Article content

(Bloomberg) — Over the last few years, the US economy has consistently defied expectations for a slowdown, and 2024 was no different.

Over the last few years, the US economy has consistently defied expectations for a slowdown, and 2024 was no different.

(Bloomberg) — Over the last few years, the US economy has consistently defied expectations for a slowdown, and 2024 was no different.

Article content

Article content

Despite uncertainty around a presidential election, elevated interest rates and a cooling labor market, economic growth remained solid this year. The US is set to be the top performer among Group of Seven countries, according to International Monetary Fund projections.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

Still, the economy was far from perfect. Inflation proved slow to recede, leading the Federal Reserve to embrace a higher-for-longer approach to interest rates. The housing and manufacturing sectors continued to struggle under the weight of high borrowing costs, and consumers with credit-card debt, mortgages and other loans saw rising delinquency rates.

Here’s a closer look at how the US economy performed in this year:

Consumers Held Up…

The answer to why the economy exceeded expectations in 2024 is the American consumer. Even as hiring slowed, wage growth continued to outpace inflation and household wealth reached new records, supporting an ongoing expansion in household spending.

Bloomberg Economics forecasters estimate household outlays advanced 2.8% in 2024 — faster than in 2023 and nearly twice their projection at the start of the year.

…But Cracks Emerged…

Though consumers are still holding up, some of the main drivers of that remarkable resilience lost steam this year. Americans have mostly exhausted their pandemic savings and have generally been putting aside a smaller share of their incomes each month.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

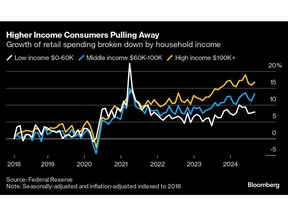

Consumer spending has also been increasingly driven by higher earners who are enjoying a so-called wealth effect from gains in housing prices and the stock market. That’s taking place while many lower-income consumers are relying on credit cards and other loans to support their spending, with some showing signs of financial strain like higher delinquency rates.

…Including in the Labor Market

The main support for consumer spending also began flashing warning signs in 2024. Hiring decelerated throughout the year and the unemployment rate edged higher, triggering a popular recession indicator. Moreover, the number of job openings declined and the unemployed are increasingly having a harder time finding new jobs.

Fed officials began cutting rates in September amid concerns that the job market could be approaching a dangerous tipping point, though they’ve become more optimistic in the final months of the year as the unemployment rate has stabilized around levels that remain low by historical standards. Wage growth, meanwhile, remains steady around 4%, which should keep supporting household finances.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Inflation Progress Stalled

Progress toward the central bank’s 2% inflation target has stalled in recent months following a swift decline in 2023 and additional progress in the first half of 2024. One of the Fed’s preferred inflation metrics — the personal consumption expenditures price index excluding food and energy — rose 2.8% in November from a year ago.

While Fed officials opted to lower rates by a full percentage point this year in an effort to take some pressure off the economy, Chair Jerome Powell has indicated that central bankers need to see more progress on inflation before making additional cuts in 2025.

High Rates Hurt the Housing Market…

The housing market continued to struggle under the weight of higher borrowing costs. Mortgage rates, which fell to a two-year low in September, have been approaching 7% again on expectations that the Fed will take longer to cut. Contractors continued to offer incentives to lure buyers, including so-called mortgage buydowns and payments on their behalf, as well as occasional price cuts.

While sales have stabilized somewhat this year, they remain below pre-pandemic levels. In the resale market — which accounts for a majority of home purchases — the National Association of Realtors anticipates the 2024 sales pace came in even lower than last year, which was already the worst since 1995.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

…And the Manufacturing Sector

The manufacturing sector was another victim of elevated borrowing costs. Investment in new structures was hindered by high rates and weaker demand abroad, and many firms shed jobs in an effort to save costs. Durable goods manufacturers subtracted from payrolls in all but one month this year.

President-elect Donald Trump’s economic agenda could also weigh on the sector in 2025. Though Trump has promised to boost domestic manufacturing, some economists and business groups anticipate his plans to impose higher tariffs, deport millions of immigrants and cut taxes could push up inflation and constrain the labor market, as well as disrupt supply chains. Capital spending by US manufacturers is seen rising at a tepid pace next year amid that uncertainty.

Article content

Share this article in your social network