Article content

(Bloomberg) — London rent inflation cooled to the weakest in three years, bringing some relief to the UK capital’s hard-pressed tenants, according to Rightmove.

London rent inflation cooled to the weakest in three years, bringing some relief to the UK capital’s hard-pressed tenants, according to Rightmove.

(Bloomberg) — London rent inflation cooled to the weakest in three years, bringing some relief to the UK capital’s hard-pressed tenants, according to Rightmove.

Article content

Article content

The average advertised rent rose just 0.1% to £2,695 ($3,362) per month in the fourth quarter, the property website said Tuesday. That’s up 2.4% from a year earlier, the slowest pace of increase since 2021.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

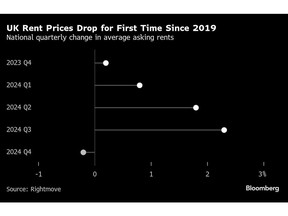

Outside of London, rents fell for the first time since 2019, the report showed. While rental prices are still well above 2023 levels, the 0.2% decline marks a “key milestone” suggesting the rampant inflation seen in recent years is coming to an end.

“We’re seeing a cooling of what has been a ferociously hot rental market over the last year, where tenants have endured intense competition and consistent rental inflation,” said Alex Bloxham, partner and head of residential lettings at Bidwells. “Landlords are continuing to invest in their buy-to-let portfolios while more tenants are choosing to stay put, likely due to continued macroeconomic uncertainty and the upfront costs involved in relocating.”

The report offers a glimmer of hope for tenants, who have been hit by a shortage of places to rent after many landlords opted to sell up due to high mortgage costs and Labour proposals to ban evictions without cause and tighten green requirements.

London rents are almost a third higher than before the pandemic, the equivalent of £630 ($788) per month, Rightmove said. Official data taking into account the total stock of rentals showed prices rising 9% last year. High housing costs tie up money that could otherwise be spent elsewhere, threatening Labour’s plans to boost growth.

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

However, the balance between supply and demand has been improving in recent months, said Rightmove’s property expert Colleen Babcock.

Larger landlords investing in buy-to-let properties are helping plug the supply gap, leading to a 13% year-on-year increase in the number of properties available for rent across the UK, according to Rightmove. Rental properties are also being freed up as some tenants become buyers of homes, lured by lower interest rates and rising real wages.

There are also fewer tenants looking to move house amid growing uncertainty. UK households are increasingly worried about potential job cuts after Labour raised employment costs in the budget, while they also face cost-of-living pressures from rising energy bills and the return of food inflation.

Still, the market remains significantly busier than before the pandemic. There are about 10 tenant applications per rental property, almost double the pre-Covid norm.

“This mismatch will continue to be a defining feature in the market, but the steady improvement we’re seeing will put downward pressure on rents and represents positive news for renters,” Bloxham said.

Article content

Share this article in your social network