Article content

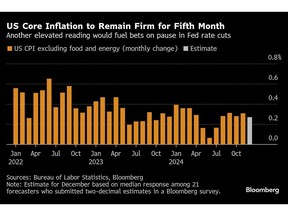

(Bloomberg) — Forecasters expect a monthly report on US consumer prices to show a fifth month of firm increases, bolstering the case for an extended pause in Federal Reserve interest-rate cuts.

Forecasters expect a monthly report on US consumer prices to show a fifth month of firm increases, bolstering the case for an extended pause in Federal Reserve interest-rate cuts.

(Bloomberg) — Forecasters expect a monthly report on US consumer prices to show a fifth month of firm increases, bolstering the case for an extended pause in Federal Reserve interest-rate cuts.

Article content

Article content

The so-called core consumer price index, which excludes food and energy, is seen rising 0.3% in December alongside a 0.4% advance in the overall index, according to the median estimates in a Bloomberg survey. The CPI report is scheduled to be published Wednesday by the Bureau of Labor Statistics.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

Wednesday’s figures come at a critical time for investors and policymakers, with the yield on 10-year Treasury notes up more than half a percentage point amid renewed inflation fears since last month’s CPI release on Dec. 11. And the median expectation for a 0.3% increase in the core measure conceals a more contentious split among forecasters, with 39 in Bloomberg’s survey at the median and 32 projecting a more benign 0.2% rise.

“December’s CPI report will likely feed concern that progress on disinflation has stalled,” Bloomberg economists Anna Wong and Chris G. Collins said in a Jan. 14 preview of the numbers. “Market chatter is focused on whether the 10-year Treasury yield could breach 5%. The combination of a firm CPI print and other macro data we expect this week suggest that’s a real possibility.”

Here are the key components to watch in the report:

Rents

Two of the most important components of the CPI — owners’ equivalent rent and rent of primary residence — rose in November at the slowest pace since early 2021, feeding anticipation that a long-awaited deceleration is finally well under way. The numbers have been volatile throughout 2024, and most analysts have penciled in somewhat higher readings for December, but the magnitude could ultimately decide where the broader core index lands.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

“We expect both rents of primary residence and OER to accelerate, but to remain below the underlying trend this year,” economists at Morgan Stanley led by Diego Anzoategui said in a Jan. 8 note previewing the report. “It is not our modal forecast, but December’s core CPI print could round to 0.2%. A weaker rebound in rents or car insurance could easily move core CPI below 0.25%.”

Travel

Categories associated with travel — like lodging away from home, airline fares and food away from home — are often viewed as proxies for underlying consumer demand and have generally logged robust price increases in recent months.

Analysts are split on the outlook for hotel rates in particular after the lodging away from home category rose 3.2% in November, the fastest monthly pace in over two years. Some expect outright declines in December and others, like Pantheon Macroeconomics Chief US Economist Samuel Tombs, are penciling in another solid increase.

“Travel hit record highs over the holidays; December airline passenger numbers were 10% above their 2019 level,” Tombs said in a Jan. 14 note. “In addition, average rates for hotel rooms rose by 2.8% in unadjusted terms in December, well above the 0.3% average increase in the previous three Decembers, according to STR Inc data.”

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Furnishings

Following outsize price declines near the end of 2023, the pace of deflation in commodities less food, energy and used cars and trucks — so-called “core goods” — slowed in 2024. In November, they rose by 0.1%, thanks in particular to a 0.7% jump in household furnishings and supplies.

Fed officials will probably be looking at core goods for clues about the broader inflation trajectory amid concerns about the impact of the incoming Trump administration’s policy proposals, according to Skanda Amarnath, the executive director of Employ America.

“To the extent tariff uncertainties manifest through anticipatory behavior, it’s plausible that price increases emerge ahead of policy announcements,” Amarnath said in a Jan. 13 note. “If core goods upside from November replicates, we will be highly cautious about the outlook for further rate cuts.”

Article content

Share this article in your social network