Article content

(Bloomberg) — South Korea’s early trade data showed weak export growth so far this month, as headwinds grow for the trade-reliant economy with political turmoil rumbling on at home and Donald Trump’s return to power clouding the outlook for global commerce.

Article content

Shipments adjusted for working-day differences expanded 1.4% in value from a year earlier in the first 20 days of January, according to data released Tuesday by the customs office. That compared with a 4.3% rise initially reported for the full month of December.

Article content

On an unadjusted basis exports fell 5.1%, reflecting fewer working days in the January period compared with last year. Overall imports decreased by 1.7% resulting in a trade shortfall of $3.8 billion.

South Korea is among nations expected to take a big hit if Trump imposes the tariffs he pledged during his campaign. Korea’s reliance on export growth and trade surpluses leaves the economy vulnerable to any disruptions in global trade.

Trump took office on Monday in the US for his second term after winning the November election. The Bank of Korea already cut its benchmark interest rate in November to help brace the economy against Trump’s tariff plans. Last week, the BOK held the rate unchanged, adopting a wait-and-see mode until after Trump reveals more details of his trade policy.

A softening trend in export growth has already raised concerns for South Korean policymakers at a time when consumer and business sentiment has weakened sharply after President Yoon Suk Yeol’s abrupt martial law declaration in early December.

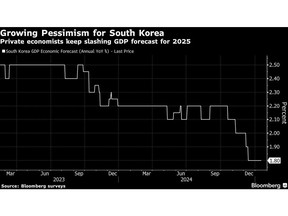

The central bank cut its growth forecast for this year on Monday amid concerns over the impact of the domestic political turbulence, the outlook for global trade and weakening overseas chip demand.

Article content

The early trade report showed that exports to China unadjusted for working days fell 4.9% from a year earlier, while those to the US decreased 9.6%. Semiconductor exports increased 19.2% and automobile shipments declined 7.3%.

Semiconductors form the biggest driving force behind South Korea’s exports. The country is home to two of the world’s biggest memory-chip makers, Samsung Electronics and SK Hynix, exporting advanced semiconductors to US companies like Nvidia. But Korea’s chipmakers also face restrictions on some exports to China as Washington seeks to prevent Beijing from acquiring state-of-the-art devices needed to fuel artificial intelligence development.

Other South Korean companies are widely embedded across global supply chains, including automobiles, rechargeable batteries, shipbuilding and refined oil.

South Korea is considering increasing its imports of US energy should trade imbalances between the two countries emerge as an issue with Washington. Trump’s promises of protectionist policies include slashing a burgeoning US trade deficit with other nations.

(Updates with more details from report)

Share this article in your social network