Article content

(Bloomberg) — Even US President Donald Trump’s tariff rhetoric can’t rattle credit markets, a sign to some money managers and strategists that the market is too complacent.

Even US President Donald Trump’s tariff rhetoric can’t rattle credit markets, a sign to some money managers and strategists that the market is too complacent.

(Bloomberg) — Even US President Donald Trump’s tariff rhetoric can’t rattle credit markets, a sign to some money managers and strategists that the market is too complacent.

Article content

Article content

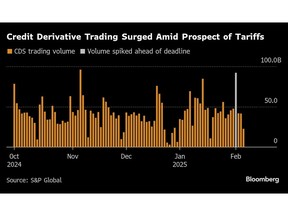

Prices on credit default swaps barely moved on Monday amid the prospect of levies being introduced on Mexican and Canadian goods, even as trading volume in the derivatives more than doubled from the previous week’s daily average. By Tuesday, activity had returned to more typical levels.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

CDS didn’t sell off because “credit remains a tight asset class with the most stretched valuations across the board,” said Gabriele Foa, an Algebris Investments portfolio manager whose Global Opportunities Fund has “extremely cautious” positioning at present. “In high yield, CDS has only been at current levels three times in the last 10 years and that’s been followed by a sharp widening in the six to nine months after that.”

Trump is trying to revitalize US industry, cut the government deficit and gain bargaining power with foreign governments through the use of tariffs, with the latest due to be announced this coming week. The speed and breadth of the announcements has surprised markets. JPMorgan Chase & Co. credit strategists in Europe including Matthew Bailey turned bearish at the end of last month, arguing there are growing signs of market complacency, with pricing “extremely difficult to justify” and “feeling completely disconnected from the headlines.”

European analysts at the bank even compiled a ‘Trade War’ basket of CDS linked to European companies most at risk of tariffs, arguing that even though the threat of levies on Mexico and Canada have receded for now, “the risks remain significant” and tight valuations make setting hedges attractive.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

Algebris’s Foa sees similar signs of debt investors becoming too comfortable with the emerging risks.

“The market is getting more relaxed with the idea that anything that is going to hurt economic growth won’t happen,” he said, adding that credit is “priced for perfection,” even though “we also do have volatility risk coming up. Credit’s in a tight spot.”

The sanguine reaction also contrasts with the foreign-exchange options market, where trading volumes have jumped to multi-year highs as investors buy downside protection.

CDS has benefited in recent weeks from the fact that the emergence of DeepSeek isn’t seen as much of a debt story, said one derivatives trader, who asked not to be identified. The threat from tariffs will have a more muted impact on credit because the asset class hasn’t seen the type of gains seen in the equity markets, so a hiccup won’t matter too much, the trader said.

Trump’s policies geared toward promoting growth and helping businesses may end up having a more material impact on credit, said Chris Wright, president and head of private debt at Crescent Capital Group, on the Bloomberg Intelligence Credit Edge podcast.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

But even so, there is ample ambiguity now about what the future holds. With bouts of market turmoil expected to continue, many debt investors are focusing on interest income, or carry, this year rather than betting on further tightening of spreads above government bonds. That might ultimately result in bigger price moves down the line.

“Credit is negatively asymmetric at the moment,” Foa said. “You can pocket carry of 3% to 4% but if there’s an accident you can easily lose 10% to 12%.”

Week In Review

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

On the Move

—With assistance from Tasos Vossos.

Article content

Share this article in your social network