Article content

(Bloomberg) — US bribery charges against Indian billionaire Gautam Adani have ensnared one of Canada’s largest public pension managers, deepening its embarrassment over a renewable-energy investment that went sour.

Three former employees of Caisse de Depot et Placement du Quebec were charged with conspiracy to violate the Foreign Corrupt Practices Act on Wednesday. The list of the accused includes Cyril Cabanes, a former managing director in CDPQ’s Asia-Pacific infrastructure unit, as well as Saurabh Agarwal and Deepak Malhotra, who also worked for the fund manager.

Article content

US prosecutors allege that defendants including Adani, one of the world’s richest people, promised to pay more than $250 million in bribes to Indian government officials to win solar energy contracts, and that they concealed the plan as they sought to raise money from US investors.

The criminal indictment and a related case from the Securities and Exchange Commission allege that executives at Adani Green Energy Ltd. were among those who paid bribes to state officials. Some of the bribes were ultimately paid, at least indirectly, by Azure Power Global Ltd., a builder and operator of solar-power projects that was a partner of Adani Green, according to the SEC.

The regulator’s complaint says that Cabanes “schemed” with others to make those payments possible while he was serving as an employee of CDPQ and a board member of Azure Power.

CDPQ is Azure’s majority shareholder, and Cabanes and Malhotra represented the money manager on the solar company’s board until October 2023, when they resigned.

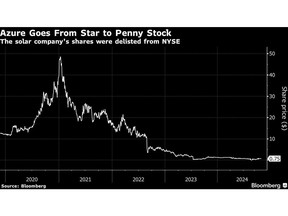

Azure said it’s cooperating with US authorities on the investigation. The shares were delisted from the New York Stock Exchange and now trade over the counter, having lost almost all of their value.

Article content

“CDPQ is aware of charges filed in the US against certain former employees,” a spokesperson for the Quebec pension manager said by email. “Those employees were all terminated in 2023, and CDPQ is cooperating with US authorities.” The spokesperson declined further comment.

Reluctant Governments

Prosecutors claim that executives attached to Adani Green paid or promised the bribes to overcome the reluctance of Indian state governments to sign power purchase agreements — contracts that were essential to making the numbers work on new solar manufacturing projects.

Over a period of many months in 2022 and 2023, Cabanes “routinely strategized” with Azure’s chairman to figure out how to pay Azure’s one-third share of the bribes, the SEC complaint alleges.

Eventually, they landed on a plan that saw Azure give up a lucrative share of a large power project in the southern state of Andhra Pradesh — to the benefit of Adani Green, which gained a bigger stake.

“Cabanes devised and directed a coordinated cover-up of the efforts to compensate Adani Green and the Adanis for the bribery payments or promises,” colluding with others at CDPQ and Azure to conceal their misconduct, the SEC documents claim. Cabanes did not reply to multiple requests for comment from Bloomberg.

Article content

CDPQ, which oversees C$452 billion ($324 billion) on behalf of pension plans and other accounts in Canada’s second-largest province, has made a number of investments in Azure since 2016, boosting its stake to more than 50%. It invested a total of about $480 million, according to calculations made by Bloomberg last year.

“When there’s irregularities from a governance standpoint, the action plan is immediate and ruthless from the Caisse,” Charles Emond, CDPQ’s chief executive officer, said in an interview with Bloomberg News in June 2023.

Although the fund has significant losses on Azure, “the reality is that there is still very good assets underneath. There is a plant, a company that distributes electricity to millions of Indians,” Emond said at the time. “Share price is one thing, value is another one.”

Another Canadian pension manager, the Ontario Municipal Employees Retirement System, is Azure’s No. 2 holder with about 21%, according to data compiled by Bloomberg. Its infrastructure arm bought a stake in Azure for $219 million in a deal announced in July 2021.

Julian Gratiaen, who oversees legal aspects of Omers’ infrastructure assets in Asia, has been on Azure’s board since July. He replaced Delphine Voeltzel, another Omers executive who was on the board from May 2022 until July 2024, according to LinkedIn.

“The allegations in this indictment are concerning,” an Omers spokesperson said. “The events alleged in the formal charges began before we became a minority shareholder in Azure Power in 2021. Omers is not implicated in any of the alleged conduct and will continue to cooperate fully with the investigation.”

Share this article in your social network