Article content

(Bloomberg) — US inflation picked up broadly at the start of the year, further diminishing chances the Federal Reserve will cut interest rates anytime soon.

US inflation picked up broadly at the start of the year, further diminishing chances the Federal Reserve will cut interest rates anytime soon.

(Bloomberg) — US inflation picked up broadly at the start of the year, further diminishing chances the Federal Reserve will cut interest rates anytime soon.

Article content

Article content

The consumer price index increased by the most since August 2023, led by a range of household expenses like groceries and gas, as well as housing costs. The figures will keep the Fed on pause for the foreseeable future, as officials await further clarity on President Donald Trump’s policies, notably tariffs.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

After the CPI report, Trump ordered his administration to consider imposing reciprocal tariffs on numerous trading partners, raising the prospect of a wider campaign against a global system he says is tilted against the US.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

US

Inflation tends to come in higher in January, because many companies choose the start of the year to hike prices and fees. That pattern has been been exacerbated in the post-pandemic era, and several forecasters suggested that the jump in price growth last month won’t be repeated going forward.

Retail sales slumped in January by the most in nearly two years, indicating an abrupt pullback by consumers after a spending spree in the closing months of 2024. The data encompassed a period marked by devastating wildfires in Los Angeles — the second-largest metropolitan area in the US — and severe winter weather in other parts of the country, which could have depressed brick-and-mortar shopping activity.

World

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

Economists are warning the next stage of Donald Trump’s trade war would open new fronts across Asia, with India and Thailand among the nations most exposed to risks from the US president’s vow to impose reciprocal tariffs on partners.

Crude shipments from Russia’s Sakhalin Island projects aren’t being discharged after the tankers carrying them were sanctioned by the US. About 6.3 million barrels of Pacific crude is being held on vessels that have been stationary for at least a week.

Zambia raised rates to a more than eight-year high, while Uruguay’s central bank also hiked. Philippines, Peru, Serbia and Romania left borrowing costs unchanged. The Bank of Russia kept rates at a record high, while Namibia cut.

Europe

French unemployment unexpectedly declined at the end of 2024, showing signs of economic resilience in a country wrestling with political instability and rising debt. The slight improvement in the labor market provides some relief for Prime Minister Francois Bayrou’s minority government as it struggles to cling to power and rein in a gaping budget deficit.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Norway’s economy surprised last quarter with the biggest contraction since the pandemic, strengthening the case for the country’s central bank to start its long-awaited easing campaign.

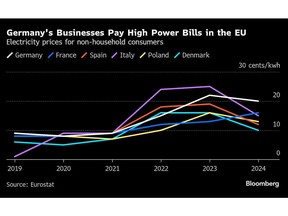

When the weather in Germany is overcast and calm, the windmills and solar plants don’t send any power to the grid. Instead, they send shockwaves through the markets. One such “Dunkelflaute” day in mid-December saw spot power prices climb to more than €900 ($939) per megawatt-hour – nine times above average.

Asia

China saw record outflows of foreign direct investment last year, an exodus that threatens to persist after the resumption of a trade war with the US. Net FDI dropped by $168 billion in 2024, according to the State Administration of Foreign Exchange, the biggest capital flight in data going back to 1990.

Japan’s current-account surplus hit a record high in 2024 with the yen’s weakness inflating the value of overseas investment returns. A record-high primary income surplus of ¥40.2 trillion ($264 billion), which includes interest and dividends earned from overseas investments, offset deficits in the trade and services balances.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

China’s busiest port processed a record amount of goods in January, as companies rushed to get their products onto ships before US tariffs kicked in and ahead of a long local holiday. Shanghai’s port processed a record 5 million containers. Last year, Chinese firms shipped almost $525 billion worth of goods directly to the US, the third-highest tally on record.

Emerging Markets

Brazil inflation edged down at the start of the year, as one-time energy credits provided consumers temporary relief from simmering price pressures.

Inflation in Argentina reached its lowest level since President Javier Milei took office and annual consumer prices dipped below 100% for the first time in two years as he continues to tame expectations in the crisis-prone economy.

Emerging-market stocks headed for a fifth week of gains as traders bet on positive outcomes from negotiations on US tariffs and a way out from Russia’s war in Ukraine. Risk appetite has been increasing on the expectation that the eventual impact of US President Donald Trump’s proposed trade tariffs will be blunted by the time international talks and other delays are over.

—With assistance from William Horobin, Julian Lee, James Mayger, Yoshiaki Nohara, Andrew Rosati, Zoe Schneeweiss, Petra Sorge, Manuela Tobias, Ott Ummelas and Josh Xiao.

Article content

Share this article in your social network