Jan. 11 (UPI) — Americans can begin filing their federal income taxes with the IRS starting on Jan. 27.

The agency announced the date Friday.

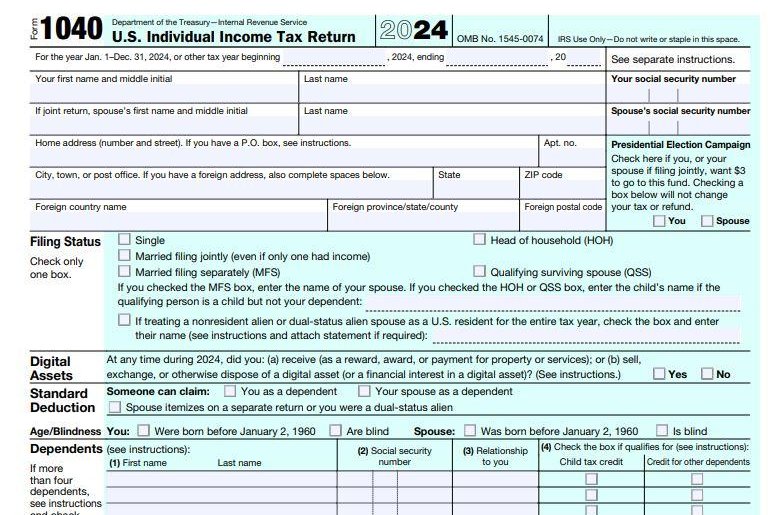

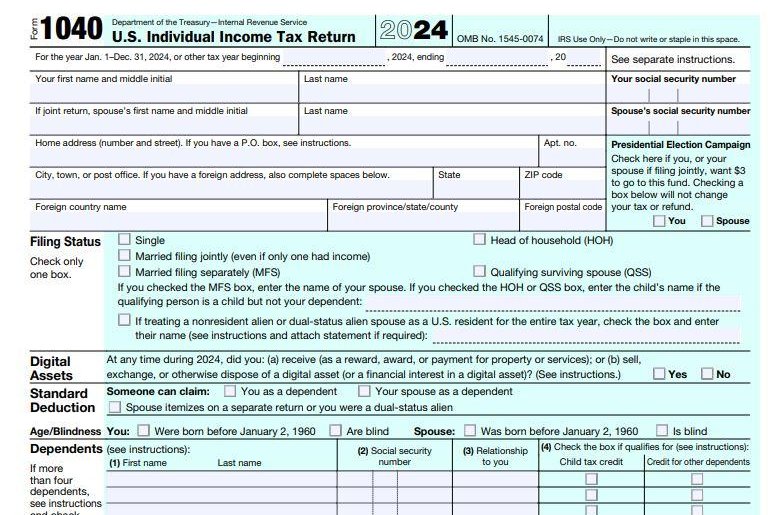

Americans can begin filing their federal income taxes with the IRS starting on Jan. 27. Image courtesy IRS

Jan. 11 (UPI) — Americans can begin filing their federal income taxes with the IRS starting on Jan. 27. The agency announced the date Friday.

“This has been a historic period of improvement for the IRS, and people will see additional tools and features to help them with filing their taxes this tax season,” IRS Commissioner Danny Werfel said in a news release. “These taxpayer-focused improvements we’ve done so far are important, but they are just the beginning of what the IRS needs to do. More can be done with continued investment in the nation’s tax system.”

The filing deadline is April 15 to avoid penalties and interest. But there is more time with people affected by natural disasters, including the wildfires in Southern California. Their date is Oct. 15.

Also people can file Form 4968 for an extension until Oct. 15 but they must pay their estimated taxes by April 15.

The Direct File program will open to eligible taxpayers in 25 states, also on Jan. 27. It taxpayers the option to file their federal tax return online for free – directly with the IRS.

The IRS Free File program opened Friday. Available on IRS.gov, IRS Free File Guided Tax Software provides taxpayers nationwide access to free software tools offered by trusted IRS Free File partners.

The IRS expects more than 140 million individual tax returns for tax year 2024.

The agency is beefing up its customer support.

“he past two filing seasons saw levels of service at roughly 85% and wait times averaging less than 5 minutes on the main phone lines, as well as significant increases in the number of taxpayers served at Taxpayer Assistance Centers across the country,” the IRS said in a news release.

The IRS says most refunds should be issued in less than 21 calendar days. Within 24 hours e-filing returns, taxpayers can use Where’s My Refund? to check the status.