It took billions of dollars in losses, a company-wide overhaul, cost-cutting and price hikes to get there, but Bob Iger and Walt Disney Co. appear to have reached a long-awaited turning point in the streaming business.

Disney direct-to-consumer operations — a combination of Disney+, Hulu and ESPN+ — have been profitable two straight quarters, helping to drive earnings that topped Wall Street expectations.

The Burbank-based entertainment giant last week said its streaming trifecta produced fiscal fourth quarter operating income of $321 million, swinging from a $387-million loss reported at the same time a year ago. Full-year operating profit for the direct-to-consumer group came in at $134 million, compared with fiscal 2023’s $2.6-billion loss. Disney+ added 4.4 million subscribers to reach 120 million accounts globally in the fourth quarter.

It’s a far cry from just a few months ago, when Iger was the focus of a nasty proxy campaign from activist shareholder Nelson Peltz, the billionaire founder of the investment firm Trian Fund Management. One of Peltz’s demands was that Disney show a realistic plan to achieve Netflix-like profit margins from streaming.

Now, Disney and Iger are showing signs of renewed swagger. The stock is up 25% so far this year, though it still isn’t as high as it was in April, when Iger defeated Peltz in the hedge fund agitator’s quest to win a board seat.

Disney’s fourth quarter earnings were also buoyed by a strong showing from its resurgent film studios, which put out big hits with “Deadpool & Wolverine” and “Inside Out 2.”

In an unusual flex for Disney, the company on Thursday surprised analysts by giving earnings guidance for the next three years. Not just 2025 and 2026, but the following fiscal year as well.

The company is projecting a “double digit” increase in adjusted earnings per share in 2027, as Iger prepares to hand off the baton to a yet-to-be determined successor.

Notably, 2027 is after Iger is expected to exit as chief executive, so the fact that the company is giving his replacement a financial target, however vague, caught several observers’ attention.”We’re not sure the incoming CEO will appreciate having their hands tied in that way,” TD Cowen analyst Doug Creutz wrote in a note to clients.

Disney also must contend with issues that continue to weigh on all legacy media companies, including the volatility of the film business and especially the erosion of traditional TV networks. Fourth-quarter sales from Disney’s linear networks business fell 6% to $2.5 billion, while profits from the unit dropped 38% to $498 million. Revenue at ESPN, reporting under the separate “sports” segment, was up 1% with profit falling 6%.

The company’s parks business, long a huge driver of results, faces an uncertain macroeconomic environment with a new incoming administration, as well as competition from the upcoming Epic Universe park in Florida (which Disney has downplayed). In sports, the company still has to successfully launch its flagship ESPN streaming service next year.

So what’s giving Disney the self-assuredness to give out these targets? Disney executives, speaking on last week’s earnings call, cited several reasons to believe in the company’s forecasts, including steady improvement in the streaming business and considerable investment in experiences such as the parks and cruise lines.

With streaming in particular, Disney was remarkably specific in its guidance for 2026. For example, executives said that Disney+ and Hulu would achieve 10% operating margins by then, excluding the Hulu Live TV streaming offering.

Management highlighted changes and improvements the company is making to its services: anti-password sharing measures, better personalization and customization technology, adding an ESPN tile, etc. All this ought to allow Disney to improve engagement, increase subscriptions, reduce churn, please advertisers and raise prices.

“We wouldn’t have given you the guidance we did if we didn’t have confidence in delivering,” Disney Chief Financial Officer Hugh Johnston said on the call.

Disney’s results are just one sign of a broader rebound for streaming, at least among the top-tier companies. Netflix is making billions of dollars in profit, with a stock market valuation of $362 billion (significantly higher than Disney’s $206-billion market cap). Spotify, the Swedish music and podcast subscription service, recently projected it would reach full year profitability for the first time.

With Disney, there are always risks to point to. The studio, which is having a strong year, has a number of high-stakes bets coming up next year, including multiple Marvel movies (“Captain America: Brave New World,” “Thunderbolts,” “The Fantastic Four: First Steps”) a live action “Snow White” and a nonsequel Pixar film, “Elio.”

