Article content

(Bloomberg) — China’s ironclad grip on the onshore yuan is leading to an unintended side effect that would hinder its push to reinvigorate the economy — exporters’ weakened competitiveness.

China’s ironclad grip on the onshore yuan is leading to an unintended side effect that would hinder its push to reinvigorate the economy — exporters’ weakened competitiveness.

(Bloomberg) — China’s ironclad grip on the onshore yuan is leading to an unintended side effect that would hinder its push to reinvigorate the economy — exporters’ weakened competitiveness.

Article content

Article content

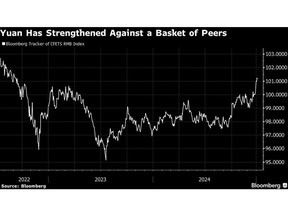

In a potential pitfall for exporters, the yuan has surged to the strongest level since October 2022 versus a basket of trading partners’ exchange rates, including the won and euro, according to a Bloomberg tracker of the CFETS Index. The outperformance came as the People’s Bank of China put a floor under the onshore yuan at 7.3 per dollar since December amid a rebound in the greenback.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

China’s active currency defense bodes well for the nation’s assets and beleaguered currencies in Asia, but more challenges for exporters — already facing US President-elect Donald Trump’s tariff-hike threats — could lead to tepid earnings that may stymie a meaningful recovery. Adopting a rigid FX strategy by drawing a red line is also controversial, as artificial stability in the market may lead to outbursts of volatility in the future.

“One of the ways monetary policy easing works is through a weaker exchange rate,” said Alvin T. Tan, head of FX strategy at the Royal Bank of Canada in Singapore. “So if the exchange rate is rising instead, it means less effective monetary policy easing, which complicates China’s efforts to improve its economic outlook.”

The PBOC’s steady fixing has helped in pushing down the onshore yuan’s two-week historic volatility to about 0.6% this week, the lowest since July. But that may mask troubles ahead.

“There will be a spike in volatility once the level breaks,” said Mingze Wu, currency trader at StoneX Financial Pte Ltd.

The yuan remains under depreciation pressure given uncertainties in the Federal Reserve’s interest rate path, Trump’s tariff policy and lingering risks from the Chinese economy, he added.

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

A tumble in the Asian nation’s benchmark yield, which just slid below 1.6% for the first time on record, also led to a wide rate discount to the US. That has also contributed to pressure on the yuan as it undermines the appeal of Chinese assets.

In supporting the yuan, the PBOC has turned to the so-called fixing — which confines the currency’s trading onshore to a 2% range on either side — at 7.1878 per dollar on Friday. That was 1,324 pips stronger than forecast in a Bloomberg survey, the largest difference since July. State banks also have sold dollars occasionally to prevent the yuan’s decline past the level of 7.3.

The calm in China’s foreign exchange market and the authorities’ resolve to maintain the currency red line will soon face tests after Trump returns later this month and works on his vow to raise tariffs on Chinese goods to 60%.

The market’s reading so far is less than sanguine. Chinese stocks posted their worst start to a year in nearly a decade while government bonds rallied. Meanwhile, the dollar remains strong, with its index ending 2024 with six straight days of gains.

The PBOC might loosen grip over the fixing if the dollar keeps rallying or if there is more clarity on Trump’s trade policy plans, Tan said. “I do think the economy weakness should nudge the PBOC to allow for more FX depreciation.”

Article content

Share this article in your social network