United States President Donald Trump’s tariffs – some threatened, others executed – have sent global markets into a tizzy, pushing down several currencies.

But some things have become costlier, especially on grocery shelves.

And for those who visit the jeweller, gold.

With Trump’s 25 percent tariffs on steel and aluminium imports kicking in this week, we look at why the price of the yellow metal has soared in recent days, why its value rises during periods of uncertainty, and whether some other assets are also benefitting from the Trump chaos.

What happened to the price of gold?

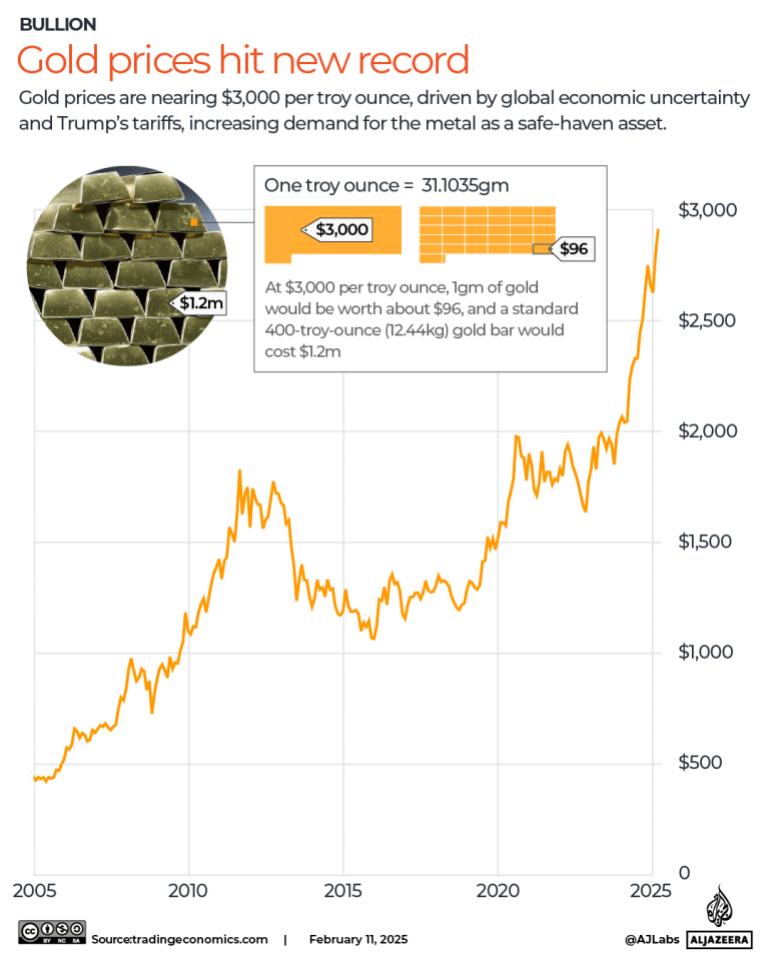

Following Trump’s economic moves and rhetoric, gold has climbed to a record high. Exports say that this points to a desire for a safe asset.

On Monday, gold broke above $2,900 per ounce for the first time. It extended gains Tuesday to hit a new peak above $2,942 per ounce.

Spot gold rose by 0.3 percent to $2,916.37 per ounce as of 07:01 GMT after earlier reaching $2,942.70.

Why is gold considered a safe asset?

People have been trading or using gold as a currency for thousands of years, and it is viewed by investors as a safe haven during times of uncertainty.

Unlike money, which can drop in value due to inflation or overprinting, gold tends to retain its worth over time because it is a scarce resource used in tangible things. Also, unlike country-specific currencies, it is universally usable.

“Gold is a highly liquid asset, which is no one’s liability, carries no credit risk, and is scarce, historically preserving its value over time,” the World Gold Council (WGC) points out.

When has the price of gold soared in the past?

History contributes to the public perception that gold is a safe asset.

In early 2008, when gold prices surpassed $1,000 per ounce for the first time, the housing crisis in the US hit. Gold prices dropped briefly before stabilising and then began to climb. By September 2011, gold reached a record high of about $1,900 per ounce, as the world grappled with the aftermath of the financial meltdown.

More recently, Russia’s full-scale invasion of Ukraine in February 2022 created uncertainty in global markets – contributing to rising oil and commodity prices – further expanding inflation concerns. By March of that year, gold prices spiked to $2,070 per ounce, from $1,910 the month before.

What’s the trigger this time?

Trump signed proclamations late on Monday, reinstating a 25 percent tariff rate on steel from all countries, and raising tariffs on aluminium to 25 percent from his previous 10 percent rate.

He also eliminated tariff exclusions on products that use both metals, as well as country exceptions and quota deals.

The US imported about $49bn worth of steel and aluminium in 2024, according to government data.

“Our nation requires steel and aluminium to be made in America, not in foreign lands. We need to create in order to protect our country’s future,” Trump said, echoing language he had used against neighbouring Canada and Mexico previously, in his threats to impose tariffs on imports from these countries.

While the steel and aluminium tariffs will apply to Canada and Mexico – major suppliers of these commodities – Trump has for the moment paused plans to impose broader 25 percent tariffs on all imports from those two neighbours. He has however imposed 10 percent tariffs on Chinese imports.

“It’s time for our great industries to come back to America. We want them back to America. This is the first of many.”

Where does the US get its steel and aluminium from?

According to the US International Trade Administration, the biggest supplier of steel to the US is Canada – which is also the largest exporter of aluminium – followed by Mexico, Brazil, South Korea, Germany and Japan.

Other major aluminium suppliers include the United Arab Emirates, South Korea and China.

The US imports roughly a quarter of the steel it uses.

How has the world responded?

Countries and experts have pointed to the economic volatility caused by Trump’s actions and words.

On the sidelines of the artificial intelligence (AI) summit in Paris, Canadian Prime Minister Justin Trudeau called the tariffs “entirely unjustified”.

“We are the US’s closest ally. Our economies are integrated. Canadian steel and aluminium is used in a number of key American industries whether it’s defence, shipbuilding, manufacturing, energy, automotive,” he said, adding that Canada’s response would be “firm and clear”.

“We will stand up for Canadian workers. We will stand up for Canadian industries,” he said.

Asia, too, is worried. China had hit back at Trump’s previous tariffs by adding their own on a range of US imports, including coal and crude oil.

Al Jazeera’s Katrina Yu, reporting from Beijing, says these Chinese tariffs are a warning to Washington.

Gabriel Wildau, senior vice president at the global business advisory firm Teneo, told Al Jazeera that these latest tariffs likely won’t start a trade war, but they are a step in that direction.

“US trading partners in Europe and Asia are virtually certain to retaliate, but this retaliation is likely to take the form of comparably narrow sectoral tariffs,” he said.

What other economic changes have occurred?

Fears that Trump’s tariffs, along with tax cuts and deregulation, will reignite inflation and force the US Federal Reserve to keep interest rates elevated have sent the dollar up against most of its peers.

Shares in Chinese steelmakers dipped between 0.145 percent and 2.62 percent, while futures in iron ore, the main steelmaking ingredient, erased early gains to trade lower as tariff concerns outweighed weather-related supply disruptions in Australia.

Asian markets struggled on Tuesday as traders keep a nervous eye on Donald Trump’s next moves.