But none of that will take up as much investor attention as the ongoing succession process for Iger, which is being led by James P. Gorman, the outgoing executive chairman of Morgan Stanley, who will become chairman of Disney’s board of directors next year.

Disney recently said it would choose a successor in early 2026, which is later than many expected. The Wall Street Journal reported that the search for a replacement had widened beyond the oft-discussed quartet of internal candidates to include outsiders such as the chief executive of video game giant Electronic Arts, Andrew Wilson. Whoever gets the job, the pressure will be high, with or without the company’s earnings projections hanging over them.

Newsletter

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Stuff we wrote

HBO ‘moved on.’ Residents of this small New York town are still fuming about network’s alleged role in a raging fire. HBO’s alleged role in a raging fire on the set of its miniseries “I Know This Much Is True,” starring Mark Ruffalo, still upsets residents of a small New York town who say they’ve been neglected amid finger-pointing over the fire’s cause.

An affordable housing complex for Hollywood workers grapples with tenant complaints. Tenants at the Hollywood Arts Collective are protesting a rent increase and airing other grievances. The complex’s backers and managers deny that they misled residents.

What the new Tiana’s Bayou Adventure ride means for Disneyland. The long-anticipated revamp of Splash Mountain represents a new chapter for the theme park, which faced pressure to shed the racist history of the attraction.

With ‘The Saints,’ Martin Scorsese puts his faith in Fox Nation. Fox News Media’s streaming service has become a home for passion projects from big names with red state appeal, including Scorsese and Kevin Costner.

The year of the ‘lega-sequel’: What ‘Gladiator II’ and ‘Twisters’ say about Hollywood. From ‘Twisters’ to ‘Beetlejuice Beetlejuice,’ decades-later sequels have scored big at the box office. Will ‘Gladiator II’ continue the trend? (Probably.)

How ‘CoComelon’ became a mass media juggernaut for preschoolers. The brightly colored cartoons have become must-watch videos for babies and toddlers. But they’ve also raised questions about what kids should be viewing.

Spotify woos video, podcast creators to better compete with YouTube. Starting in January in the U.S. and other markets, Spotify Premium users will be able to see ad-free videos, and video creators can earn money off those videos.

ICYMI:

TNT’s ‘Inside the NBA’ will move to ESPN

Craig Melvin to succeed Hoda Kotb on ‘Today’

Amazon to shut down Freevee for real this time

Heart layoffs: L.A.’s KFI-AM news division hit hard

Intimacy coordinators to unionize with SAG-AFTRA

Number of the week

60 million

Netflix may be the reigning champion of streaming, but it’s not quite a heavy hitter in live sports yet.

Yes, the streamer got 60 million households to tune in to Friday night’s boxing match between Jake Paul and Mike Tyson, demonstrating that there’s audience appetite for major sporting events on Netflix. That’s encouraging news for Netflix’s growing advertising business. The ad-supported tier recently reached 70 million monthly active users.

But for many viewers, the event was hard to watch, in more ways than one. Viewers encountered technical difficulties, including buffering and poor visuals. It turns out that cable and satellite technology is still hard to beat when it comes to the quality of live broadcasts.

The contest itself was an uncomfortable spectacle, as it became apparent in the early rounds that Tyson, at age 58, did not have a chance of defeating Paul, a 27-year-old YouTube star-turned pro boxer. The company said nearly 50 million homes streamed the evening’s earlier and much more exciting battle between Amanda Serrano and Katie Taylor.

Netflix has much at stake, with two NFL games planned for Christmas Day. Analysts expect Netflix will figure out the technical kinks by then. Beyoncé is set to perform at halftime during the Houston Texans-Baltimore Ravens face-off. Forget football fans — you do not want to face the wrath of the BeyHive after a blurry stream.

