Article content

(Bloomberg) — Mexico’s central bank will likely double the pace of monetary policy easing Thursday, delivering a half-point rate cut with inflation back in the target range, growth slowing and tariffs delayed.

Mexico’s central bank will likely double the pace of monetary policy easing Thursday, delivering a half-point rate cut with inflation back in the target range, growth slowing and tariffs delayed.

(Bloomberg) — Mexico’s central bank will likely double the pace of monetary policy easing Thursday, delivering a half-point rate cut with inflation back in the target range, growth slowing and tariffs delayed.

Article content

Article content

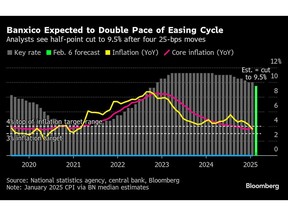

Banco de Mexico, known as Banxico, will cut its key rate by 50 basis points to 9.5%, according to 22 of 26 economists surveyed by Bloomberg. Three analysts see a fifth-straight 25 basis-point reduction and one expects no change.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

Mexico had a turbulent few days between President Donald Trump’s announcement of 25% tariffs on exports from Latin America’s second-largest economy and the decision to delay for a month. Mexico’s economy had already been facing a slowdown, after growing only 1.5% all of last year and shrinking more than economists had expected in the last three months of 2024.

Economists have argued that the bank now has room to ease its stranglehold on the economy. Inflation in the first two weeks of the year slowed to 3.69%, within the central bank’s target range of 3% plus or minus one percentage point. Core inflation also held fairly steady at 3.72%. Economists are less optimistic about growth in 2025, arguing it could fall below 1%.

Banxico Governor Victoria Rodriguez had said the bank would consider cuts larger than 25 basis points in its first meetings of the year. Addressing the threat of tariffs earlier this year, she told Mexican outlet El Financiero that such levies could have varied effects on inflation, including the value of the currency and the strength of her country’s economy.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

For now 25% tariffs remain a threat but Mexico’s President Claudia Sheinbaum and Canada’s Prime Minister Justin Trudeau secured one-month delays from Trump after agreeing to beef up border security and take steps to fight drug trafficking. Mexico and the US will have working groups on commerce, security and migration, Sheinbaum said after a call with Trump.

The three countries are signatories to the North American free trade agreement, known as the USMCA, which is scheduled for a joint review next year that Trump sees as an opportunity to renegotiate some parts of the accord. Many goods go back and forth across the border multiple times before being finished, including in the auto sector, which has raised concern about the effects of any tariffs.

What Bloomberg Economics Says

“We expect Mexico’s central bank to cut its benchmark interest rate to 9.5% from 10%. Forward guidance is likely to keep the door open for additional accommodation, with a more cautious tone acknowledging risks and emphasizing data dependence will guide future decisions.”

— Felipe Hernandez, Latin America economist

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

— Click here for full report

Sheinbaum had argued that tariffs would raise prices for US consumers, making the decision unwise for the US government. Refrigerators, cars, televisions and fruits and vegetables would all cost more for US consumers if the government went ahead with the move, Economy Minister Marcelo Ebrard told reporters ahead of the decision to postpone.

The members of Banxico’s board have been divided about the right pace with which to adjust the rate, Deputy Governor Jonathan Heath said in an interview with outlet Excelsior.

—With assistance from Rafael Gayol and Alex Vasquez.

Article content

Share this article in your social network