Article content

(Bloomberg) — A looming election, unemployment edging higher and an automotive industry in crisis may not seem like a recipe for German corporate success this year, but a look at earnings projections tells a different story.

A looming election, unemployment edging higher and an automotive industry in crisis may not seem like a recipe for German corporate success this year, but a look at earnings projections tells a different story.

(Bloomberg) — A looming election, unemployment edging higher and an automotive industry in crisis may not seem like a recipe for German corporate success this year, but a look at earnings projections tells a different story.

Article content

Article content

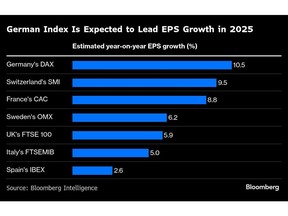

The companies that make up the DAX Index are expected to deliver earnings per share growth of more than 10% in 2025, the highest among European peers, data compiled by Bloomberg Intelligence show. The 40-member gauge, which includes carmakers BMW AG, Mercedes-Benz Group AG and Volkswagen AG, is the only European benchmark seen delivering a double-digit increase, more than the 7.1% average anticipated for the broader Stoxx Europe 600 and ahead of the 8.8% expected for France’s CAC 40.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

Some caveats apply, according to BI equity strategists Kaidi Meng and Laurent Douillet. Much of the growth will depend on a rebound in economically sensitive cyclical sectors, and — crucially — Germany’s beleaguered auto industry, which may not materialize until the second half, said Douillet.

“That’s not guaranteed,” they said, pointing to risks including their high exposure to China, a snap election in February that could alter the domestic political landscape, and the advent of potential US tariffs under Donald Trump, who’s set to be inaugurated as president on Jan. 20.

Auto companies will probably deploy some “kitchen sinking in 2024 accounts, which will make the earnings comparison base easier for this year,” said Douillet, who predicts lender Deutsche Bank AG, engineering giant Siemens AG, software maker SAP SE, sports gear maker Adidas AG and luxury carmaker Porsche AG will likely deliver the lion’s share of the growth. Many uncertainties remain, he said.

“Longer term, Germany’s GDP faces the risk of another year of contraction, so clarity of government leadership and a commitment to fiscal expansion will be critical to reviving the slowing economy and the DAX’s valuation.”

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

The Feb. 23 election may usher in a new government after Chancellor Olaf Scholz pulled the plug in November on a three-way coalition led by his Social Democrats. The conservative CDU-CSU bloc leads polling with almost 33% voter support, according to the latest Bloomberg tally. The far-right Alternative for Germany party, or AfD, is in second place with 18%, with the Social Democrats trailing third on 16%.

Politicians have so far failed to come up with answers to reviving Germany’s faltering economy, which the Bundesbank predicts will barely grow in 2025 after shrinking last year, according to its latest forecasts.

A wild card is if the elections “offer some potential for the relaxation of the debt rule,” said JP Morgan analyst Sophie Warrick in a Dec. 12 note, referring to Germany’s self-imposed borrowing limit, dubbed the “debt brake.”

A higher-spending, pro-growth policy government in Berlin would be a positive surprise, said analysts at Barclays in a Dec. 4 note.

Hopes that struggling sectors might rebound after a difficult 2024 mirror similar expectations playing out across the broader European equities market, which still lags the US. While the Euro Stoxx 50 Index could show earnings growth of 7.5%, after a 4% decline last year, that would require a recovery in cyclical sectors like consumer discretionary, energy and technology and continued growth in industrials and financials, BI’s Meng and Douillet said.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

“In terms of economic growth, Europe – and particularly its Franco-German heart – is currently and will remain in 2025 the weakest link,” Oddo BHF strategists led by Thomas Zlowodzki wrote in a Dec. 10 note.

Some analysts have begun to dial down their European earnings growth expectations for 2025.

“We believe that Eurozone equities will continue to struggle, both in absolute and relative terms, for a while longer,” said JP Morgan’s Warrick. “On the positive side, valuations and positioning are already depressed, and this could usher in some rebound once tariff risks, earnings risks and geopolitical risks are digested.”

—With assistance from Michael Msika.

Article content

Share this article in your social network