Article content

(Bloomberg) — Rising trade frictions pose an additional risk to the euro-area economy and threaten to amplify vulnerabilities in the region’s financial system, the European Central Bank warned.

Macroeconomic risks have shifted from concerns about inflation remaining high to fears over weaker-than-expected growth, the ECB cautioned in its bi-annual Financial Stability Review. Geopolitical uncertainty is further clouding the prospects for the 20-nation bloc.

Article content

At the same time, rising global trade tensions are also “increasing the likelihood of tail events,” Wednesday’s report said. “In a context of elevated macro-financial and geopolitical uncertainty, there could be a sudden sharp reversal in risk sentiment, given high asset valuations and concentrated risk exposures in the financial system.”

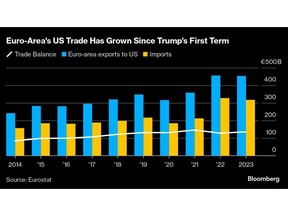

The comments come after the re-election as US president of Donald Trump, who’s threatened to impose a barrage of tariffs on trading partners. Bundesbank President Joachim Nagel cautioned this week that the world is “on the brink of significant escalation” in geo-economic fragmentation.

European policymakers have repeatedly highlighted that Trump’s return to the White House could harm the economy – something that may be taken into account in deciding on the pace and extent of further interest-rate cuts after a likely reduction in December.

“Rising global trade tensions and a possible further strengthening of protectionist tendencies across the world raise concerns about the potential adverse impact on global growth, inflation and asset prices,” the ECB said.

Article content

For Europe, the pace of economic recovery is likely to be slower than expected a few months ago, it added.

An intensification in international friction could lead to greater inflationary pressures or increased volatility in consumer-price growth and central banks may have to react with higher borrowing costs, Nagel said this week.

A further escalation of geopolitical tensions, such as those in the Middle East and Ukraine, “could have a considerable adverse impact on euro area growth − through higher energy and import prices and lower confidence among euro area households and firms − and could pose upside risks to the disinflation process,” the ECB said.

What Bloomberg Economics Says…

US President-elect Donald Trump has threatened to increase tariffs on Chinese goods to 60% and on those from the rest of the world to 20%. We estimate that could take roughly 1% off euro-area GDP — not what the monetary union needs at a time of already meager economic performance.

—David Powell and Maeva Cousin. Click here for full INSIGHT

The report also warned that policy uncertainty, weak fiscal fundamentals in some countries and sluggish potential growth raise concerns about the sustainability of government borrowing.

Article content

“Sovereign-debt service costs are expected to continue rising as maturing debt is rolled over at interest rates that are higher than those on outstanding debt,” it said.

Firms and households could also experience difficulties, though that’s not happening just yet, the ECB said.

“While the overall increase in credit risks has so far been gradual, small and medium-sized companies and lower-income households could face strains if growth slows by more than is currently expected, which could, in turn, adversely affect the asset quality of euro area financial intermediaries,” it said.

(Updates with Bloomberg Economics.)

Share this article in your social network