Article content

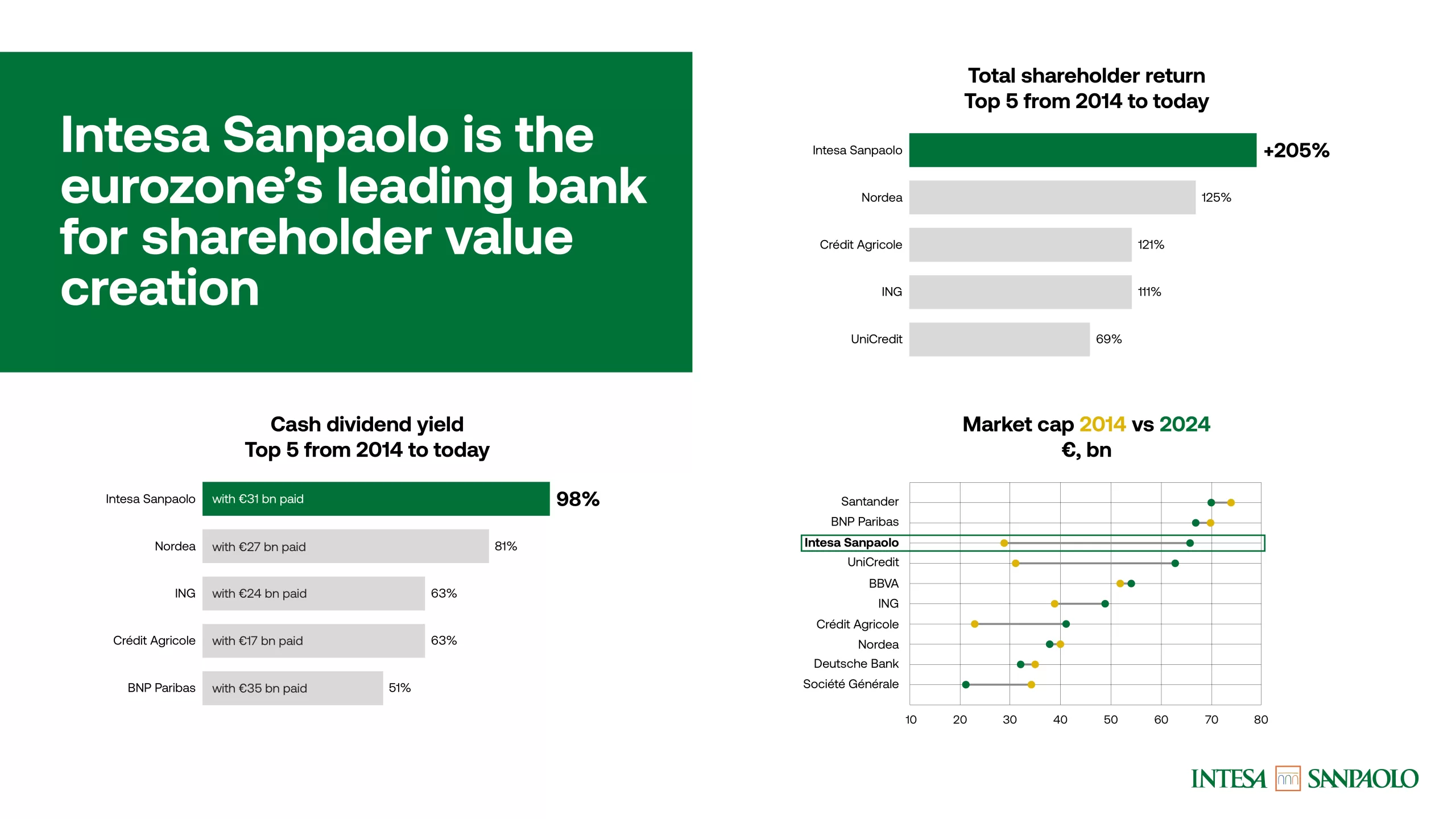

MILAN, Nov. 20, 2024 (GLOBE NEWSWIRE) — With today’s distribution of €3 billion in interim dividends for 2024, Intesa Sanpaolo is the leading bank in the eurozone for total shareholder return, with a remarkable +205% increase. This reflects the combined growth in share value and dividend distributions since 1 January 2014.

Over the past 10 years, under the leadership of Carlo Messina, the bank has:

Article content

- achieved a 107% increase in stock market value, with a €37 billion rise in market capitalization since January 2014;

- distributed €31 billion in dividends to its shareholders, resulting in a cumulative dividend yield of 98%, including the interim dividend paid today.

In comparison with the other leading eurozone banks in terms of market-capitalization, Santander (which raised €15 billion through capital increases) distributed €23 billion in dividends, while BNP Paribas distributed €35 billion, with a cumulative dividend yield of 51%.

Media Relations Intesa Sanpaolo

[email protected]

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b9b3ef4a-725c-4758-8551-8eb897e801fa

Share this article in your social network