Article content

(Bloomberg) — Germany’s Gerhardi Kunststofftechnik GmbH weathered Napoleon’s invasion, the Great Depression and two world wars. But Europe’s current auto slump has brought the plastics manufacturer to its knees.

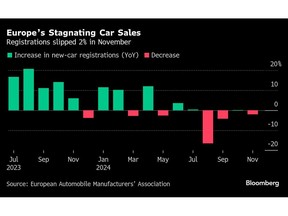

Germany’s Gerhardi Kunststofftechnik GmbH weathered Napoleon’s invasion, the Great Depression and two world wars. But Europe’s current auto slump has brought the plastics manufacturer to its knees.

(Bloomberg) — Germany’s Gerhardi Kunststofftechnik GmbH weathered Napoleon’s invasion, the Great Depression and two world wars. But Europe’s current auto slump has brought the plastics manufacturer to its knees.

Article content

Article content

Founded in 1796, Gerhardi started out making metal products before riding Germany’s postwar automotive boom. Its mastery of injection molding and hot stamping made it a trusted supplier of grills, handles and chrome trims for Mercedes-Benz Group AG. But last month, after a protracted period of rising costs and withering demand, the company filed for bankruptcy, plunging its 1,500 employees into an uncertain future.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

Gerhardi — which makes the plastic star mounted on the grill of Mercedes sedans — is one of hundreds of small manufacturers in Europe’s automotive supply chain that are struggling to stay afloat as carmakers slash production to cope with weak sales and a rocky transition to electric vehicles. With painful cuts planned at Volkswagen AG, Stellantis NV and Ford Motor Co., their situation could get worse.

France’s Forvia SE, which makes components for Stellantis and Volkswagen, is cutting thousands of jobs as the shift to EVs makes traditional products like transmissions and exhaust systems obsolete. But suppliers linked to EVs — like Swedish battery maker Northvolt AB — are also sufffering after governments pulled back subsidies and sales cratered.

This year, European parts makers have announced 53,300 job cuts, most of which in Germany, according to the CLEPA industry lobby. That’s more than during the coronavirus pandemic, when factories and showrooms shuttered for months. And with the continent’s high energy prices, red tape and the threat of worsening trade ties with the US, next year looks similarly grim, said Matthias Zink, the group’s president.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

“It’s a perfect storm,” Zink said in an interview. “Companies have invested heavily in anticipation of a surge in electric vehicle sales that hasn’t happened.”

Automotive suppliers employ around 1.7 million workers across the European Union and spend some €30 billion ($31.2 billion) each year on research and development. They range from large conglomerates like Germany’s Robert Bosch GmbH to the hundreds of smaller hidden champions that are often the economic backbone of their communities.

According to consulting firm McKinsey, one in five auto suppliers expects to lose money next year after two-thirds reported margins of 5% or less in 2024.

The slowdown in EV demand is squeezing companies that have retooled production to serve what they expected to be a steadily growing segment. Germany’s Webasto SE, which makes parts including car roofs and heating systems, is facing a potential restructuring of more than €1 billion in debt after spending heavily on new products. And while Northvolt’s US bankruptcy filing has been the most high-profile setback, the fallout is spreading, with 11 out of 16 planned European-led battery factories delayed or canceled, according to a Bloomberg News analysis.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

“The automotive industry is one of the most disrupted sectors in the world,” said Andrew Bergbaum, global co-head of the Automotive & Industrial Practice at AlixPartners. “Manufacturers are slowing down and stopping production lines, which is having a profound impact on the supply base.”

In Friedrichshafen, southern Germany, a Zeppelin bearing ZF Friedrichshafen’s name — a major manufacturer of car transmissions that aren’t needed in an EV — regularly drifts overhead. As the town’s largest employer, ZF supports a range of local businesses from logistics firms to bakeries and restaurants. That’s all been put at risk by the company’s plan to slash its German workforce almost in half, to 14,000 people.

“Numerous suppliers and the entire retail and service structure depend directly or indirectly on the company overcoming the crisis and being securely positioned for the future,” the local branch of union IG Metall said.

In Italy, Stellantis’ decision to halt production at its Mirafiori plant are rippling through the supply chain. Stellantis has had to repeatedly halt output of the Fiat 500’s electric version it introduced four years ago as customers balked at its high price tag. To go electric, buyers need to fork over more than twice the cost of the larger Dacia Sandero, a combustion-engine vehicle that’s becoming more popular with cash-strapped households.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Delgrosso, a manufacturer of filters that supplies the Fiat factory, went under earlier this year, laying off hundreds of workers. CLN-Coils Lamiere Nastri SpA, which makes wheels and steel body parts for Stellantis, is working with PricewaterhouseCoopers on a restructuring plan because of the shutdown. Manufacturers of electronics to die-casting parts have resorted to Italy’s version of furloughs as orders dry up.

To reverse their fortunes, suppliers depend on a rebound in the car market, which doesn’t appear imminent. Ford Motor Co. announced plans last month to cut an additional 4,000 jobs in the region, while Volkswagen is in the midst of an historic restructuring its namesake brand to cope with intensifying competition and high costs.

“It is deeply troubling,” Marco Gay, president of the Industrial Union of Turin said in an interview, referring to the struggles facing suppliers hit by the disruptions at Mirafiori. “We are at high risk of losing something that has brought jobs, prestige and shaped the history of our region.”

—With assistance from Albertina Torsoli.

Article content

Share this article in your social network