Article content

(Bloomberg) — Underlying US inflation probably cooled only a touch at the close of 2024 against a backdrop of a resilient job market and steadfast economy, supporting the Federal Reserve’s go-slow approach to further rate cuts.

Underlying US inflation probably cooled only a touch at the close of 2024 against a backdrop of a resilient job market and steadfast economy, supporting the Federal Reserve’s go-slow approach to further rate cuts.

(Bloomberg) — Underlying US inflation probably cooled only a touch at the close of 2024 against a backdrop of a resilient job market and steadfast economy, supporting the Federal Reserve’s go-slow approach to further rate cuts.

Article content

Article content

The consumer price index excluding food and energy is seen rising 0.2% in December after four straight months of 0.3% increases, according to the median projection in a Bloomberg survey of economists. The core CPI, a better snapshot of underlying inflation, is forecast to have risen 3.3% from a year earlier — matching readings from the prior three months.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

The annual figure suggests progress toward tamer inflation has essentially stalled, at a time when the labor market and demand show scant signs of distress. Employers added more than a quarter million jobs in December, well above forecasts, and the unemployment rate unexpectedly fell, according to government data released on Friday.

The jobs figures were followed by a consumer survey that showed a spike in long-term inflation expectations. Some 22% of those polled by the University of Michigan reported that buying big-ticket goods now would enable them to avoid future price hikes — a share that matches the largest since 1990.

Economists at some of the biggest US banks pared their forecasts for more rate reductions after the jobs report. Fed officials in December indicated that they’d only lower their benchmark twice in 2025, a less aggressive outlook than they had in September, and recent comments suggest even more restraint.

What Bloomberg Economics Says:

“Recent FOMC communications indicate several members see the disinflation process as temporarily stalled, or see risks that it could. December’s CPI report is likely to support the view that it has indeed stalled, adding to the case for a careful approach to monetary-policy decisions in coming quarters.”

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

— Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou & Chris G. Collins, economists. For full analysis, click here

According to economists at Morgan Stanley & Co., recent momentum in the economy can be chalked up to elevated household net worth, pent-up spending on automobiles, and wage growth that’s outpacing inflation.

Wednesday’s CPI report will be followed a day later by December retail sales numbers, which are expected to confirm robust spending during the holiday season.

Meantime, Fed data on Friday may indicate manufacturing is stabilizing, albeit at a depressed level. Economists project a 0.2% gain in December factory output, in line with November’s advance — the first back-to-back increase since February-March.

In Canada, US President-elect Trump’s threatened tariffs will be the overriding focus, with outgoing Prime Minister Justin Trudeau convening provincial premiers to discuss responses and Energy Minister Jonathan Wilkinson visiting Washington in a last-ditch bid to avert the crisis.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Elsewhere, UK inflation data will draw attention after a week of market ructions, while China and Germany release economic growth numbers.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Asia

The week brings trade figures from across the region, providing a snapshot of commerce at the end of 2024 before any potential tariffs are announced by the US. The flow of data from China continues, with key economic readings including gross domestic product late in the week.

The region’s biggest economy will be the main focus, kicking off with trade balance and export data for December, with analysts expecting to see activity remaining firm as global customers placed orders ahead of potential US levies.

India, Indonesia and Singapore also release trade figures, while South Korea supplies trade price data which should provide an indication of demand.

In central banking, South Korea officials are expected to cut the main lending rate for the third time in a row. The economic outlook there has dimmed amid political turmoil, slowing domestic demand and expectations of a slide in exports, which drive growth.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Bank of Japan Deputy Governor Ryozo Himino speaks Tuesday, and wages rising at the fastest pace in three decades could clear the way for further rate hikes. Indonesia’s central bank also announces its latest rate decision after holding at the prior meeting.

China caps the week with a slew of data. Home prices likely continued their slide — though perhaps at a slower pace. Industrial production probably held firm and retail sales accelerated on the back of stimulus measures. GDP is set to show the economy managed to hit the “around 5%” annual growth target for 2024, something President Xi Jinping already announced at the end of December.

Amid the deluge, Australia releases a number of labor market figures and joins Thailand in providing a look at consumer confidence. Malaysia reports advance GDP, which is expected to show a slower fourth quarter. And Indian consumer prices are seen weakening slightly.

Europe, Middle East, Africa

The UK will take the spotlight again after a week when a global bond selloff threatened to upend the Labour government’s whole approach to the public finances.

Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Article content

With consumer-price gains deemed by investors to be persistent, data for December on Wednesday will draw attention. Inflation probably accelerated slightly further above the Bank of England’s 2% goal, to 2.7%, though the gauge focusing on services may show slowing.

Given the market backdrop, any BOE remarks will be closely monitored. Deputy Governor Sarah Breeden is scheduled to speak on Tuesday with fellow policymaker Alan Taylor on the calendar for the following day.

In Europe’s other current fiscal hotspot, France, Prime Minister Francois Bayrou will lay out his policy agenda to parliament on Tuesday, including details on the budget.

Data on Wednesday in Germany will probably confirm a second consecutive annual contraction in 2024. It’s also the first hint from within the G-7 of its performance in the final quarter of the year.

Euro-zone numbers include industrial production on Wednesday and a final reading of inflation on Friday. A few European Central Bank appearances are scheduled, including Vice President Luis de Guindos and chief economist Philip Lane, while the account of the Dec. 11-12 monetary-policy meeting is down for Thursday.

Advertisement 7

This advertisement has not loaded yet, but your article continues below.

Article content

Two rate decisions are scheduled:

Further afield, several consumer-price reports will be published on Wednesday:

Advertisement 8

This advertisement has not loaded yet, but your article continues below.

Article content

Latin America

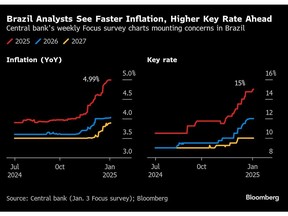

Brazilian inflation and rate expectations will likely push higher in the central bank’s weekly survey. Local analysts have marked up their year-end 2025 forecasts for the two metrics by 40 basis points and 150 basis points, respectively, in just four weeks.

Markets are pricing in a year-end key rate that’s roughly 100 basis points higher than economists. The central bank next meets Jan. 28-29.

The week also sees Argentina release December inflation data that’s expected to show the annual print slowing for an eighth month to just under 120%, after peaking at almost 290% in April. Economists surveyed by the central bank see it ending 2025 at 25.9% before declining further to 15.3% in 2026 and 10% in 2027.

With the December monthly inflation figure likely in line with previous months, President Javier Milei has vowed to slow the pace of the peso’s crawling peg to 1% a month from 2%.

Brazil’s piping-hot economy looks to finally be cooling under the weight of tight financial conditions, with the central bank expected to push borrowing costs up higher still.

Month-on-month GDP-proxy figures for November may turn negative as the year-on-year reading drops from October’s 7.31% pace.

—With assistance from Katia Dmitrieva, Laura Dhillon Kane, Vince Golle, Monique Vanek, Robert Jameson, Piotr Skolimowski, Paul Wallace and Greg Sullivan.

Article content

Share this article in your social network