UNDER-pressure Rachel Reeves was given a glimmer of hope as inflation fell — raising interest rate cut hopes.

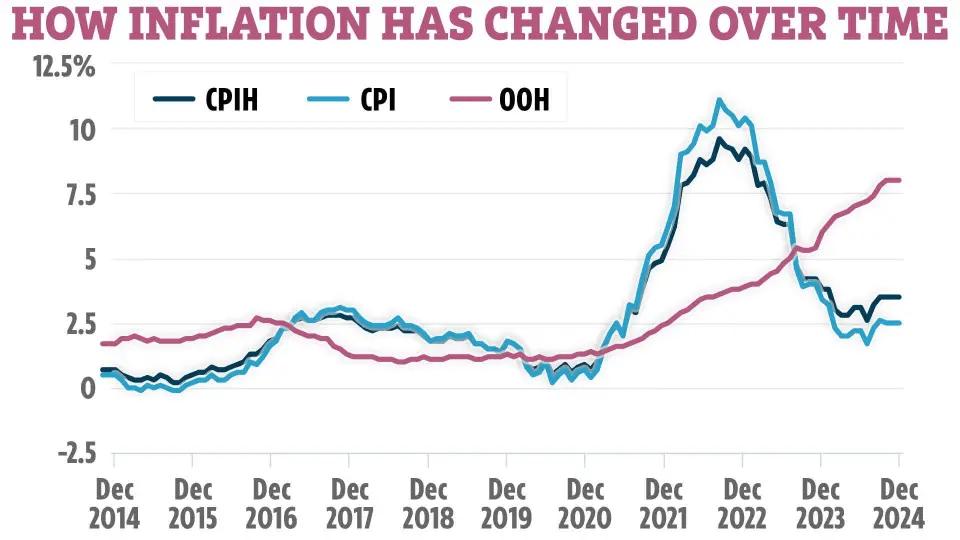

The Chancellor saw inflation sink 0.1 per cent to 2.5 per cent in December, the drop defying expectations.

Contributory factors included lower hotel prices and slower air fare rises, say City analysts.

Many reckon the Bank of England will now cut interest rates by 0.25 to 4.5 per cent in February, boosting homeowners.

A second fall is expected at the end of the year.

Experts warned, however, that the Chancellor’s relief would be short-lived.

Retailers have warned that prices will go up to cover costs imposed on them in her Autumn Budget.

The British Retail Consortium has warned food inflation could hit 4.2 per cent this year.

Economists also pointed to a rise in oil prices which could lead to higher pump prices.

PM Sir Keir Starmer refused to rule out more tax rises this year after Tory leader Kemi Badenoch said the Government had ignored warnings about a borrowing and tax spree.

Ms Reeves agreed yesterday that there was “work to be done” to help families with the cost of living.

The Chancellor will meet regulators today, among them Ofcom and Ofgem, to discuss how best to cut red tape.

She said: “Growth is the number one mission of this Government so we can put more money in people’s pockets and help fund our public services.

“That can only happen if we tackle barriers to investment.”

Lower inflation eases one big worry

By Ashley Armstrong, Business Editor

IF you’re looking to buy a house or remortgage circle February 6 in your diary as the Bank of England is very likely to cut rates for the third time on that date.

Lower inflation eases one big worry for the Bank while it turns its attention to the loud warnings of a slowdown in the jobs market.

Keeping rates high again would kibosh hiring hopes and strangle growth.

The market flip-flops on how many more cuts there may be but the money is on next month being the first of 2025.