Article content

(Bloomberg) — The dollar fell and Bitcoin’s rally stalled as traders viewed Donald Trump’s pick of Scott Bessent for Treasury Secretary as a measured choice, tempering some of the more fevered bets spurred by the president-elect’s victory.

The greenback declined against major peers with the Aussie and euro leading gains, while Bitcoin fell below $97,000 before paring losses. Australian shares and US equity futures climbed, with futures in Japan also pointing to an early gain. Contracts in Hong Kong were steady.

Article content

The moves indicate elements of the so-called Trump Trade are cooling after the incoming president named Bessent, who runs macro hedge fund Key Square Group, to oversee the US government debt market, tax collection and economic sanctions. While Bessent indicated he’ll back Trump’s tariff and tax cut plans, investors expect he will prioritize economic and market stability over scoring political points.

“He brings this sense of almost gradualism to the administration as opposed to taking a big bang approach to making big policy changes,” Brian Jacobsen, chief economist at Annex Wealth Management, said on Bloomberg TV. Markets may be relieved that the pick signals “an ‘America First’ kind of administration but not an ‘America Exclusively’ kind of administration,” he said.

Bessent’s nomination may ease some concerns over Trump’s impact on other countries’ economies and currencies around the world.

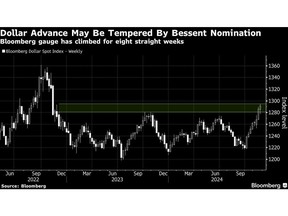

The dollar has now climbed for eight straight weeks, the longest advance in more than a year, as traders continued to price Trump’s fiscal policies including sweeping trade tariffs and persistent economic growth. The euro fell to a two-year low and the Swiss franc slid to the weakest against the greenback since July as speculative investors turned the most bullish on the dollar since late June.

Article content

US stocks rose on Friday, with the S&P 500 gaining 0.4% as beneficiaries of the incoming administration’s looser regulation and business-friendly stance climbed. The Treasury curve flattened, with yields on 2-year notes climbing after strong US business activity data. Benchmark 10-year yields edged lower. Australia’s equivalent fell six basis points in early Monday trading.

Japan, US Data

Oil was steady after the ongoing conflict in Ukraine helped to push West Texas Intermediate crude above $71 a barrel on Friday. Gold was little changed after trading at more than $2,700 an ounce in its best week since March 2023.

This week, traders in Asia will be closely monitoring Japan’s inflation data after Bank of Japan Governor Kazuo Ueda last week indicated the December policy meeting is live. The Reserve Bank of New Zealand is expected to cut its key rate on Wednesday.

Elsewhere, a swath of inflation and growth readings in Europe are due. The Federal Reserve’s November meeting minutes, consumer confidence and personal consumption expenditure data, the central bank’s preferred gauge of inflation, will be closely parsed to help assess the outlook for rate cuts next year.

Article content

“Equity bulls will want to see a healthy bounce in the consumer data, married with a below consensus read on PCE inflation,” said Chris Weston, head of research at Pepperstone Group in Melbourne. “With US swaps now implying a 36% chance of a 25 basis point cut from the Fed on 18 Dec, weaker US data would see pricing for a 25 basis point cut rise back above 50%, which should support equity risk and be a headwind for the US dollar.”

Key events this week:

- Singapore CPI, Monday

- BOE Deputy Governor Clare Lombardelli and rate-setter Swati Dhingra speak, Monday

- ECB chief economist Philip Lane and Governing Council Member Gabriel Makhlouf speak, Monday

- Riksbank Deputy Governor Anna Seim speaks, Tuesday

- US FOMC minutes, new home sales, US Conference Board consumer confidence, Tuesday

- Bank of Canada Deputy Governor Rhys Mendes speaks, Tuesday

- China industrial profits, Wednesday

- New Zealand rate decision, Wednesday

- US PCE, initial jobless claims, GDP, durable goods, Wednesday

- Bank of Australia Governor Michelle Bullock speaks, Thursday

- South Korea rate decision, Thursday

- Eurozone economic confidence, consumer confidence, Thursday

- Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

- Eurozone CPI, Friday

- Bank of England issues financial stability review and policy committee minutes, Friday

- Canada GDP, Friday

Article content

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.4% as of 8:30 a.m. Tokyo time

- Hang Seng futures were little changed

- Australia’s S&P/ASX 200 rose 0.7%

- Nikkei 225 futures rose 0.6%

Currencies

- The euro rose 0.8% to $1.0500

- The Japanese yen rose 0.4% to 154.15 per dollar

- The offshore yuan rose 0.2% to 7.2435 per dollar

- The Australian dollar rose 0.7% to $0.6545

Cryptocurrencies

- Bitcoin rose 1% to $98,009.5

- Ether rose 0.6% to $3,365.62

Bonds

- Australia’s 10-year yield declined six basis points to 4.48%

Commodities

- West Texas Intermediate crude rose 0.1% to $71.34 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

Share this article in your social network