Article content

(Bloomberg) — Follow Bloomberg India on WhatsApp for exclusive content and analysis on what billionaires, businesses and markets are doing. Sign up here.

Shares of Indian IT outsourcing giants Infosys Ltd., HCL Technologies Ltd. and Wipro Ltd. got a boost from Donald Trump’s US election win. They will get a chance to comment on how his presidency might affect their businesses when they post earnings.

(Bloomberg) — Follow Bloomberg India on WhatsApp for exclusive content and analysis on what billionaires, businesses and markets are doing. Sign up here.

Article content

Article content

Shares of Indian IT outsourcing giants Infosys Ltd., HCL Technologies Ltd. and Wipro Ltd. got a boost from Donald Trump’s US election win. They will get a chance to comment on how his presidency might affect their businesses when they post earnings.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

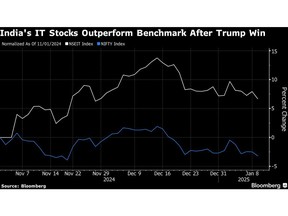

Overall, investors appear to view the incoming administration favorably for the sector, as the NSE Nifty IT Index has outperformed the broader market since the election. The president-elect’s promised tax cuts may result in businesses boosting technology expenditure. On the other hand, “America First” policies may discourage outsourcing, which the Indian companies depend on.

“While the rate-cutting cycle has begun and uncertainty of US presidential election is over, their impact on demand improvement is likely to be visible earliest in the upcoming budget cycle of clients” in January-February, analysts at Nomura said in a note.

US-listed peer Accenture Plc raising its revenue outlook last month showed greater deal flow from widespread generative-artificial intelligence adoption. Net hiring in the Indian IT sector also turned positive in the July-September quarter, analysts at PL Capital said, suggesting companies were preparing for better order inflows. Rival Tata Consultancy Services Ltd. on Thursday offered some optimism on increasing client spends despite profit undershooting estimates.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

Avenue Supermarts Ltd. on Saturday reported profit that missed estimates amid competition from e-commerce companies. The Indian retailer also appointed Unilever veteran Anshul Asawa to replace CEO Ignatius Navil Noronha in February 2026.

Further east, Taiwan Semiconductor Manufacturing Co. may also need to address geopolitical risks such as potential US tariffs or restrictions affecting its China business, Morgan Stanley said.

Country Garden Holdings Co. will post earnings for full-year 2023 and the first half of 2024 after delays. The distressed developer earlier proposed new terms with key banks to slash debt and borrowing costs, aiming to reduce debt by up to $11.6 billion. But a key bondholder group, which holds over 30% of the company’s outstanding notes, has not been on board with the restructuring terms.

Highlights to look out for:

Monday: HCL Technologies’ (HCLT IN) software business should power sequential growth as the IT business suffered from seasonal furloughs. Analysts at Nuvama expect the company to upgrade its full-year services revenue forecast to 4% to 5%, from 3.5% to 5% earlier.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Tuesday: Country Garden (2007 HK) likely recorded further losses in delayed full-year 2023. It reached an understanding with a coordination committee, which comprises seven banks that are long-term business partners of the group for its restructuring. The embattled developer is relying on a turnaround in sales to reassure debt holders, although it also expects fewer home completions this year.

Thursday: Infosys’ (INFO IN) constant-currency revenue growth probably reached 6.3% thanks to the financial services segment, which saw better discretionary outlays, Bloomberg Intelligence said. A less severe effect from seasonal furloughs may help margins expand from a year ago. Moneycontrol reported the company had deferred annual salary hikes to the January-March quarter. PL Capital expects Infosys to marginally raise full-year revenue guidance.

Friday: Wipro (WPRO IN) is projected to post little-changed revenue because of weakness in the Americas and furloughs. Strategic initiatives from Wipro’s new management will be in focus, analysts at Motilal Oswal said.

—With assistance from Charlotte Yang.

(Updates throughout.)

Article content

Share this article in your social network