Article content

(Bloomberg) — Australia’s core inflation eased by more than expected in the final three months of 2024, opening the door to an interest-rate cut as soon as next month and sending the currency lower.

Australia’s core inflation eased by more than expected in the final three months of 2024, opening the door to an interest-rate cut as soon as next month and sending the currency lower.

(Bloomberg) — Australia’s core inflation eased by more than expected in the final three months of 2024, opening the door to an interest-rate cut as soon as next month and sending the currency lower.

Article content

Article content

The annual trimmed mean gauge of consumer prices, which shaves off volatile items, rose 3.2% in the three months through December, compared with an expected 3.3% gain, official figures showed Wednesday. On a quarterly basis, core consumer prices rose 0.5% versus a forecast 0.6%.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

In response, the currency slid and the yield on policy sensitive three-year government bonds declined as much as 8 basis points. Stocks extended gains as money markets boosted bets on a February rate cut to better than 90%.

Economists at Westpac Banking Corp., Royal Bank of Canada, TD Securities and AMP Ltd. brought forward their calls for the first Reserve Bank cut to February. Goldman Sachs Group Inc., which was already predicting February and May rate reductions, now sees an easing in April as well.

“CPI has been the deciding factor,” said Luci Ellis, chief economist at Westpac who was previously a senior official at the RBA. “We see encouraging signs in housing-related inflation suggesting that the momentum in domestic price pressures is fading a bit faster than the RBA feared.”

Today’s result will buttress the RBA’s growing confidence that inflation is on track to return sustainably to the 2-3% target in a reasonable timeframe. At their last meeting in December, policymakers pivoted to a more dovish stance and discussed scenarios in which rates might be lowered or remain at current restrictive levels.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

They assessed that either outcome was plausible and opted to hold rates at 4.35%, a 13-year high that has been in place since late 2023.

“Today’s data cements a February rate cut,” said Diana Mousina, AMP’s deputy chief economist, pointing to disinflation in some “problem areas” such as rents, medical and eating out.

“It tells me that the period of goods inflation is over and what you want to see is services inflation slow a bit further from here.”

The RBA, which aims for the midpoint of its CPI target, is focused on core inflation because government subsidies are suppressing headline prices. Trimmed mean CPI hasn’t been inside the band since the end of 2021.

What Bloomberg Economics Says…

“The downside miss to the RBA’s projections will likely prompt the central bank to trim its inflation forecasts by enough to greenlight the beginning of its easing cycle despite recent robust labor market readings.”

— James McIntyre, economist

For full note, click here

Still, there remain reasons for the RBA board to take a cautious approach when they meet in just under three weeks’ time.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Annual services prices remain elevated at 4.3%, led by rents, medical and hospital services and insurance, the ABS said.

The inflation report also showed non-discretionary goods and services fell 0.5% during the quarter, while discretionary rose 1.1%, marking the first time in nearly four years that inflation in non-discretionary items is lower than for discretionary items.

That underscores recent data that consumer spending has picked up, while the labor market has remained strong — pointing to the risk of persistent inflation pressures. The RBA is sensitive to the possibility that revived consumption and the strong jobs market may combine to frustrate efforts to bring core inflation down to target.

At the same time, Australia will soon be headed to the polls and economists fear that both sides of politics will be tempted to unleash major spending initiatives to try to sway what’s expected to be a tight election.

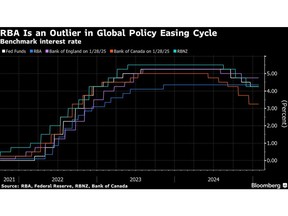

The RBA, in tackling inflation through 2022-23, opted for a lower peak rate than global counterparts. It worried about the capacity of heavily-geared households to cope with significantly higher mortgage repayments.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Australia has been a global outlier in the current easing cycle as most developed world central banks, including the Federal Reserve, have already cut substantially. The Fed is due to announce the outcome of its meeting later today and is expected to stand pat.

The RBA’s baseline scenario is for unemployment to peak at 4.5% this year, up from 4% now. The central bank forecast in November that the trimmed mean would end 2024 at 3.4% before easing to the top of the inflation target by mid-2025. The bank will publish updated forecasts on Feb. 18 together with its rate decision.

Wednesday’s inflation report also showed:

—With assistance from Matthew Burgess and Garfield Reynolds.

(Adds rate-call changes, economist’s comments, updates market reaction.)

Article content

Share this article in your social network