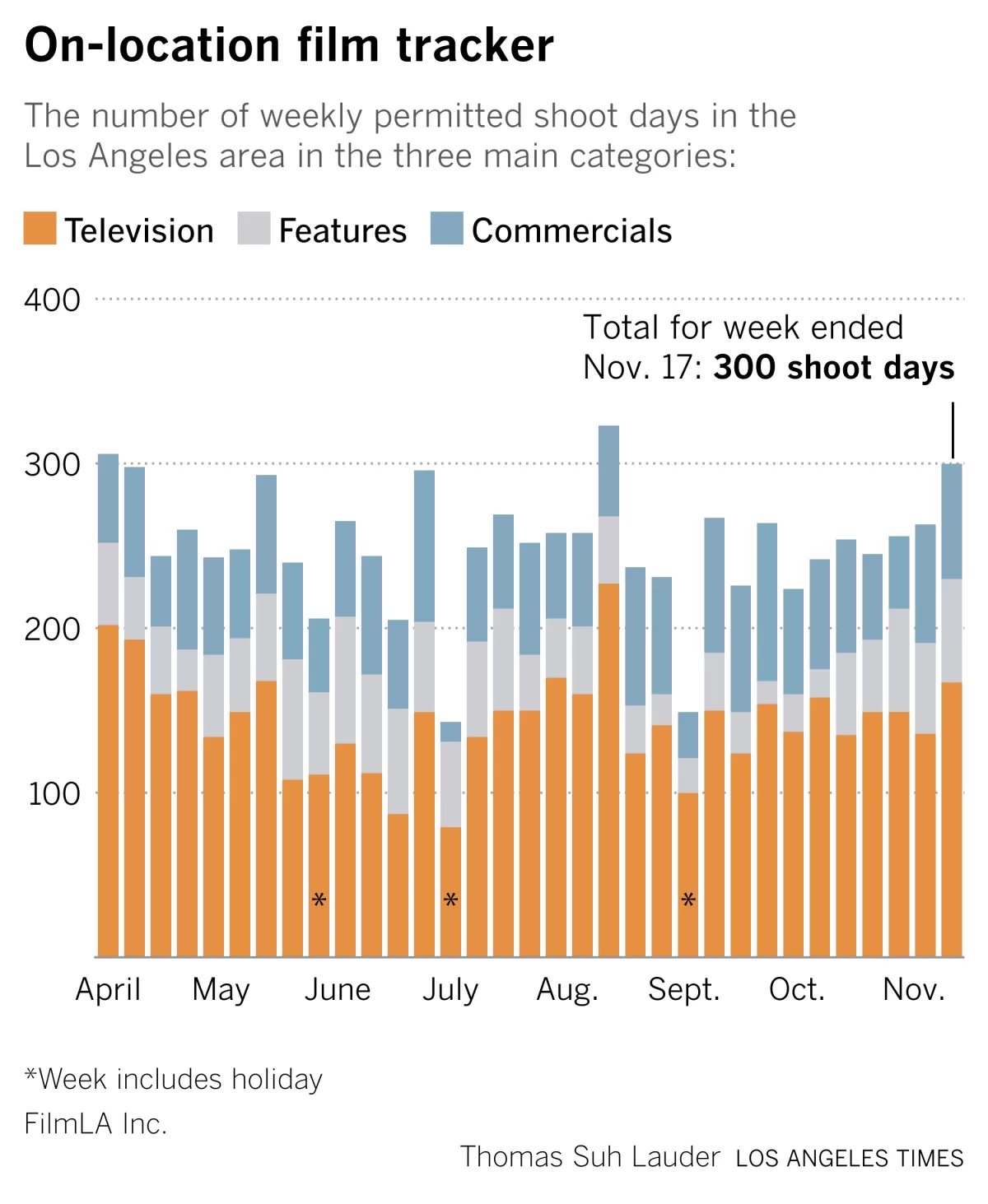

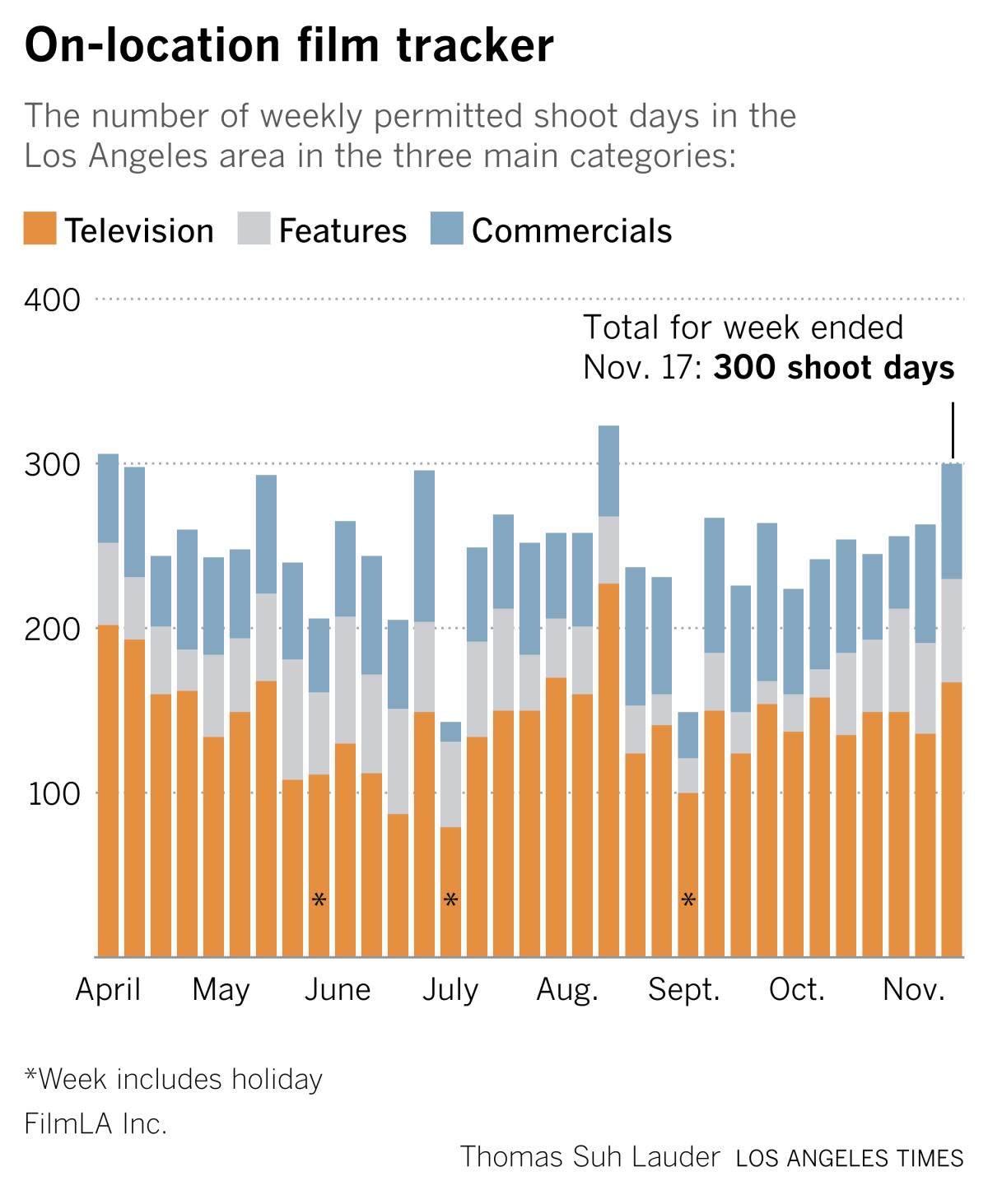

Film shoots

On-location production was up from the previous week, according to FilmLA.

Finally…

No recommendation this week. But I do have a prediction: “Wicked” is going to gross more than $100 million domestically from its opening weekend. Tracking is strong and the marketing campaign has been relentless. But how will musical theater fans feel about it being a “Part I?” I don’t dare to guess.