the global monetary easing campaign with a cut to its cash rate target to 4.1% on Tuesday after core inflation slowed more abruptly than expected in the fourth quarter.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Neighboring New Zealand is seen continuing its easing cycle a day later with another 50 basis-point reduction in its benchmark that would take the rate to 3.75%. Bloomberg Economics predicts the RBNZ will signal a lower terminal rate for this cycle.

Elsewhere, Bank Indonesia is forecast to stand pat on Wednesday, while lenders in China, with a nod from the central bank, are expected to hold the 1-year and 5-year loan prime rates steady on Thursday.

In data, Japan’s economic growth may have moderated a tad at the end of 2024 as private demand sagged, while consumer inflation statistics due Friday will likely show prices rising at or above the central bank’s target for a 34th month, keeping rate hikes on the radar.

Thailand’s economic growth may have accelerated to 3.4% in the last quarter of 2024.

Trade data are due this week from New Zealand, Singapore, Malaysia, Japan, South Korea, India, Thailand and Indonesia, and India and Japan report preliminary purchasing manager index figures for February on Friday.

Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Article content

Europe, Middle East, Africa

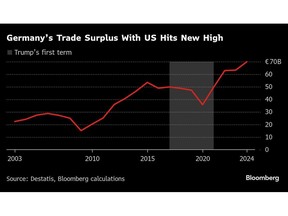

With Trump pledging tariffs to curb what he sees as excessive trade imbalances, data on Monday will reveal just how large a surplus in goods the European Union had with the US in 2024. Numbers earlier this month from Germany, the bloc’s biggest member, showed a new record there.

Other key reports this week include gauges of confidence from German investors on Tuesday and euro-area consumers on Thursday, and the region’s purchasing manager indexes on Friday. All will illustrate sentiment and activity in the economy while facing that threat from the White House.

Among European Central Bank speakers scheduled, Chief Economist Philip Lane will appear in Vienna on Friday. The institution itself will release 2024 financial statements the previous day. Last year, it reported a loss.

Switzerland’s fourth-quarter gross domestic product data will be released on Monday, and the report is anticipated by economists to show a pickup in growth.

Further afield, South African Finance Minister Enoch Godongwana will present his annual budget in Cape Town on Wednesday.

Advertisement 7

This advertisement has not loaded yet, but your article continues below.

Article content

Investors will be monitoring to see if the government sticks to its fiscal consolidation plans as spending pressures increase. They also want energy and logistics reforms expedited to boost economic growth as Trump’s protectionist policies may put strain on the economy.

On the same day, data will likely show that South Africa’s inflation climbed to 3.2% in January from 3% a month prior, in part due to higher food and gasoline prices.

The region’s main monetary decisions will take place around Africa:

Latin America

Colombia’s economy likely posted a modest rebound last year from 2023 and most analysts see somewhat faster growth in 2025 on easing financial conditions, an uptick in sentiment and and steady household consumption. The full year, fourth-quarter and December GDP-proxy data are due out Monday.

Advertisement 8

This advertisement has not loaded yet, but your article continues below.

Article content

In Brazil, inflation expectations in the central bank’s weekly market survey continue to run roughshod over an aggressive central bank tightening cycle. The 12-month estimate is now at 5.87% after rising for 18 straight weeks.

Brazil will also report December GDP-proxy data, likely to betray gathering weakness at the margins as the monthly figure turns negative.

Argentina reports its January budget data along with the trade balance, exports and imports. South America’s No. 2 economy posted its first fiscal surplus in over a decade last year while recording a $18.9 billion trade surplus after 2023’s $6.9 billion deficit.

Banxico will publish the minutes of its Feb. 6 decision to double the pace of easing with a half-point cut to 9.5%. The post-decision communique was surprisingly dovish given risk of US tariffs.

Mexico also publishes its final fourth-quarter output report, a far more complete reading than the flash print posted last month, which showed that the economy shrank 0.6% from the previous three months. December GDP-proxy data and retail sales figures can be expected to underscore the slowdown.

—With assistance from Brian Fowler, Laura Dhillon Kane, Monique Vanek, Robert Jameson and Vince Golle.

Article content

Share this article in your social network