Article content

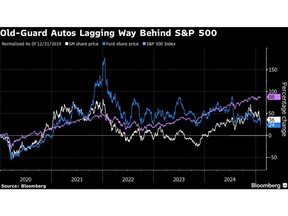

(Bloomberg) — General Motors Co. and Ford Motor Co. are among the cheapest stocks in the S&P 500 Index. But that doesn’t make them buying opportunities, say Wall Street analysts, who are rapidly souring on the century-old carmakers’ shares as risks around their outlooks grow.

Article content

The share of sell recommendations from analysts covering GM and Ford is currently at the highest level in at least a decade. More than 9% of analysts covering GM have a sell rating on the stock, the largest share since 2015, according to data compiled by Bloomberg. For Ford, 27% analysts recommend selling, the highest since 2010, which is as far back as the data goes.

Article content

Both companies reported earnings recently — Ford on Wednesday, and GM last week — with Ford warning of sharply reduced profit this year on lower vehicle prices and costs from new-model launches, and GM unveiling an improved outlook profit that failed to cheer investors. Weighing on the shares of both, though, are worries about the potentially damaging effect of tariffs under President Donald Trump, which has sparked a slide in the stocks.

The auto industry is widely considered to be one of the most vulnerable to tariffs, given carmakers’ sprawling global supply chains. But their problems go deeper than that. There’s also the longer-term challenge that traditional automakers face as they seek to transform their businesses to compete in an industry moving toward electric vehicles and self-driving cars — areas where competitors such as Tesla Inc., China’s BYD Co. Ltd and Alphabet Inc.’s Waymo are far ahead.

“We are not a buyer here because the traditional automotive business, which is a tough business to begin with, is about to get disrupted,” said Ivana Delevska, chief investment officer at Spear Invest.

Article content

Shares of GM traded at 4.3 times its 12-month forward earnings as of Thursday’s close, while Ford traded at 6 times. The average price-to-earnings multiple for the S&P 500 Index is 22.

“There might be the risk of a value trap,” Bloomberg Intelligence analysts Steve Man and Peter Lau said. “The stocks are cheap but fundamentals are not looking good, the industry is getting a shake-up and the businesses are low margin.”

Analysts’ profit and revenue growth expectations for the two companies are dismal as well. After a 38% climb in annual profit for 2024, GM’s adjusted earnings per share are projected to rise just 4.5% in 2025, and revenue is seen falling more than 3%, according to data compiled by Bloomberg. For Ford, the picture is gloomier. Adjusted EPS this year is expected to drop 18% on a 0.8% dip in revenue, the data show.

For the time being, though, the tariff headlines will likely roil these stocks the most. Shares of GM and Ford have remained depressed even after Trump delayed his plan to implement 25% tariffs on Canadian and Mexican goods. A new 10% levy against China did go through this week.

Article content

The trade problems have reappeared for US automakers at a time when they have already been grappling with slowing demand for electric cars in which they had invested heavily as well as higher development costs and warnings from industry watchers that prices of US vehicles have climbed so much that consumers will soon find it hard to afford them.

If the tariffs proposed by Trump against Canada and Mexico are actually imposed, they will further raise the cost of making cars, with Bloomberg Intelligence estimating an at least $3,500 jump in cost per vehicle. Companies typically pass on these higher costs to the buyers.

“While the delayed implementation of the tariffs gives carmakers additional time to plan their responses, the prolonged uncertainty complicates the US autos sector from an investment standpoint,” Bernstein analyst Daniel Roeska wrote in a note this week. Given the lack of clarity on the issue right now, it would be best for investors to wait until there’s information on policy negotiations, he added.

Share this article in your social network